Certified Management Accountant (CMA) Exam Braindumps

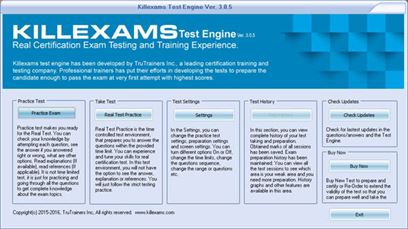

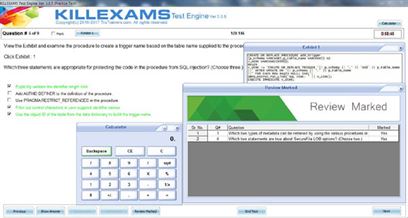

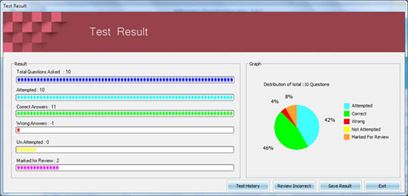

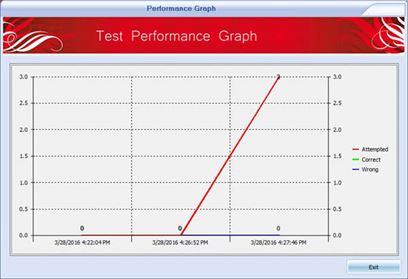

Killexams.com CMA Exam Braindumps contain complete question pool, updated in April 2024 including VCE exam simulator that will help you get high marks in the exam. All these CMA exam questions are verified by killexams certified professionals and backed by 100% money back guarantee.

CMA information - Certified Management Accountant (CMA) Updated: 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Precisely same CMA questions as in real test, WTF! | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Exam Code: CMA Certified Management Accountant (CMA) information January 2024 by Killexams.com team | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CMA Certified Management Accountant (CMA) Content Specification Outlines CMA® (Certified Management Accountant) Examinations Part 1 - Financial Planning, Performance, and Analytics A. External Financial Reporting Decisions (15% - Levels A, B, and C) 1. Financial statements a. Balance sheet b. Income statement c. Statement of changes in equity d. Statement of cash flows e. Integrated reporting 2. Recognition, measurement, valuation, and disclosure a. Asset valuation b. Valuation of liabilities c. Equity transactions d. Revenue recognition e. Income measurement f. Major differences between U.S. GAAP and IFRS B. Planning, Budgeting, and Forecasting (20% - Levels A, B, and C) 1. Strategic planning a. Analysis of external and internal factors affecting strategy b. Long-term mission and goals c. Alignment of tactics with long-term strategic goals d. Strategic planning models and analytical techniques e. Characteristics of a successful strategic planning process 2. Budgeting concepts a. Operations and performance goals b. Characteristics of a successful budget process c. Resource allocation d. Other budgeting concepts 3. Forecasting techniques a. Regression analysis b. Learning curve analysis c. Expected value Part 1 - Financial Planning, Performance, and Analytics 4. Budgeting methodologies a. Annual business plans (master budgets) b. Project budgeting c. Activity-based budgeting d. Zero-based budgeting e. Continuous (rolling) budgets f. Flexible budgeting 5. Annual profit plan and supporting schedules a. Operational budgets b. Financial budgets c. Capital budgets 6. Top-level planning and analysis a. Pro forma income b. Financial statement projections c. Cash flow projections C. Performance Management (20% - Levels A, B, and C) 1. Cost and variance measures a. Comparison of real to planned results b. Use of flexible budgets to analyze performance c. Management by exception d. Use of standard cost systems e. Analysis of variation from standard cost expectations 2. Responsibility centers and reporting segments a. Types of responsibility centers b. Transfer pricing c. Reporting of organizational segments 3. Performance measures a. Product profitability analysis b. Business unit profitability analysis c. Customer profitability analysis d. Return on investment e. Residual income f. Investment base issues g. Key performance indicators (KPIs) h. Balanced scorecard D. Cost Management (15% - Levels A, B, and C) 1. Measurement concepts a. Cost behavior and cost objects b. real and normal costs c. Standard costs d. Absorption (full) costing e. Variable (direct) costing f. Joint and by-product costing 2. Costing systems a. Job order costing b. Process costing c. Activity-based costing d. Life-cycle costing 3. Overhead costs a. Fixed and variable overhead expenses b. Plant-wide vs. departmental overhead c. Determination of allocation base d. Allocation of service department costs 4. Supply chain management a. Lean resource management techniques b. Enterprise resource planning (ERP) c. Theory of Constraints d. Capacity management and analysis 5. Business process improvement a. Value chain analysis b. Value-added concepts c. Process analysis, redesign, and standardization d. Activity-based management e. Continuous improvement concepts f. Best practice analysis g. Cost of quality analysis h. Efficient accounting processes E. Internal Controls (15% - Levels A, B, and C) 1. Governance, risk, and compliance a. Internal control structure and management philosophy b. Internal control policies for safeguarding and assurance c. Internal control risk d. Corporate governance e. External audit requirements 2. System controls and security measures a. General accounting system controls b. Application and transaction controls c. Network controls d. Backup controls e. Business continuity planning F. Technology and Analytics (15% - Levels A, B, and C) 1. Information systems a. Accounting information systems b. Enterprise resource planning systems c. Enterprise performance