AngularJS Exam Braindumps

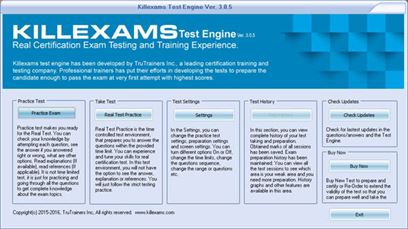

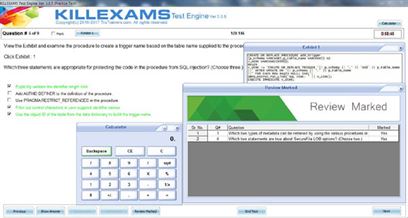

Killexams.com AngularJS Exam Braindumps contain complete question pool, updated in April 2024 including VCE exam simulator that will help you get high marks in the exam. All these AngularJS exam questions are verified by killexams certified professionals and backed by 100% money back guarantee.

AngularJS information - AngularJS Updated: 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| killexams.com AngularJS exam brain dumps with practice test | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Exam Code: AngularJS AngularJS information January 2024 by Killexams.com team | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

AngularJS AngularJS Exam: AngularJS Exam Details: - Number of Questions: The exam consists of multiple-choice questions and coding exercises. - Time: Candidates are given a specified amount of time to complete the exam. Course Outline: The AngularJS course is designed to provide candidates with a comprehensive understanding of the AngularJS framework for building dynamic web applications. The course outline includes the following topics: 1. Introduction to AngularJS - Overview of AngularJS and its features - Understanding the AngularJS architecture - Setting up the development environment 2. AngularJS Basics - AngularJS expressions and data binding - Directives and their usage - Controllers and scope management 3. Modules and Dependency Injection - Creating and managing AngularJS modules - Understanding dependency injection - Using services and providers 4. Templates and Views - Working with AngularJS templates - Using ngRoute for routing and navigation - Handling form input and validation 5. Directives and Components - Creating custom directives - Building reusable components - Understanding the directive lifecycle 6. Services and HTTP Communication - Working with built-in AngularJS services - Making HTTP requests with $http service - Handling data using promises 7. Advanced Concepts - Understanding the digest cycle - Using filters and pipes - Implementing animations and transitions Exam Objectives: The AngularJS exam aims to assess candidates' understanding of the AngularJS framework and their ability to develop web applications using AngularJS. The exam objectives include: 1. Understanding the key concepts and features of AngularJS. 2. Demonstrating proficiency in AngularJS expressions, data binding, and directives. 3. Building and organizing AngularJS modules. 4. Implementing routing and navigation using ngRoute. 5. Creating custom directives and components. 6. Working with services and making HTTP requests. 7. Applying advanced concepts such as filters, animations, and transitions. Exam Syllabus: The exam syllabus covers the following topics: - Introduction to AngularJS - Overview of AngularJS and its features - Understanding the AngularJS architecture - Setting up the development environment - AngularJS Basics - AngularJS expressions and data binding - Directives and their usage - Controllers and scope management - Modules and Dependency Injection - Creating and managing AngularJS modules - Understanding dependency injection - Using services and providers - Templates and Views - Working with AngularJS templates - Using ngRoute for routing and navigation - Handling form input and validation - Directives and Components - Creating custom directives - Building reusable components - Understanding the directive lifecycle - Services and HTTP Communication - Working with built-in AngularJS services - Making HTTP requests with $http service - Handling data using promises - Advanced Concepts - Understanding the digest cycle - Using filters and pipes - Implementing animations and transitions | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AngularJS Financial AngularJS information | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other Financial examsABV Accredited in Business Valuation (ABV)AFE Accredited Financial Examiner (AFE) AngularJS AngularJS AVA Accredited Valuation Analyst CABM Certified Associate Business Manager CBM Certified Business Manager (APBM CBM) CCM Certified Case Manager (CCM) CFE Certified Financial Examiner (CFE) CFP Certified Financial Planner (CFP Level 1) CGAP Certified Government Auditing Professional (IIA-CGAP) CGFM Certified Government Financial Manager (CGFM) CHFP Certified Healthcare Financial Professional (CHFP) - 2023 CIA-I Certified Internal Auditor (CIA) CIA-II Certified Internal Auditor (CIA) CIA-III The Certified Internal Auditor Part 3 CIA-IV The Certified Internal Auditor Part 4 CITP Certified Information Technology Professional (CITP) CMA Certified Management Accountant (CMA) CMAA Certified Merger and Acquisition Advisor (CM and AA) CPCM Certified Professional Contracts Manager (CPCM) 2023 CPEA Certified Professional Environmental Auditor (CPEA) CPFO Certified Public Finance Officer (Governmental Accounting, Auditing, and Financial Reporting) CRFA Certified Forensic Accountant (CRFA) CTFA Certified Trust and Financial Advisor (CTFA) CVA Certified Valuation Analyst (CVA) FINRA FINRA Administered Qualification Examination CEMAP-1 Certificate in Mortgage Advice and Practice (CeMAP) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| We have valid and updated AngularJS exam questions and brain dumps. killexams.com gives the correct and latest dump questions braindumps which basically contain all AngularJS data that you have to pass the AngularJS exam. With the guide of our online AngularJS exam prep, you don't need to strike your head on reference books however just need to consume 10-20 hours to retain our AngularJS dump questions and answers. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial AngularJS AngularJS https://killexams.com/pass4sure/exam-detail/AngularJS AngularJS Section 1: Sec One (1 to 50) Details:This section provides a huge collection of Angularjs Interview Questions with their answers hidden in a box to challenge you to have a go at them before discovering the correct answer. Question: 1 What is AngularJS? Answer: AngularJS is a framework to build large scale and high performance web application while keeping them as easy-to-maintain. Following are the features of AngularJS framework. AngularJS is a powerful JavaScript based development framework to create RICH Internet Application (RIA). AngularJS provides developers options to write client side application (using JavaScript) in a clean MVC (Model View Controller) way. Application written in AngularJS is cross-browser compliant. AngularJS automatically handles JavaScript code suitable for each browser. AngularJS is open source, completely free, and used by thousands of developers around the world. It is licensed under the Apache License version 2.0. Question: 2 What is data binding in AngularJS? Answer: Data binding is the automatic synchronization of data between model and view components. ng model directive is used in data binding. Question: 3 What is scope in AngularJS? Answer: Scopes are objects that refer to the model. They act as glue between controller and view. 1 AngularJS Question: 4 What are the controllers in AngularJS? Answer: Controllers are JavaScript functions that are bound to a particular scope. They are the prime actors in AngularJS framework and carry functions to operate on data and decide which view is to be updated to show the updated model based data. Question: 5 What are the services in AngularJS? Answer: AngularJS come with several built-in services. For example $http service is used to make XMLHttpRequests (Ajax calls). Services are singleton objects which are instantiated only once in app. Question: 6 What are the filters in AngularJS? Answer: Filters select a subset of items from an array and return a new array. Filters are used to show filtered items from a list of items based on defined criteria. Question: 7 Explain directives in AngularJS. Answer: Directives are markers on DOM elements (such as elements, attributes, css, and more). These can be used to create custom HTML tags that serve as new, custom widgets. AngularJS has built- in directives (ng-bind, ng-model, etc) to perform most of the task that developers have to do. Question: 8 2 AngularJS Explain templates in AngularJS. Answer: Templates are the rendered view with information from the controller and model. These can be a single file (like index.html) or multiple views in one page using "partials". Question: 9 What is routing in AngularJS? Answer: It is concept of switching views. AngularJS based controller decides which view to render based on the business logic. Question: 10 What is deep linking in AngularJS? Answer: Deep linking allows you to encode the state of application in the URL so that it can be bookmarked. The application can then be restored from the URL to the same state. Question: 11 What are the advantages of AngularJS? Answer: Following are the advantages of AngularJS. AngularJS provides capability to create Single Page Application in a very clean and maintainable way. AngularJS provides data binding capability to HTML thus giving user a rich and responsive experience AngularJS code is unit testable. AngularJS uses dependency injection and make use of separation of concerns. AngularJS provides reusable components. With AngularJS, developer writes less code and gets more functionality. 3 For More exams visit https://killexams.com/vendors-exam-list Kill your exam at First Attempt....Guaranteed! | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

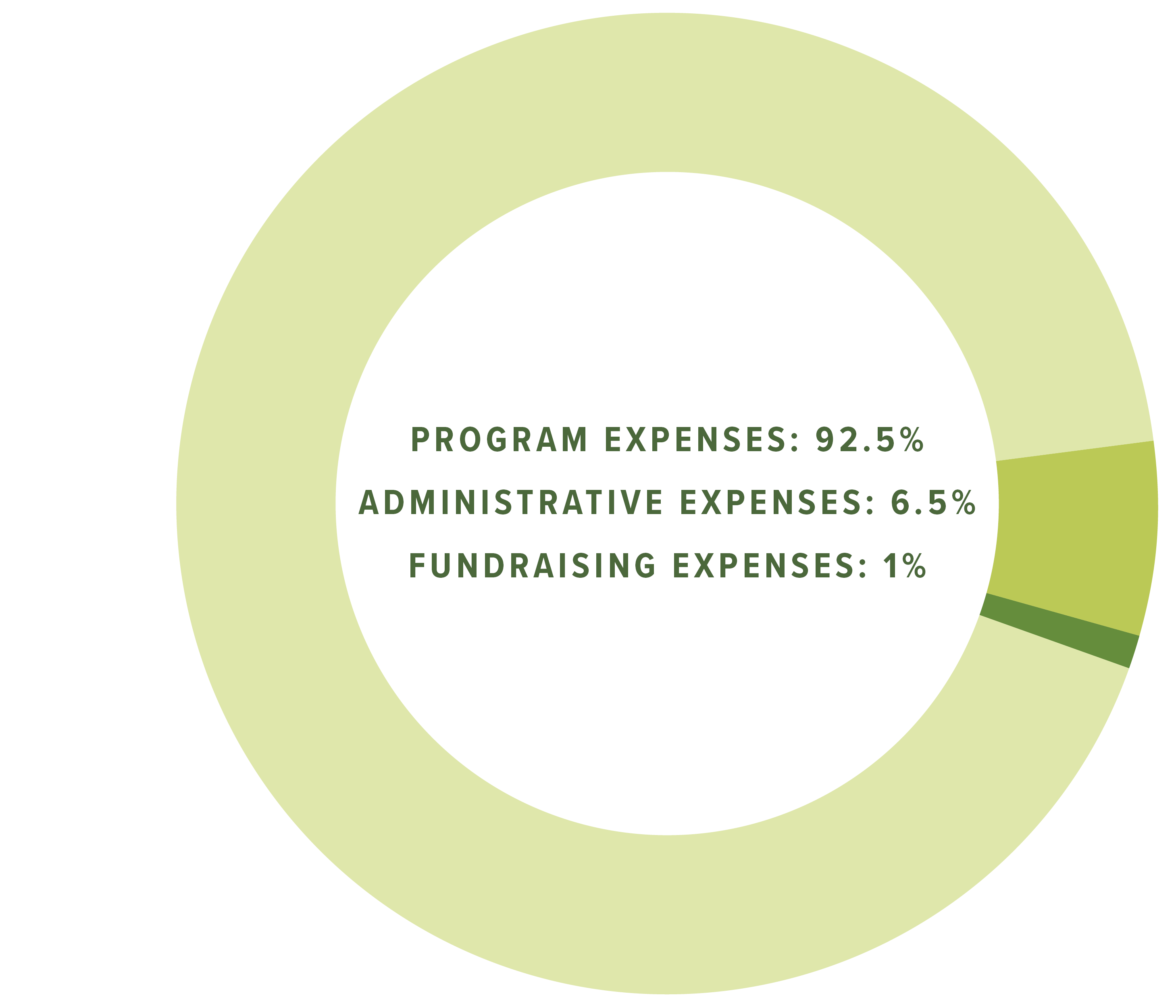

As with other nonprofit organizations, AWI’s expenses are broken down into three categories: administrative expenses, fundraising expenses, and program expenses. The first two are generally thought of as operating expenses (or “overhead”), while the latter—program expenses—are those directly related to fulfillment of the organization’s mission. As indicated by the diagram, the vast majority of AWI’s expenses are program related—spent directly on efforts to reduce animal suffering caused by people. For the independent auditors' report of AWI's 2022–2023 Financial Statements, click here. For a copy of our latest annual informational return (Form 990) on file with the IRS, click here or visit the Guidestar website. AWI's Federal Employer Identification Number (FEIN or Tax ID) is 13-5655952. To read about our activities over the past fiscal year to Excellerate animal welfare, check out our annual report. AWI has been evaluated by Charity Navigator and has received the highest ratings. This independent evaluation is intended to assure the public that AWI is properly governed, that our programs are consistent with our statement of purpose, that our funding is sound, and the bulk of our annual expenses is devoted to our programs to protect animals. For further information on AWI, you may contact the aforenamed organization:

Borrowing InformationFinancial Planning and Analysis is responsible for the oversight and administration of all University debt. Purdue borrows money to construct and Excellerate campus facilities for better student-education experiences. Financial Planning and Analysis typically issues 20-year tax-exempt bonds with serial (yearly) amortization to pay the obligation. Maps of Financed BuildingsColor coding on the maps of each campus details whether restrictions are in place for a specific facility. GeneralAll financial aid offers are based on enrollment and are dependent upon a determination of eligibility based on grade level, whether priority application deadlines have been met (if applicable) and other program-specific criteria at the time of the offer. Offers are contingent upon continued funding from federal, state and institutional sources. Action by federal and state governments – including, but not limited to insufficient funds or discontinuation of funds – may result in rescinding or reducing offer amounts. A financial aid offer is based on information that the student and the student's family (if applicable) submitted in the Free Application for Federal Student Aid (FAFSA) as well as any other supporting documentation. SNHU is required by federal law to resolve any conflicts of information that become evident as part of the application review process. It is the student's responsibility to complete and submit application materials to the appropriate agencies within the required timeframes. It is also the student's responsibility to notify Student Financial Services of any circumstantial changes to the information reported in the FAFSA and/or supporting documentation. False or incomplete information submitted by a student, or on behalf of a student, may result in the cancellation of an offer and may require repayment of all or part of the funds disbursed to the student. In the event a student has received aid to which they are not entitled, it will be the responsibility of the student to repay those funds. Generally, students are not eligible to receive federal student aid from two different schools when attending two schools at the same time. Students should carefully review and ensure they understand all financial aid related materials sent from SNHU and/or other agencies that offer financial aid. Students are advised to keep copies of these items for their records. During a student's application for aid or at any subsequent time thereafter, they will have the right to receive a thorough explanation of the financial aid offer process, including the conditions of any student loan that may be offered. Conditions may include but are not limited to interest rates for student loans, deferment options, repayment periods and programs, etc. The student will also be responsible for complying with the provisions of any promissory note or other agreement which they may sign, including repayment of any student loans. Students accepting an employment offer as part of the Federal Work-Study (FWS) program will be entitled to disclosure of the terms and conditions (including pay rate) for any position that is offered. Rights & ResponsibilitiesStudents are obligated to know the rights and responsibilities associated with being a financial aid applicant and recipient as well as a student loan borrower and a Federal Work-Study employee (if applicable). Students have the right to know:

Students have the responsibility to:

Offering of AidThere are two types of calculations used to determine a student's financial aid offer. The following definitions are required to understand these calculations:

Financial Need Aid Calculation: COA minus EFC equals financial need. Non-Need-Based Aid Calculation: COA minus need-based aid offered equals eligibility for non-need-based aid. Non-need-based aid is financial aid that is not based on a student’s EFC. The student's COA and offered assistance is what matters in the calculation. Non-need-based programs include Direct Unsubsidized Loans, Direct PLUS Loans, SNHU merit scholarships and other SNHU scholarship programs. Financial aid is offered for an academic year or remaining period of study and distributed equally between the terms or payment periods that define the academic year or remaining period of study.