management systems 2. Data governance a. Data policies and procedures b. Life cycle of data c. Controls against security breaches 3. Technology-enabled finance transformation a. System development life cycle b. Process automation c. Innovative applications 4. Data analytics a. Business intelligence b. Data mining c. Analytic tools d. Data visualization A. Financial Statement Analysis (20% - Levels A, B, and C) 1. Basic financial statement analysis a. Common size financial statements b. Common base year financial statements 2. Financial ratios a. Liquidity b. Leverage c. Activity d. Profitability e. Market 3. Profitability analysis a. Income measurement analysis b. Revenue analysis c. Cost of sales analysis d. Expense analysis e. Variation analysis 4. Special issues a. Impact of foreign operations b. Effects of changing prices and inflation c. Impact of changes in accounting treatment d. Accounting and economic concepts of value and income e. Earnings quality Part 2 - Strategic Financial Management B. Corporate Finance (20% - Levels A, B, and C) 1. Risk and return a. Calculating return b. Types of risk c. Relationship between risk and return 2. Long-term financial management a. Term structure of interest rates b. Types of financial instruments c. Cost of capital d. Valuation of financial instruments 3. Raising capital a. Financial markets and regulation b. Market efficiency c. Financial institutions d. Initial and secondary public offerings e. Dividend policy and share repurchases f. Lease financing 4. Working capital management a. Working capital terminology b. Cash management c. Marketable securities management d. Accounts receivable management e. Inventory management f. Types of short-term credit g. Short-term credit management 5. Corporate restructuring a. Mergers and acquisitions b. Other forms of restructuring 6. International finance a. Fixed, flexible, and floating exchange rates b. Managing transaction exposure c. Financing international trade C. Decision Analysis (25% - Levels A, B, and C) 1. Cost/volume/profit analysis a. Breakeven analysis b. Profit performance and alternative operating levels c. Analysis of multiple products 2. Marginal analysis a. Sunk costs, opportunity costs, and other related concepts b. Marginal costs and marginal revenue c. Special orders and pricing d. Make vs. buy e. Sell or process further f. Add or drop a segment g. Capacity considerations 3. Pricing a. Pricing methodologies b. Target costing c. Elasticity of demand d. Product life-cycle considerations e. Market structure considerations D. Risk Management (10% - Levels A, B, and C) 1. Enterprise risk a. Types of risk b. Risk identification and assessment c. Risk mitigation strategies d. Managing risk E. Investment Decisions (10% - Levels A, B, and C) 1. Capital budgeting process a. Stages of capital budgeting b. Incremental cash flows c. Income tax considerations d. Evaluating uncertainty 2. Capital investment analysis methods a. Net present value b. Internal rate of return c. Payback d. Comparison of investment analysis methods F. Professional Ethics (15% - Levels A, B, and C) 1. Business ethics a. Moral philosophies and values b. Ethical decision making 2. Ethical considerations for management accounting and financial management professionals a. IMAs Statement of Ethical Professional Practice b. Fraud triangle c. Evaluation and resolution of ethical issues 3. Ethical considerations for the organization a. Organizational factors and ethical culture b. IMAs Statement on Management Accounting, “Values and Ethics: From Inception to Practice” c. Ethical leadership d. Legal compliance e. Responsibility for ethical conduct f. Sustainability and social responsibility | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Certified Management Accountant (CMA) Financial Management information | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other Financial examsABV Accredited in Business Valuation (ABV)AFE Accredited Financial Examiner (AFE) AngularJS AngularJS AVA Accredited Valuation Analyst CABM Certified Associate Business Manager CBM Certified Business Manager (APBM CBM) CCM Certified Case Manager (CCM) CFE Certified Financial Examiner (CFE) CFP Certified Financial Planner (CFP Level 1) CGAP Certified Government Auditing Professional (IIA-CGAP) CGFM Certified Government Financial Manager (CGFM) CHFP Certified Healthcare Financial Professional (CHFP) - 2023 CIA-I Certified Internal Auditor (CIA) CIA-II Certified Internal Auditor (CIA) CIA-III The Certified Internal Auditor Part 3 CIA-IV The Certified Internal Auditor Part 4 CITP Certified Information Technology Professional (CITP) CMA Certified Management Accountant (CMA) CMAA Certified Merger and Acquisition Advisor (CM and AA) CPCM Certified Professional Contracts Manager (CPCM) 2023 CPEA Certified Professional Environmental Auditor (CPEA) CPFO Certified Public Finance Officer (Governmental Accounting, Auditing, and Financial Reporting) CRFA Certified Forensic Accountant (CRFA) CTFA Certified Trust and Financial Advisor (CTFA) CVA Certified Valuation Analyst (CVA) FINRA FINRA Administered Qualification Examination CEMAP-1 Certificate in Mortgage Advice and Practice (CeMAP) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Our CMA test braindumps are collected from real exams and carefully assembled in PDF and VCE test simulator. Our CMA CMA test will supply you test questions with correct answers that reflect the real exam. We have made arrangements to engage you to pass your CMA test with over the top marks. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial CMA Certified Merger and Acquisition Advisor (CM and AA) https://killexams.com/pass4sure/exam-detail/CMA ($17,200,000 of plant and equipment+ $1,800,000 of working capital), a 15% imputed interest charge equals $2,850,000. Adding $2,000,000 of residual income to the imputed interest results in a target profit of $4,850,000. This profit can be achieved if costs are $25,150,000 ($30,000,000 revenue �$4,850,000 profit). Question: 621 The following information relates to Cinder Co.�s Northeast Division Sales $600,000 Variable costs 360,000 Traceable fixed costs 60,000 Average invested capital 120,000 Imputed interest rate 8% Cinders residual income was A. $170,400 B. $180,000 C. $189,600 D. $230,400 Answer: A Residual income is income of an investment center minus an imputed interest charge for invested capital. Accordingly, Cinder�s residual income is $170,400 [($600,000 sales� $360,000 variable costs �$60,000 traceable fixed costs) net income �($120,000 average invested capital x 8%) imputed interest]. Question: 622 REB Service Co. is a computer service center. For the month, REB had the following operating statistics: Based on the above information, which one of the following statements is true? REB has a A. Return on investment of 4%. B. Residual income of $(5,000). C. Return on investment of 1.6%. D. Residual income of $(22,000). Answer: B Return on investment is commonly calculated by dividing pretax income by total assets available Residual income is the excess of the return on investment over a targeted amount equal to an imputed interest charge on invested capital. The rate used is ordinarily the weighted-average cost of capital. Some companies measure managerial performance in terms of the amount of residual income rather than the percentage return on investment. Because REB has assets of $500,000 and a cost of capital of 6%, it must earn $30,000 on those assets to cover the cost of capital. Given that operating income was only $25,000, it had a negative residual income of $5,000. Question: 623 Charli&s Service Co. is a service center. For the month of June, Charlie�s had the following operating statistics: Charlie�s has a A. Return on investment of 3.33%. B. Residual income of $(5,000). C. Return on investment of 6%. D. Residual income of $(20,000). Answer: B Residual income is the excess of the real ROl in dollars over a targeted amount equal to an imputed interest charge on invested capital. The rate used is ordinarily the weighted-average cost of capital. Some entities measure managerial performance in terms of the amount of residual income ratherthan the percentage ROl. Assuming the investment base is defined as total assets available, Charlie�s targeted amount is $30,000 ($500,000 total assets x 6% cost of capital). Assuming that operating income of $25,000 is the ROI in dollars, residual income was $(5,000). This result is consistent with defining the numerator of the ROl calculation (Income � Investment) as operating income. However, it might also be defined as net profit aftertaxes (net income). Moreover, the ROl denominator may be defined variously, e.g., total assets available, total assets employed, working capital plus other assets, or shareholders� equity. Edith Carolina, president of the Deed Corporation, requires a minimum return on investment of 8% for any projectto be undertaken by her company. The company is decentralized, and leaves investment decisions up to the discretion of the division managers as long as the 8% return is expected to be realized. Michael Sanders, manager of the Cosmetics Division, has had a return on investment of 14% for his division for the past 3 years and expects the division to have the same return in the coming year. Sanders has the opportunity to invest in a new line of cosmetics which is expected to have a return on investment of 12%. Question: 624 Residual income is a better measure for performance evaluation of an investment center manager than return on investment because A. The problems associated with measuring the asset base are eliminated. B. Desirable investment decisions will not be neglected by high-return divisions. C. Onlythe gross bookvalue