Direct loan proration is required when a student is enrolled in a remaining period of study that is shorter than a full academic year. Direct loans are offered to maximum eligibility or a per term amount based on academic program. If less than maximum eligibility is offered, the student’s financial aid offer will indicate the possibility for additional eligibility. Students can contact Student Financial Services to discuss their options. SNHU promotes responsible borrowing to minimize student loan debt upon graduation. Reporting Additional Financial Aid OffersIf a student receives additional funds not listed on their financial aid offer (including but not limited to employer reimbursement or assistance, tuition waivers, private scholarships, fellowships, veteran’s benefits, veteran readiness benefits, etc.), they are required to report funds to Student Financial Services. Should the additional funds result in a change to a student's financial aid eligibility, they will receive notification of the change in eligibility. If a student receives additional assistance, their aid may be adjusted or reduced, even if already disbursed. Overawards of AidOverawards can occur when SNHU receives additional information not accounted for in the student’s initial financial aid offer. SNHU is required to resolve any overaward on a student’s account. Common examples that cause overawards include but are not limited to:

Overawards can result in a balance due to the university, which is the student’s responsibility to pay. College Financing PlanSNHU complies with the Principles of Excellence Executive Order 13607 and participates in the Department of Defense Voluntary Education Partnership Memorandum of Understanding (DoDMOU) to provide the College Financing Plan to all military-identified students who are offered federal student aid. The College Financing Plan is a standardized form that is designed to simplify the information about costs and financial aid so students can make informed decisions about where to attend school. This is in addition to the SNHU offer for all military-identified students who file a FAFSA and are offered federal aid. The College Financing Plan also comes with a supplemental guide to assist with projecting estimates for total costs, costs covered by military benefits, availability of financial assistance, estimated student loan debt, graduation rates, placement information, acceptance of transfer credits, additional program information and consumer tools for college choice. Review a demo of the College Financing Plan to further understand the information provided. VerificationIn some instances, SNHU is required by federal and state regulations to review financial aid applications through the process of verification. Student Financial Services reserves the right to request verification of any data submitted by applicants or the parents/spouses of applicants (if applicable). Verification requires that the university review additional documents to verify the information reported on the FAFSA for the student, parent(s) and/or spouse (if applicable). Information that may be Checked includes income, high school completion, number of family members in the household and number of children in the household who are enrolled at least half time in college. Required documentation may include:

Failure to submit requested documents in a timely manner may result in a delay or cancellation of a financial aid offer. If during the verification process data is found to be incorrect, the data may be corrected and the offer revised. If a student is found to have knowingly submitted false or intentionally misleading information, SNHU shall reserve the right to (1) refuse to offer financial aid, (2) cancel all aid that was previously offered even if aid has already disbursed and/or (3) dismiss the offending student from the university. Additionally, at SNHU’s discretion, all fraudulent information shall be forwarded to the U.S. Department of Education Office of the Inspector General for further investigation. Verification Deadline: An applicant who is selected for verification for the 2022-2023 aid year must complete the process no later than 120 days after the last date of the student’s enrollment or Sept. 9, 2023. Secondary Confirmation In addition to the verification process, SNHU reserves the right to select any student’s file for secondary confirmation. As part of this process, SNHU may request identifying information including but not limited to:

Failure to submit all required items within the allotted seven to 10 business day timeline, or submission of information that cannot be authenticated, will result in a failed review. Failed reviews shall be evaluated on a case-by-case basis, but will result in loss of financial aid eligibility, withdrawal from course(s), administrative dismissal and/or permanent expulsion from the university. Additionally, at SNHU’s discretion, all fraudulent information shall be forwarded to the U.S. Department of Education Office of the Inspector General for further investigation. Expectations after Successful Completion of Secondary Confirmation Following a successful review for secondary confirmation prior to enrollment, a previously selected student shall be expected to maintain strict adherence to course participation requirements for online students in their first term of enrollment. Failure to comply with these requirements will result in loss of financial aid eligibility, withdrawal from course(s) and removal from the university. Students removed from the university in this manner shall have the option of returning but will be required to use non-federal payment (cash, check, credit card, employer benefits, etc.) to fund their educational costs. Direct Loan Borrower RequirementsFirst-time direct loan borrowers must complete the following requirements before a loan will be disbursed to their account:

Offer amounts are based on cumulative credits earned toward a specific degree program. Annual borrowing limits for dependent undergraduate students are $5,500 for a freshman (zero to 29 credits), $6,500 for a sophomore (30-59 credits) and $7,500 for a junior or senior (60 or more credits). Independent undergraduate students may borrow an additional Direct Loan of $4,000 in their freshman year and up to $5,000 in both their junior and senior years. Graduate students can borrow up to $20,500 each year and may also be eligible for a Graduate PLUS loan. SNHU promotes responsible borrowing and encourages students to borrow only what they need to assist with the cost of their education as opposed to borrowing the maximum amount they are eligible to receive. Repayment for direct loans typically begins six months after a student ceases attendance or their enrollment status is less than half time. Students should contact their loan servicer directly to review repayment responsibilities. The standard repayment term is 10 years. Interest rates will vary based on the type of loan borrowed and its disbursement date. To learn more about direct loan requirements, annual borrowing limits and lifetime borrowing limits, review important student loan information. Lifetime LimitsFederal Pell Grant: Students who are eligible to receive a Federal Pell Grant will have a lifetime limit of 12 full-time semesters or six full years of eligibility if the student remains eligible each award year upon completing a new FAFSA. This policy is retroactive to colleges or universities that the student attended prior to SNHU. Federal Direct Loan: All students are subject to aggregate lifetime borrowing limits. Financial Aid Enrollment Status CriteriaAs mandated by the U.S. Department of Education, for financial aid purposes, only courses that are considered a requirement to complete the program can be included in the student’s enrollment status. For repeat coursework, students may retake coursework until a grade above an F is received. If a student passes a course but would like to receive a higher grade or it is required by their program, the student may retake the course one time while receiving financial aid. Students’ financial aid eligibility is based on two parts: enrollment status and participation. The student’s enrollment status is reviewed at time of disbursement and throughout the given term of enrollment. The student’s participation is defined as the submission of a graded project or discussion for online forums. The student must participate in any given class in order to receive disbursement. Direct Assessment Competency-Based Education Programs As mandated by the U.S. Department of Education, for financial aid purposes, only competencies that are considered a requirement to complete the program can be included in the student’s enrollment status. Credit LoadCredit load is determined by total trimester credits. Based on either full-time, three-quarter-time or half-time credit load status, student loans will automatically go into deferment. Based on less than half-time academic load status, student loans will not go into deferment. All SNHU undergraduate students (online, on-campus and direct assessment competency-based) and on-campus Mountainview Low-Residency Master of Fine Arts (MFA) program in a 22-week term

NOTE: Undergraduate students are considered full time with any combination of undergraduate and approved graduate courses provided they have met all eligibility requirements as outlined within the Undergraduates Taking Graduate Courses policy. Undergraduate students in eight-week terms:

Undergraduate students in all other undergraduate terms:

All SNHU online graduate students, education graduate field-based programs, doctoral programs and Mountainview Low-Residency Master of Fine Arts (MFA) program in a 16-week term

Credit load is based on total credits in a single term. In order to enroll in more than six credits in any given term, a student must obtain permission from their academic advisor and have a cumulative GPA of 3.0 or higher. On-Campus SNHU Graduate Students: School of Business, Master of Arts in Teaching English as a Second or Other Language, and Education Programs