of assets needs to be calculated. D. The arguments about the implicit cost of interest are eliminated Answer: B Residual income is the excess of the amount of the ROI over a targeted amount equal to an imputed interest charge on invested capital. The advantage of using residual income ratherthan percentage ROI is thatthe former emphasizes maximizing a dollar amount instead of a percentage. Managers of divisions with a high ROI are encouraged to accept projects with returns exceeding the cost of capital even if those projects reduce the department�s ROI. Edith Carolina, president of the Deed Corporation, requires a minimum return on investment of 8% for any projectto be undertaken by her company. The company is decentralized, and leaves investment decisions up to the discretion of the division managers as long as the 8% return is expected to be realized. Michael Sanders, manager of the Cosmetics Division, has had a return on investment of 14% for his division for the past 3 years and expects the division to have the same return in the coming year. Sanders has the opportunityto invest in a new line of cosmetics which is expected to have a return on investment of 12%. Question: 625 If the Deed Corporation evaluates managerial performance using return on investment, what will be the preference for taking on the proposed cosmetics line by Edith Carolina and Michael Sanders? Carolina Sanders A. Accept Reject B. Reject Accept C. Accept Accept D. Reject Reject Answer: A A company with an 8% ROl threshold should obviously accept a projectyielding 12% because the company�s overall ROI would increase. The manager being evaluated on the basis of ROI who is already earning 14% will be unwilling to accept a 12% return on a new project because the overall ROl for the division would decline slightly. This absence of goal congruence suggests a weakness in ROl-based performance evaluation. Question: 626 Managerial performance can be measured in many differentways, including return on investment (ROD and residual income (RI). A good reason for using RI instead of ROl is that A. RI can be computed without regard to identifying an investment base. B. Goalcongruence is more likelyto be promoted by using RI. C. RI is well understood and often used in the financial press. D. ROl does not take into consideration both the investment turnover ratio and return-on� sales percentage. Answer: B The residual income method calculates the excess of the return on an investment over a targeted amount equal to an imputed interest charge on invested capital. The rate used is usually the weighted average cost of capital. Residual income may be preferable to ROl because an enterprise will benefit from expansion as long as residual income is earned. Using a ROl, expansion might be rejected if it lowered ROl even though residual income would increase. Thus, the residual income method promotes the congruence of a manager�s goal with those of the enterprise. Actions that tend to benefit the company will also tend to improve the measure of the manager�s performance. Question: 627 The balanced scorecard provides an action plan for achieving competitive success byfocusing management attention on critical success factors. Which one of the following is not one of the perspectives on the business into which critical success factors are commonly grouped in the balanced scorecard? A. Competitor business strategies. B. Financial performance. C. Internal business processes. D. Employee innovation and learning. Answer: A A typical balanced scorecard classifies critical success factors and measures into one of four perspectives on the business: financial, customer satisfaction, internal business processes, and learning and growth. Question: 628 Using the balanced scorecard approach, an organization evaluates managerial performance based on A. A single ultimate measure of operating results, such as residual income. B. Multiple financial and nonfinancial measures. C. Multiple nonfinancial measures only. D. Multiple financial measures only. Answer: B The trend in managerial performance evaluation is the balanced scorecard approach. Multiple measures of performance permit a determination as to whether a manager is achieving certain objectives at the expense of others that may be equally or more important. These measures may be financial or nonfinancial and usually include items in four categories: profitability; customer satisfaction; innovation; and efficiency, qualify, and time. Question: 629 On a balanced scorecard, which of the following would not be an example of a customer satisfaction measure? A. Market share. B. Economic value added. C. Response time D. Customer retention. Answer: B Customer satisfaction measures include market share, retention, response time, delivery performance, number of defects, and lead time. Economic value added, or EVA�, is a