Additional Information Graduate students enrolled in their comprehensive exam or who are in dissertation status are considered full time. Graduate students who are registered in a continuation course for a counseling practicum or internship are considered half time, due to the academic and experiential requirements of the counseling continuation courses. International students in F-1 and J-1 student status must be enrolled full time to maintain lawful presence in the U.S. Online classes are limited to one class per term counting toward your minimum full-time course load. Any classes taken over the minimum full-time course load may be in-class or online format. NOTE: For international students, all reductions in a full course load for academic or medical reasons, as well as terms off, must be approved by the Office of International Student Services prior to the start of the term or class load reduction. In a final term, if only one course is remaining, it must be taken in-class to maintain F-1 or J-1 student status. Disbursement of AidFinancial aid is disbursed during each payment period or academic term (based on academic program) throughout the academic year or remaining period of study. At the time of disbursement, student eligibility is checked to confirm attendance, program of study, enrollment status and completion of loan requirements (Master Promissory Note, Loan Entrance Counseling, etc.). Financial aid is disbursed as follows:

Disbursement of financial aid funds is based on the type of financial aid being paid:

Direct loan recipients will receive a disbursement notification to their SNHU email within seven days of funds being applied to their student account. Students should review their account for the types of loans disbursed (subsidized, unsubsidized, PLUS), dollar amount and date of disbursement. Students have the right to request cancellation of all or a part of the direct loan amounts disbursed within 30 days of the notification. Use of AidFunds listed on a financial aid offer may only be used for educational expenses for the respective academic year. SNHU applies all financial aid directly to institutional charges (charges may include but are not limited to tuition, fees, housing, book vouchers, etc.). Following deduction of these charges, any remaining financial aid funds will be released to the student in the form of a refund. If subsequent charges are incurred after the refund process in any given term, the student will be responsible to pay the new charges. Students may provide authorization to apply federal student aid to non-institutional charges by completing the Federal Aid Authorization form under the Financial Information tab in their mySNHU portal. Parents may provide authorization to apply federal student aid to non-institutional charges. Please contact Student Financial Services to obtain an authorization form. Non-institutional charges may include but are not limited to residence hall damage fees, parking fees, health insurance, library fees, etc. Students and parents have the right to cancel or modify the authorization at any time. A cancellation or revision is not retroactive and will take effect on the date that SNHU receives the authorization. Credit Balances & RefundsUsing federal funds to obtain books and supplies SNHU provides students using federal financial aid with a method to purchase books and supplies prior to the beginning of the term if (1) SNHU can disburse the federal funds to the eligible student and (2) the student would have a credit balance created from federal funding. Depending on program and location, students have the option to use their Penmen Cash account or an online book voucher.

Students may opt out of either program by not using the process or funds provided. Opting out will not result in an expedited refund. To understand the process and learn more, please visit the University Store. Refunds When the disbursed financial aid and/or payments made on a student account total more than the billed cost, the additional amount will be returned to the student as a credit balance. The university processes credit balances to students based on a refund processing schedule in a manner that complies with U.S. Department of Education requirements for refunding financial aid. All credit balances will be processed according to a student's refund preference with BankMobile. For more information, visit the BankMobile website. Learn more about our BankMobile contract disclosure. If financial aid funds are disbursed in error, the student agrees to repay the full amount to SNHU. If a mistake was made, whether by the student, Student Financial Services or another agency, federal regulations require that the mistake be corrected and balances billed back as necessary. SNHU may use a current credit balance created by financial aid to satisfy a past due balance for allowable unpaid charges within the current academic year. The current academic year is defined as:

SNHU can apply up to $200 from a current financial aid credit balance to pay prior year charges. Prior year is defined as:

Return of Financial Aid FundsIf a student withdraws before the completion of a payment period for which financial aid has been received, federal regulations govern the procedural guidelines that SNHU must follow to return the aid. These regulations require Student Financial Services to recalculate financial aid eligibility for students who withdraw, are dismissed or take a leave of absence prior to completing 60% of an academic term or payment period. Visit the Return of Title IV Funds information page to learn more about the effect of withdrawals on financial aid. Satisfactory Academic Progress (SAP)To remain eligible for federal financial aid programs, students must maintain Satisfactory Academic Progress (SAP). Federal regulations require Student Financial Services to monitor the progress of each student toward degree completion. Students who fail to achieve the defined minimum standards for grade point average and/or fail to maintain the standards for pace and completion of their program may lose eligibility for all types of federal and/or institutional aid. Learn more about SNHU's current SAP standards for all programs. Duration & Renewal of AidFinancial aid is offered one academic year at a time. Students intending to use financial aid in future academic years will need to file a FAFSA that corresponds to the appropriate federal aid year. The new FAFSA becomes available on Oct. 1 of each year. Student Information & ConfidentialityThe student shall be responsible for notifying the university of any change in status including but not limited to marital, academic, enrollment, legal name, etc. Additionally, the student will be expected to keep their permanent mailing address on file with the Office of the University Registrar. Pursuant to the Family Educational Rights and Privacy Act (FERPA), all records and data submitted with an application for financial aid or documentation in support of the student's verification or financial aid appeal, will be treated as confidential information. Additional information is available under the full FERPA Student Right to Privacy policy. It should be noted that university staff members may be required to disclose information about certain issues that relate to the health and safety of SNHU community members, and other exceptions that are detailed in the FERPA policy. Your eligibility for need-based financial aid has been determined according to federal government regulations and university policies governing financial aid programs. Using the information that you reported on the 2024-25 CSS Profile, the 2024-25 Free Application for Federal Student Aid (FAFSA), once available, student and parent tax returns (if submitted to our office prior to review), and other supporting documentation, the Office of Student Financial Services has calculated your Expected Family Contribution (EFC), the amount of family financial resources you and your parent(s) are expected to contribute toward your educational costs. (Note: The federal version of the EFC is now called the Student Aid Index, or SAI.) If you did not, or were unable, to file the 2024-2025 FAFSA prior to receiving their aid offer, we estimated eligibility for federal financial aid as closely as possible using the information provided on the CSS Profile and other supplemental information submitted. The final financial aid offer may vary from the amount initially estimated due to the data on your FAFSA, your and your parent(s)' tax returns, etc. Your EFC is not a prediction of how much cash you actually have on hand, nor a value judgment about how much you “ought” to be able to pull from your current income, nor a measure of your liquidity. Rather, it is our best estimate of your capacity to absorb the costs of education over time. The EFC is subtracted from a standard budget of expected educational expenses, or Cost of Attendance (COA). The difference between the EFC and the COA is your maximum eligibility for need-based assistance. Federal law prohibits a student from receiving need-based financial assistance in excess of calculated eligibility as well as need- or non-need-based (e.g., private loans, etc.) financial assistance in excess of the COA. In most cases, your EFC consists of a contribution from your income and assets and a contribution from your parent(s)’ income and assets. In cases of divorce or separation, a contribution is normally expected of both biological/ adoptive parents for purposes of institutional grant and from the custodial parent (the parent who provides more than 50% of your financial support) and his or her new spouse, if he or she has remarried, for federal financial aid purposes. (Unmarried biological parents who live together are considered married for purposes of institutional and federal financial aid.) Please note that in determining eligibility for assistance, all assets are assumed to belong to the person who reports the interest and/or dividends earned from those assets on his or her tax return. The formulas used to determine your eligibility expect all students to use 20–25% of their assets each year for educational expenses. Your EFC has been based upon the assumption that the information contained in your financial aid application has been reported accurately to us. The university may request verification of certain application items, including, but not limited to, your and/or your family’s income and assets, your academic-year residency status (i.e., living on campus, off campus or commuting from home/relative’s home), and your sibling(s)’ enrollment/cost of enrollment in an undergraduate program at another postsecondary institution. Please be advised that any changes to the information originally provided to us may result in a revision of your EFC. If you have qualified to have your aid eligibility determined as an independent student, you may not have an expected parent contribution. In order to be considered independent, you must meet specific federal-government criteria. You may not declare yourself independent for reasons other than those outlined on the FAFSA. Even though you may meet federal criteria for independence and therefore receive federal funds as an independent student, the university requires parental information from all students unless they are orphans or wards of the court (or were wards of the court until age 18) and may, in fact, expect a parent contribution before awarding any institutional funds. In order to be considered for Brandeis financial aid, all students must indicate their intent to apply for financial aid on the admission application — no consideration for institutional financial aid can be given after admission decisions are released. Eligible students can apply for federal financial aid, in the form of student loans or work-study assistance, at any time during the school year. The Annual Reports (the UBS Group AG Annual Report and the combined UBS Group AG and UBS AG Annual Report) include the consolidated financial statements of UBS Group AG and UBS AG, respectively, and provide comprehensive information about our firm, including our strategy, businesses, financial and operating performance, and other key information. With more than a half-million members, The Heritage Foundation is the most broadly supported public policy research institute in the nation. This broad base of support guarantees that no donor or group of donors has the ability to direct the views or activities of Heritage. Additionally, the total of all corporate support to Heritage amounts to less than 2% of all contributions, and Heritage takes no money from government—whether federal, state, local, tribal, or foreign—for any research activity or any other purpose. Rather, our power to impact government policy and to promote and defend America’s founding ideals comes directly from the voluntary support of our more than 500,000 members. Our members make it possible for Heritage to conduct expert research, educate Congress and the American people, and promote consistently effective policy solutions based on the ideals of free enterprise, limited government, individual freedom, traditional American values, and a strong national defense.