profitabilit/ measure. Question: 630 On a balanced scorecard, which is more of an internal process measure than an external- based measure? A. Cycle time. B. Profitability. C. Customer satisfaction. D. Market share. Answer: A Cycle time is the manufacturing time to complete an order. Thus, cycle time is strictly related to internal processes Profitability is a combination of internal and external considerations. Customer satisfaction and market share are related to how customers perceive a product and how competitors react. For More exams visit https://killexams.com/vendors-exam-list Kill your test at First Attempt....Guaranteed! | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Nottingham City Council must publish a secret report raising “very serious concerns” over its financial management following a ruling by the Information Commissioner’s Office. Accounting firm Ernst and Young (EY) was asked to review the Labour-run authority’s books following the uncovering of significant misspending in the council’s Housing Revenue Account in 2021. Millions of pounds strictly intended for council housing and tenants had been wrongly and unlawfully transferred to the authority’s general fund over a series of years. It is estimated the cost to make amends is around £51m. But the council only published its own 10-page summary of the review, and said the full report cannot be made public. In July 2023 a Freedom of Information (FOI) request was made to the council asking that the full report be made public on the grounds its release would be in the public interest. A response was delayed in August while the council undertook a public interest test to determine if the report should be published. However, the test ruled in favour of not disclosing the information. A subsequent internal review was requested, and this too concluded the report should not be published due to the council’s need to consider technical reports for officers in a “safe space”. The Local Democracy Reporting Service appealed the decision of the internal review to the Information Commissioner’s Office (ICO). Today (January 5) It has ruled in favour of a full disclosure of the report. In the decision notice Christopher Williams, Senior Case Officer, said: “Given the facts of this case, the Commissioner does not find it plausible to dismiss the interest in the council’s financial governance as a purely private interest, as if it were the equivalent of mischievous or salacious tabloid reporting. “The Commissioner considers that the publicly documented concerns about the council’s financial management provide legitimate and demonstrable grounds for public concern and a valid public interest argument in favour of disclosure in this case. “Moreover, the Commissioner notes that public concerns about the council’s financial management are not confined to the matters associated with the Report. “It is a matter of public record that the council recently lost considerable sums of public money in its investment in Robin Hood Energy. “It is not the Commissioner’s role to scrutinise the council’s financial practices but it is clear that it would be reasonable for the public to be concerned about the council’s practices. “In considering the public interest factors more directly associated with the exemption, namely, the need for a safe space for effective decision making, the Commissioner considers that the arguments provided by the council are generic and do not provide details of the specific harm which disclosure would be likely to cause. “Public awareness of any issues identified in the Report should not inhibit the council’s ability to make decisions and any concerns about misinterpretation of technical details could be addressed in a preface or covering release. “The Commissioner recognises that the issuing of the section 114 notice postdates the request and cannot be considered as a relevant public interest factor. “However, he does consider that, to an extent, it retroactively legitimises and adds weight to the public interest concerns which count in favour of disclosure in this case.” The City Council must now release the full report within 35 calendar days of The council had a right to appeal the decision to a first-tier tribunal, however it says it will be complying with the ICO’s decision. A spokesman said: “The Information Commissioner has made clear in the decision notice that the council had legitimate concerns around the disclosure of the report and that it had engaged the exemption not to publish correctly. However they have decided that on balance, the public interest outweighed the exemption in this case. “It’s important to make clear that key information included in the report had already been published in a public report to the council’s Audit Committee. The council took the view that the full report was of a technical nature designed to support the work of professional officers. “The council has never shied away from the seriousness of the findings as explicitly set out in the report to Audit Committee and has been focused on addressing those weaknesses. Good progress is being made in all the areas where improvement was required. “The council will fully comply with the ICO’s decision within the required timeframe.” • Council faces growing public pressure over unpublished finances report The Department of Housing and Urban Development (HUD) received some good news as the year closed. It achieved a clean financial audit opinion, with no material weaknesses. It even won praise from its inspector general. For how this happened, the Federal Drive with Tom Temin spoke with Chief Financial Officer Vinay Singh. Tom Temin And I guess the significant thing is not that this is not the first time and now for a lot of agencies. Great. We got a first clean opinion. Tell us more. Why not your first and why not? Being the first is significant. Vinay Singh You know, first is always great, but this is about sustainability and a continued focus on what an unqualified or clean audit opinion means. In addition to this is the first time without a material weakness and a material weakness obviously, as you know, there are significant deficiencies over internal controls, over financial reporting. So that itself is significant. In addition, this year, we also hit the timeline of November 15th, which has been eluding us for quite some time. So what it’s showing is the sustainability and the ability of our teams to start really leveraging our rigorous processes that we’ve put in place to not only get that clean opinion, to do it on time, to do it, removing the material weakness. I mean, this continues to show and should enable the public trust. Tom Temin And for those of us that aren’t enthralled by federal finance, which I find fascinating personally, but maybe everybody doesn’t. Sure. What is the process by which the opinion is rendered and who renders it? Vinay Singh Yes, this is opinion. We have an external auditor, Clifton Lawson Associates, Clay. In the past it was done by our Office of Inspector General, or I.G. But having a third party, external party free, you know, independent is critical. So the processes, you know, during the year they will evaluate or controls, they will look at our processes, talk to management, talk to the programs, and really test whether all our financial statements are free of material errors. Tom Temin Yeah, interesting. And just again, on the civics side of this, you’re the CFO and the chief financial officer has one function, kind of a comptroller type of function, but then the accounting function is not necessarily within that channel. Maybe just a brief backgrounder on how that works. Vinay Singh Actually, the accounting is sort of the CFO role has several functions and really getting this clean audit opinion, it does take a village financial management of which MelaJo Kubacki, our Assistant CFO, runs the core elements of financial management it controls. But the accounting team where I have Nita Nigam, who is the Assistant CFO, they’re our systems team, which looks at the financial systems. They all play a role together along with the programs. So the CFOs sole role is obviously financial stewardship, ensuring we do have clean audit opinions. But there’s a lot more that happens behind the scenes in a CFO function. Tom Temin Yeah, sure. It’s a pretty complex function and it’s been developed almost like a nurturing porridge over the past 35 years or so since the CFO ACT And you mentioned that this time there were no material weaknesses, which was the last one to get excised out of here. Vinay Singh There was the validation of grant accruals, which was the last one, and that was across several programs. Tom Temin Well, that’s a big one, though, because HUD is a major granting agency. And if you look across government, grants management is the object of a lot of oversight, A lot of I.G., a lot of GAO, a lot of congressional concern over the years. So to not have a material weakness in something so crucial that’s also uniquely federal. That sounds like a big deal. Vinay Singh Yes, it has been. And the teams have been working on this. This is not like something that happened within 12 months or 18 months of me being here. This goes back to continued management focus on this. You know, HUD has been set up as a decentralized agency where the programs do have their own financial analysts. They put out the grants and we work with them. So it’s different than just kind of a private sector organization where you have more of an autocratic, you know, the CFO controls everything. So to be able to do it this way is also, you know, I think substantial is it shows that kind of connective tissue with the programs and the CFO continue to build that