To honor the intent of our members, we ensure that all Heritage research and policy proposals are guided by a core set of principles. Heritage does not support policies that deviate from these principles, nor are our recommendations ever influenced by outside political pressure. Heritage also carefully protects the independence and quality of our research by refusing to engage in contract research. Our research products all go through a rigorous, multi-layer review process prior to publication to ensure the highest research quality and integrity of our work.  >>> Read more about Heritage’s Research Independence and Integrity The steadfast support of our members combined with Heritage’s operational effectiveness earned us the ranking of the No. 1 think tank in the world for our impact on public policy.  It is only with our members’ ongoing support that we can continue to create effective solutions to the biggest issues America faces; make significant policy impacts at the federal, state, and local levels; and build an America where freedom, opportunity, prosperity, and civil society flourish. A significant way we strive to be good stewards of our members’ gifts is by making our financial information easy to find and easy to understand. We disclose the names of donors, with their approval, in our annual report. You can find more detailed financial information in The Heritage Foundation’s annual reports and annual audited financial statements:  The Heritage Foundation’s IRS Form 990 is available here. If you have any questions, don’t hesitate to contact our membership office at (800) 546-2843 or [email protected]. Save the Children has a proven track record of using donations efficiently and effectively. From school children who send their allowance for relief efforts to the largest philanthropic donors, we cherish all of our supporters. You can be assured that Save the Children uses the valuable resources donors have provided in the most cost-effective ways possible. Our independently audited financial statements consistently show that out of every dollar spent, 86 cents goes directly toward helping children. We keep administrative costs low so that more funding goes to children’s programs. The Center for Strategic and International Studies (CSIS) is a nonprofit, nonpartisan 501(c)(3) organization located in Washington, DC. CSIS provides strategic insights and solutions to decisionmakers, and relies upon your support to help us fulfill our vision of a more secure and prosperous future. Ideas matter. Stability and prosperity are not natural conditions, but the results of sound policies and more effective government institutions. Our mission at CSIS is to promote and generate practical ideas to address the world’s greatest challenges. Since 1962, CSIS has been a proven source of thoughtful, innovative, and balanced solutions to the most complex foreign policy and national security challenges of our time. Our staff of more than 250 full-time employees, large network of affiliated scholars, and world-class Board of Trustees share a common purpose to build a better, safer, more prosperous world. Our work would not be possible without the support we receive from individuals, private foundations, corporations, and government agencies. We invite you to support CSIS as we help our world navigate toward a more peaceful and secure future. Your support means you will have a positive impact on Washington and the world. Percentages listed below are drawn from the audited financial statements from the fiscal year ending: FY22 Operating Revenue - $46,853,261Corporate Grants & Contributions - 32% FY22 Operating Expenses - $46,809,005 **Operating expenses exclude building depreciation and capital campaign expenses Operating Expenses: $42.1 Million