relationship so that this will continue. It’s not just a one off. Tom Temin We’re speaking with Vinay Singh. He is the chief financial officer at Housing and Urban Development. And from the CFO standpoint, sitting in your chair, what are the things, the indicators, the dashboard lights that you watch day to day to make sure that this vast and complicated and very hard to see inside of functions like finance and accounting and cash control and all the rest of it is operating the way it should, and that nothing horrible is brewing under the surface. Vinay Singh Yeah, that’s a great question. I have several dashboards that I look at, one around the controls that we talked about, where financial management looks at things like the single audit compliance and other aspects of accounting and looking at balances. Receivables. But in addition, it’s about kind of some of the compliance around systems. So, you know, one of the other key progress areas that we’ve made is that all HUD systems are now FFMIA compliant, which is the Federal Financial Management Improvement Act, and we resolved our last system noncompliance. So even getting our systems and you know, you’re obviously following government, that’s a significant piece. We’ve got budget reports that I look at. I look at something we call the air reports around assurance, integrity. There’s several key pieces that I monitor daily, some weekly, some monthly, and then have discussions with the team around. Tom Temin I would guess the magic in this is being able to spot things before they turn into material weaknesses or some worse kind of financial leakage, which, you know, they pop up from time to time fraud, improper payments and the like. Vinay Singh Correct. And we do have dashboards around that, our risk team. And that’s also sits in CFO, you know, monitors a variety of risks that we continue to monitor and mitigate. And if you will, you’re correct when we say, you know, catch things before they happen. So our teams have really continued to perform readiness reviews and risk assessments, and it’s kind of an ongoing process. So it’s year long even though our financial year is fixed and then September 30th, the teams are always looking three months out, six months out and monitoring what is coming down the pipe. Tom Temin And is there an information technology type of enhancement that can help people because of many of the financial systems? I think HUD for a while there had some of the oldest systems still running in government. And I think you’ve done a lot of modernization over the last few years. So it seems like the CIO is a good partner as you’re trying to get best CFO practice established. Vinay Singh 100%, 100% CIO is fully integrated with us. Our teams all have great relationships and have built processes where we work together. And so that mentioning, you know, our compliance with our FFMIA, is critical. But also, you know, financial management overall was removed as a top management challenge for the department where the OIG has said, you know, HUD has shown that sustained progress. But it does require technology and tools. We have had antiquated and continue to have some that we continue to try to make progress on. But we’re starting to leverage, you know, tools that are a little bit more common, such as the BI tools, the business intelligence tools. I know our teams are aggressively looking and using robotic process automation, RPA bots, but just the ability to be able to process and transaction do data mining and DNA analytics, that’s the critical part. That’s where I think we started to make progress in why this the fourth year in a row? Because, you know, relying on those older systems, it was very difficult to get comfort for the auditors around what we have. But now that we have more progressive systems, more information showing up in real time or closer to near time, it starts to supply comfort and assurance to the auditors that we’re understanding our transactions. We’re seeing what’s happening now, able to monitor the risks that could happen. And it’s just that sharing of information, that transparency and that ability to cut across. Tom Temin And I would think that for a shrewd program manager, in fact, I’ve told hundreds of them over the years, your best friend in program management can be the CFO because they can help you be an ally in what you want to get done, but just don’t try to do it without them. And so I’m guessing that having full control over financial management and getting that clean audit and knowing your processes are accurate can make you a better and more informed counselor to programs that are trying to find ways financially to get things done. Vinay Singh Absolutely. I mean, what HUD’s been doing is leveraging these process improvements and those I.T resources you referenced to really reduce the monitoring burden on grantees