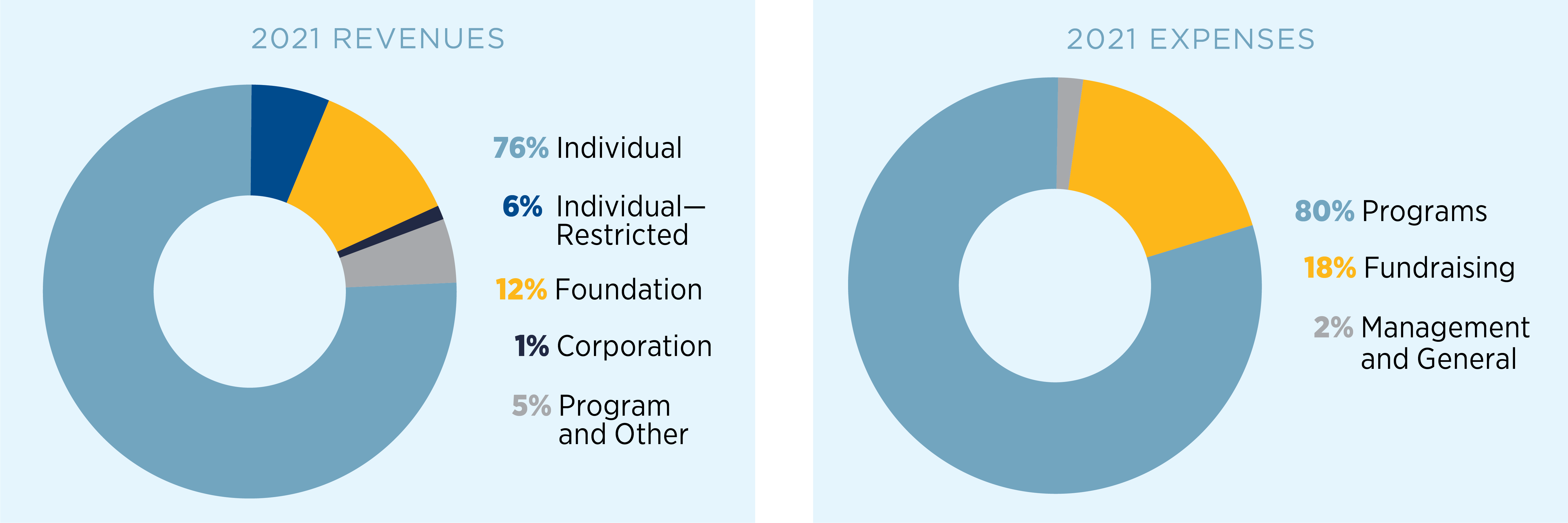

**Operating expenses exclude building depreciation and capital campaign expenses Additional Financial Information:The International Rescue Committee (IRC) responds to the world’s worst humanitarian crises, earning top marks from charity watchdog groups for our efficient and effective use of donations. Tax informationThe IRC is a 501c (3) tax-exempt organization. All donations to the IRC are tax-deductible. (Archived Form 990: FY2021 | FY2020 | FY2019 | FY2018 | FY2017 | FY2016) Financial statements(Archived Financial Statements: FY2020 l  FY2019 l  FY2018 |  FY2017) Annual reportThanks to the generosity of IRC supporters, millions of people benefited from IRC programs and those of our partner organizations in the past year. Download the IRC's 2021 annual report. See highlights of our impact in 2021 at a glance. Efficiency and resultsThe IRC is consistently awarded top marks by charity watchdog groups for our efficient use of donor contributions and the effectiveness of our work. Among these: CharityWatch gives the IRC an A. Charity Navigator gives the IRC a four-star rating. The IRC meets all 20 of BBB Wise Giving Alliance’s accountability standards. See more reasons to give to the IRC. Financial disclosureRead our financial disclosure information. Procurement policies and RFPsLearn about our procurement policies and current bid opportunities. IRC grant awards from the Office of Refugee Resettlement, Department of Health & Human Services The International Rescue Committee, Inc. (“IRC”), through competitive funding through the U.S. Department of Health and Human Services, Administration for Children and Families, received awards for the Matching Grant, Preferred Communities and other programs. The contents of this website are solely the responsibility of the authors and do not necessarily represent the official views of the U.S. Department of Health and Human Services, Administration for Children and Families. NOTE: All information regarding college expenses and financial aid is subject to change without notice by official action. College ExpensesThe ESF tuition and college fee structure is set by the State University of New York Board of Trustees and generally covers the costs associated with instruction and the use of facilities and services at the College. Tuition ScheduleResidencyFor purposes of tuition, “residence” refers to the principal or permanent home to which the student returns. Students who believe they qualify as New York residents may apply for a change in residency after they are accepted by ESF. Application forms are available in the Office of Business Affairs in 101 Bray Hall. Tuition Schedule as of the beginning of the 2023-2024 Academic Year NOTE: Tuition is subject to change at any time by official action.

Additional ExpensesFees and Other ExpensesSeveral mandatory, optional and/or program-specific fees add to the cost of attendance. In addition to the costs of books and supplies, there may be expenses associated with a specific degree program, including summer field experience costs, study abroad expenses, Syracuse University course or lab fees, etc. Personal expenses include clothing, transportation, recreation, etc. Details are found on the bursar website Housing and Meal PlansMost entering first-year (freshmen) students are required to live in college housing and have a minimum meal plan that includes both Syracuse University Dining Services and ESF's Trailhead Cafe. Students are not required to live on campus after their first year. Entering transfer students and continuing ESF students may choose to live on campus or off campus, with housing and meal costs charged accordingly. Visit the ESF housing website for details. Terms of PaymentNew undergraduate students pay an advance payment deposit and must pay ensuing bills according to a payment schedule set by the college. Information on the deposit, payment schedule, late fees, refunds and all other subjects related to student financial obligation are available on the Bursar's website. Financial AidThe College offers these basic forms of student financial assistance: scholarships or grants; part-time employment; educational loans; diversity student scholarships and fellowships; assistantships, tuition scholarships, and fellowships for graduate students; a deferred tuition payment plan; and sources of non-need loans to students and parents. Federal and state financial aid programs are for United States citizens, permanent residents or other eligible non-citizens. International students will be considered for academic merit-based scholarships, assistantships and fellowships, but are not eligible for need-based student financial assistance. Aid programs are coordinated to supplement parental support, summer work, savings, and assistance from other sources. The sources of funds for financial assistance programs, the guidelines for determining the recipients, the procedures for applying, and the method of disbursement of funds vary from one program to another. This information is presented in detail on the ESF Financial Aid Web Page. Financial aid is awarded primarily on the basis of financial need. Some scholarships and fellowships, however, are based on other criteria, such as academic achievement or diversity status. Assistantships, tuition scholarships and fellowships for graduate students are awarded based upon academic achievement. In order for students to receive aid, they must be making satisfactory academic progress toward a degree. Please refer to the appropriate sections under ESF College Aid, Federal Student Aid, and New York State Aid later in this chapter for satisfactory academic progress requirements. In addition, students are only eligible to receive most types of aid for courses that are required for degree completion. Students enrolled in credits beyond the number required for the degree or enrolled in courses that are not applicable to a degree requirement will have financial aid adjusted accordingly. Financial aid advisors are aware of the many problems associated with financing higher education and meeting living expenses for both undergraduate and graduate students and are available to discuss individual problems. All students are encouraged to apply for financial aid. Applying For and Receiving AidHow to ApplyStudents interested in receiving financial assistance, with the exception of graduate assistantships, graduate tuition scholarships, graduate fellowships, and merit-based scholarships, must complete the Free Application for Federal Student Aid (FAFSA). It is highly recommended that all students complete the FAFSA as soon as possible each year. Timely completion of the FAFSA, which is available starting October 1 each year, will ensure that aid eligibility is maximized and any problems can be resolved without delaying the arrival of funds. In order to receive priority consideration and maintain eligibility for need-based grants and scholarships, a processed FAFSA must be received by the Financial Aid Office no later than February 1 each year. The school code for SUNY ESF is 002851. Paper versions of the FAFSA are available for obtain at https://studentaid.gov/apply-for-aid/fafsa/filling-out. Students completing the FAFSA online (recommended) will need an FSA ID in order to access the application and provide electronic signatures. Parents of dependent students will also need an FSA ID in order to sign the student's FAFSA. New or forgotten FSA IDs can be requested at https://studentaid.gov/fsa-id/sign-in/landing. While completing the FAFSA, you will have the option to automatically import your tax data directly from the IRS into your application. All students and parents are highly encouraged to take advantage of this tool as it will make the FAFSA process much easier and simplify the application verification process for any students selected to submit tax forms and other information. Tax information reported should be from the "prior-prior year" (ex. 2021 tax year data when applying for the 2023-2024 school year, 2022 tax year data when applying for the 2024-2025 school year, etc.). Students interested in receiving financial assistance for the summer must complete the separate SUNY ESF Summer Aid Application.

ÂNew York State Tuition Assistance Program (TAP)New York State residents are encouraged to apply for state grants and scholarships, including the Tuition Assistance Program (TAP), Excelsior Scholarship, STEM Incentive Grant, and others. The Express TAP Application (also known as the Application for Payment of New York State Grants and Scholarships) is required annually for determination of TAP Grant eligibility. It must also be completed for other state awards, which require separate applications, to be awarded and paid. Students who are New York State residents and list a New York State school while completing the FAFSA will be given the opportunity to complete an online TAP Application by clicking on the link which appears on the FAFSA Submission Confirmation Page. The online application may also be accessed at https://www.tap.hesc.ny.gov/totw/. Eligibility for TAP and other New York State grants and scholarships is determined by the New York State Higher Education Services Corporation (HESC). Students interested in applying for NY grants and scholarships other than TAP should be sure to complete each separate application in addition to the TAP application. The SUNY ESF School Code for state aid applications is 0950. If searching for ESF use "SUC En" as the criteria. Students will be asked to provide a college issued ID number when completing the applications. If known at the time of application, students should enter their ESF Banner ID, which begins with "F". If not known, this step can be skipped with no ID entered. Graduate Student AssistantshipsAssistantships and tuition scholarships for graduate students are not awarded by the Financial Aid Office. Students interested in these forms of financial assistance should contact The Graduate School. All students who request financial assistance may be required to submit information about their and/or their family's personal financial situation prior to aid disbursement. The College may request copies of parents' and/or students' federal tax transcripts, along with other statements which will be used to verify other sources of income, family size, number of dependents in college, and other pertinent information. Requests for verification information are authorized by the FAFSA signature process. Failure to comply with a request to verify pertinent information will result in the cancellation of any aid offered, and the possibility of legal action being taken by the U.S. Department of Education. Summer Financial AidMatriculated students planning to take courses over the summer at SUNY ESF may be eligible for limited amounts and types of financial aid through the following programs:

Summer PlanningStudents are highly encouraged to plan summer expenses prior to the end of the spring semester each year. Some students may have remaining unused aid available at that time, but no longer have that eligibility once the semester has ended. Only students meeting the minimum enrollment requirements can be considered for aid once the spring semester has ended. Academic Year StructureThe summer term at SUNY ESF is the trailer to the academic year. This means that federal loan amounts will be limited to funds remaining within the annual limits for each program that were not used during the preceding fall and spring semesters. Summer courses are offered in what are called modules, or segments which do not span the entire length of the full summer term. Year Round Pell GrantsSpecial regulations now allow for Pell-eligible students to receive more than 100% of a scheduled Pell Grant award for a single year if certain criteria have been met. Â For summer enrollment, these awards can be from either the academic year before or after the summer term, known as a "cross-over" period. When possible, the academic year used for the funds should be based on what is most beneficial for the student. Â This determination will be made by the Office of Financial Aid based on various criteria and considerations. Â Please note that a valid FAFSA is required for the school year used. Â If a student has only completed a FAFSA for one year, only that year can be considered for possible funding. Students receiving summer Pell Grants should be sure to note in which academic year aid package the grant is awarded. Â Enrollment requirements are different for the period in which a student is receiving funding in excess of 100% of a scheduled award. Â In order to receive any Pell Grant funding in excess of 100% of the scheduled award, a student must be enrolled in at least 6 degree-applicable credits (half-time enrollment). Â If summer Pell is awarded from the preceding school year, a student may not qualify for funding in the following spring if the number of degree-applicable credits is less than 6. Â It is the student's responsibility to carefully plan their enrollment and notify the Office of Financial Aid if a summer Pell Grant award could cause difficulty with future eligibility within the same school year. Example 1: A student receives Pell Grant funds from the 2022-2023 school year based on full-time enrollment for both the fall 2022 and spring 2023 semesters. Â This would use 100% of the student's scheduled award, 50% for each semester. Â Pell Grant funds from the 2022-2023 school year could also be awarded for the summer 2023 term as long as the student is enrolled at least half-time in degree-applicable courses (6 credits). Example 2: A student receives Pell Grant funds from the 2022-2023 school year based on full-time enrollment for the summer 2022 and fall 2022 terms. Â This would use 100% of the student's scheduled award, 50% for each term. Â Pell Grant funds from the 2022-2023 school year could also be awarded for the Spring 2023 term as long as the student is enrolled at least half-time in degree-applicable courses (6 credits). Enrollment RequirementsIn order to potentially qualify for summer aid, students must meet minimum degree-applicable enrollment requirements as follows:

*One term of Pell Grant eligibility at full-time enrollment uses 50% of a scheduled award.  At lower enrollment levels that percentage is pro-rated: half-time enrollment uses 25% and so forth. Application ProcessStudents seeking financial aid for summer enrollment should submit a completed Summer Financial Aid Application to the Financial Aid Office by the listed deadline and must have a valid FAFSA (Free Application for Federal Student Aid) on file. Please do not e-mail any personal information.  Applications should be delivered in-person, mailed, faxed, or uploaded with the document exchange function available from the financial aid section of the MyESF portal (student accounts only). Notification of EligibilityStudents will be notified of eligibility for federal aid sources with an amended financial aid package. Notifications of amendments are sent electronically to campus e-mail addresses and are viewable through the MyESF student portal. It is important that students view aid packages from both crossover aid years (2022-2023 and 2023-2024), if available, as aid for the summer may be awarded in both years. Students who are not eligible for federal aid will be notified either electronically or in writing. Students seeking funds from alternative student loans are responsible for working directly with the lender they have chosen. Disbursement of FundsAid funds will only be disbursed to student accounts once the student has started enough courses in the summer to reach the minimum enrollment requirements. Withdrawals and Return of FundsStudents who fail to begin each of their scheduled classes during the full summer term may be considered to have withdrawn from the term and could be required to return funds already received. This can occur in the following scenarios:

In order to avoid complications in these scenarios, students are highly encouraged to do the following:

Study Abroad Financial AidVarying types and amounts of financial aid may be available to students who wish to travel abroad as part of their degree program. All students seeking financial aid for this purpose must be taking courses that specifically meet a degree requirement. Enrollment level for aid eligibility will be based only on the courses which meet this condition. Before any aid eligibility can be considered, students must have submitted an approved SUNY ESF Study Abroad Request Form, a fully completed Study Abroad Data Form, and additional paperwork as indicated in the following sections. Financial aid is only available for abroad study which is during an existing term at SUNY ESF. Students seeking financial aid must also meet all existing eligibility requirements for each individual source of funding. SUNY ESF Students Participating in a SUNY Study Abroad ProgramStudents studying abroad through a program at another SUNY school may be eligible for the following types of financial aid:

To be considered for financial aid, students in this category must submit the following: SUNY ESF Students Participating in a Non-SUNY Study Abroad ProgramStudents studying abroad through a program at a non-SUNY school which participates in the Federal Student Aid Programs may be eligible for the following types of financial aid:

To be considered for financial aid, students in this category must submit the following:

SUNY ESF Students Participating in a Foreign School or Outside Organization Study Abroad ProgramStudents studying abroad through a program at a foreign school which does not participate in the Federal Student Aid Programs or through an outside organization acting on behalf of such an institution may be eligible for the following types of financial aid:

To be considered for financial aid, students in this category must submit the following:

SUNY ESF Students Participating in a Domestic Off-Campus ProgramStudents studying off-campus within the United States through a school which participates in the Federal Student Aid Programs may be eligible for the following types of financial aid:

To be considered for financial aid, students in this category must submit the following:

Disbursement of Financial Aid FundsAll financial aid funds for study abroad will be scheduled for disbursement to SUNY ESF ten days prior to the students departure. Once disbursed, funds are processed through the Bursars Office. With the exception of tuition charges to any SUNY institution, all aid funds will be disbursed directly to the student or to the parent (if from a Parents Loan) once they are available through the Bursars Office. SUNY tuition charges will be collected by SUNY ESF and transferred to the host school. No other funds will be disbursed or paid to the host school or organization. It is the students responsibility to make all necessary payment arrangements as necessary. Academic Credit EarnedAll students studying abroad must ensure that an official transcript of all courses is submitted to SUNY ESF upon completion of the program. Students who do not submit an official transcript or who do not fully complete the approved program will be subject to the College's Withdrawal, Refund, and Satisfactory Academic Progress policies. This could result in a loss of eligibility for funds already received or a loss of eligibility for future financial aid. Satisfactory Academic ProgressIn order for students to receive federal, state, and institutional aid, they must be making "satisfactory academic progress" toward a degree. The rules for satisfactory academic process depend upon the type of aid involved: ESF College AidFull-time undergraduate students receiving any of the following ESF awards are eligible to have their awards renewed in future years if they maintain an overall Grade Point Average (GPA) as indicated and complete the FAFSA by the February 1st priority deadline each year:

Federal Student AidUndergraduate and graduate students must meet specified criteria in order to be eligible for Title IV Federal Student Assistance, which includes Federal Pell Grants, Federal Supplemental Educational Opportunity Grants, Federal Student Loans, the Federal College Work-Study Program, and the Federal Parent Loan for Undergraduate Students. The criteria that students must meet to be eligible for Title IV student aid are the same criteria all ESF students must adhere to in terms of institutional academic policies and, specifically, academic progress requirements. The evaluation criteria are the following:

1. Cumulative Grade Point AverageUndergraduate students enrolled in an approved degree program at the Syracuse LocationIn order to remain eligible for Title IV Federal Student Assistance, a student must meet the cumulative and semester grade point average requirements of the Academic Performance Policy. A student will no longer be eligible for federal aid if the student’s cumulative grade point average and most latest term grade point average are below 2.0 or when the cumulative grade point average alone is less than the required limits in the chart below.