where the programs can rely on our processes and that reduces a lot of the manual efforts on many sides and increases that data integrity. So we use, obviously, as you said, you know, technology, innovation to connect, analyze, visualize data. And that just lets our officers prioritize where the weak spots are. So now it’s not just everything is on fire. We really are able to take a step back, understand where, you know, we spots are and focus our efforts on strengthening the high risk controls. Tom Temin And when you go to the Hill, you probably have a lot more credibility as an agency. Vinay Singh Yeah, I think so. I believe so. And I think that’s what coming back to what I started with on public trust. I mean, that’s what I try to instill in a lot of folks that don’t understand that are not non CFO right up to the program officers others. Why is this so important? I mean, a lot of this is compliance and you know, a lot of folks push back and say, why are we doing so much? It’s so much else to do. But I you know, I try to convey the essence of the mission is if we’re able to supply you that clean audit opinion, that public trust has improved, the Hill and other stakeholders believe that we are able to have good financial stewardship of the monies and make improvements on our mission. And so therefore, yes, it’s a it’s a circle is a lifecycle, and it continues. Tom Temin In just briefly, your own background to come to CFO because you sound passionate about this type of work. Vinay Singh Absolutely. I mean. It started as an accountant, senior accountant. I did have a zigzag life, but I have held positions. As I told my team in almost every function the CFO has. I used to be an auditor. I used to be a staff accountant. I used to do risk work. I used to do controls work. I did work and kind of analysis. So for me, that path up and, you know, most recently I was at SBA, but before that I was a partner at KPMG and I do have a CPA certified public accountant. You know, I love numbers because numbers tell a story. So now in my role, it’s not only making sure we’ve got this great stewardship, but also conveying that story like I mentioned, about public trust so that others across the agency understand why CFO is important, continue to deepen our collaboration, and that just helps us get more transparency in real time and information and monitor these risks. Tom Temin So you’re one of those guys that reads the footnotes on financial statements. Vinay Singh I learned early on that everything is actually in the footnotes. Everything else doesn’t matter. Actually, you should read the footnotes first. Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

Welcome to our guide for mastering financial management in the UAE! Ever wondered how to make your money work smarter for you? Well, you’re not alone, and we’re here to help. In this blog, we’ll be your personal navigator of effective financial management. We’ll explore the process of setting clear goals that align with your dreams and aspirations. This journey includes understanding the ins and outs of taxes, maximizing the potential of your investments, and ensuring the protection of your assets with insurances like: Life Insurance, Property Insurance as well Medical Insurance in Dubai.We’ve got you covered, so get ready for a financial journey tailored just for you—where simplicity meets success in the vibrant landscape of the UAE! Tip 1: Set Clear Financial GoalsSetting clear financial goals is the first step towards effective financial management. Whether you aim to grow your business, save for retirement, or purchase a new home, defining your objectives will help you stay focused and motivated. Use SMART Criteria: Prioritize goals that are Specific, Measurable, Achievable, Relevant, and Time-bound for focused and effective planning. Make Smart Money Moves to use your resources wisely to achieve your financial goals. By having well-defined financial goals, you can make informed decisions and allocate your resources effectively. Tip 2: Build an Emergency FundEstablishing an emergency fund is essential for financial stability. Unforeseen expenses, such as medical emergencies or job loss, can significantly impact your finances. Aim to save enough money to cover at least three to six months’ worth of living expenses in a dedicated savings account. This fund will serve as a financial safety net, providing you with peace of mind during challenging times. Tip 3: Diversify Your InvestmentsEducate yourself about various investment opportunities available in the UAE and diversify your investment portfolio. Diversify Across Asset Classes: Spread your investments across various asset classes like stocks, bonds, and real estate to reduce risks and enhance potential returns. Consider Mutual Funds: Look into mutual funds that offer diversification by pooling investments across