Graduate students enrolled in an approved degree program at the Syracuse locationIn order to remain eligible for Title IV Federal Student Assistance, a student must meet the minimum cumulative grade point average of 3.000 as indicated in the Academic Performance Policy. Students enrolled in an approved degree program at the Wanakena locationIn order to remain eligible for Title IV Federal Student Assistance, a student must meet the minimum cumulative grade point average of 2.000. 2. Maximum TimeframeStudents receiving federal student aid funds must make steady academic progress toward their degrees. While most students pursue their degrees on a full-time basis, others do not. In order to allow for maximum flexibility to complete a degree, federal regulations state that students' maximum timeframe to be eligible for federal aid shall not exceed 150 percent of the published length of time it takes to complete that degree on a full-time basis. The following chart lists the maximum number of credit hours a student may take and still receive federal student aid. These figures are based on 150 percent of the credit hours required to complete each of the degrees offered by the College—regardless of the time it takes to complete that degree. For any program not specifically listed, the maximum timeframe is 150% of the number of credits required to obtain the degree. Standard of Satisfactory Academic Progress for Purpose of Determining Eligibility for Federal Aid

3. Pace of ProgressionFederal student aid (Title IV) eligibility is also related to the successful completion of credit hours completed versus credit hours attempted. This component of eligibility is referred to as Pace of Progression or Pursuit of Program. Pursuit of Program is defined as: the cumulative number of credit hours completed divided by the cumulative number of credit hours attempted. This equation is tied back into the overall credits needed to be earned to graduate for any of our degrees. Generally, the cumulative number of credits a student must complete to remain fully eligible is 67 percent (.67) of the attempted credits. Percentages are rounded up for this calculation. For example, a student completing courses at a rate of 66.5 to 66.9 percent will be considered to be completing courses at a 67 percent rate. Students receiving federal student aid from Title IV programs must be making progress towards their degree at the cumulative rates of completion as follows:

An example of meeting the requirement is:

The completed credits exceed .67 and the student is eligible for continuing to receive Title IV aid by successfully meeting the Pace of Progression requirement. An example of not meeting the requirement is:

The credits completed fall below the minimum requirements and therefore the student is not meeting the Pace of Progression requirement. Treatment of Incomplete Grades, Withdrawals, Repeated Courses, Remedial Courses, Change of Major, and Transfer Credits1. Incomplete grades Incomplete grades do count as attempted credits, but grade point average will only be affected once the incomplete status has been resolved and a final grade assigned. The assigned grade and the attempted/completed credits will be included in the Satisfactory Academic Progress calculations during the next regular review. Resolution of incomplete grades follows the “Incomplete and Missing Grades” College policy as follows: Incomplete and missing gradesA temporary grade of I may be assigned by an instructor only when the student has nearly completed the course but because of significant circumstances beyond the student’s control the work is not completed. Grades of I should be resolved within one academic year. If the incomplete is not resolved within one year, it will be changed to a grade of I/F or I/U, depending on the grading basis for the course. No degree will be conferred until all grades of I have been resolved. 2. Withdrawals Withdrawals from courses after the deadline to drop a course each semester (end of the 4th week) will be included in Satisfactory Academic Progress reviews based on the grades assigned according to the College’s “Withdrawal from ESF” policy. All courses dropped after the deadline to drop a course (end of the 4th week) will be considered attempted but not completed. Courses dropped by the deadline to drop a course will not be included in the Satisfactory Academic Progress reviews. Withdrawal from ESFStudents who withdraw from matriculation at the College on or before the deadline to drop a class for a semester will have their records marked: “Withdrew on (date).” Courses will appear for that semester with the grade of W. Students who withdraw after the end of the 4th week of the semester, but on or before the last class day before the final examination period, will have either WP (withdraw passing) or WF (withdraw failing) listed after each uncompleted course. Students who do not withdraw on or before the last class day will have a grade on a scale of A-F, an I (incomplete), or I/F (unresolved incomplete) assigned by the instructor for each registered course. Students who wish to withdraw from ESF should schedule a meeting to review the withdrawal process and complete an exit interview in the Office of Student Affairs. Withdrawal from Individual CoursesStudents may drop individual courses up until the last day to add as set by the Registrar in the ESF Academic Calendar using an add/drop form. Dropped courses during this period will be completely removed from the transcript when dropped on or before this deadline. Deadlines and actions to be taken after the last day to add deadline are:

Precise deadline dates noting the official end of weeks above shall be listed on the ESF Academic Calendar found on the Registrar’s webpage. 3. Repeated Courses Repeated courses will be included in Satisfactory Academic Progress reviews according to the College’s “Repeating Courses” policy: Repeating CoursesUndergraduate students may repeat any course previously taken either to earn a higher grade or because of a previous failure. Courses taken at ESF or Syracuse University that contribute to the GPA may be repeated. Ability to repeat a course may be limited by space availability, providing priority for first time registrants. Repeated courses will be reported as follows: a) the original and the repeated grade(s) appear on the transcript; b) only the higher (or highest) grade is included in the calculation of the cumulative grade point average. The highest grade will be marked with an "I" for included to show that it is included in the cumulative GPA. Any other grades will be marked with an "E" for excluded to show that it is excluded from the cumulative GPA. When a student earns the same grade in a repeated course a) the grade is calculated once in the cumulative grade point average and b) the credits and quality points are applied to the most latest term or semester in which the grade was earned. Credit hours for the repeated course may be counted only once toward meeting graduation requirements. For state-based financial aid, repeated courses in which students have received a passing grade will not count toward full time status. Students retaking courses may find their financial aid reduced if they fall below 12 credits when the retaken courses are not included. Students should contact the Financial Aid Office to determine the impact of retaking courses on their financial aid. Students receiving Federal Aid may repeat a previously passed course one time and still receive aid. Students may receive aid for previously failed courses that are repeated more than once. All repeated courses count as attempted credits for the purposes of measuring Satisfactory Academic Progress. 4. Remedial Courses Eligible remedial courses will be included in the Satisfactory Progress review in all categories. 5. Change of Major If a student changes major, courses previously taken which do not apply to the new major will not be considered as part of the Satisfactory Academic Progress Review. 6. Transfer Credits For the purposes of Satisfactory Academic Progress reviews, all transfer credits that are accepted as meeting a degree requirement will be counted as both attempted and completed credit hours. Title IV Aid: Satisfactory Academic Progress Review ProcessStudents receiving Federal Title IV aid will be reviewed for Satisfactory Academic Progress by the College at the end of each term of enrollment, including summer terms, in order to comply with our responsibility with the regulations. This review will monitor a student’s status in each of the three evaluation criteria. Based on this review, each student will be determined to be in one of four eligibility categories as noted below. Students will be notified of any change in status which affects eligibility for Title IV aid.

EligibleStudents will be determined to be in the eligible category when meeting the calculated Pace of Progression, Maximum Timeframe, and Grade Point Average requirements or when previously on Financial Aid Probation and currently working under and meeting all conditions of an approved academic plan. Financial Aid WarningEligible students who are not meeting any of the Satisfactory Academic Progress Requirements at the end of a term will automatically be placed in a status of Financial Aid Warning. Students placed in this status will remain eligible for one additional semester of Title IV aid. IneligibleStudents already in a status of Financial Aid Warning will be placed in the ineligible category if any of the following conditions are met at the time of review:

Financial Aid ProbationStudents in the Ineligible category may appeal that status based on extenuating circumstances such as the death of a relative, an injury or illness of the student, or other special circumstances. Appeals must be submitted in writing to the Director of Financial Aid and must include the following:

If an appeal is approved, the student will be placed on Financial Aid Probation status and will regain eligibility for Title IV aid. Students on Financial Aid Probation may receive Title IV aid for one semester if it is determined that the student should be able to meet all Satisfactory Academic Progress requirements by the end of that semester. If it is determined that the student will not be able to meet all Satisfactory Academic Progress requirements by the end of one semester, an academic plan can be developed to allow for additional semesters of eligibility as indicated in that plan. Students without an approved academic plan who do not meet all Satisfactory Academic Progress requirements after one semester of Financial Aid Probation will be again placed in the Ineligible category. Additional appeals are allowed as long as the circumstances are not exactly the same as those that were used for a previous appeal. Academic PlanStudents in Financial Aid Probation status who will not meet all Satisfactory Academic Progress requirements within one semester may regain Title IV aid eligibility by developing and following a specific academic plan. The need for an academic plan will be determined during the appeal process. Students in need of an academic plan will need to submit a plan proposal to the Financial Aid Office which specifies the following: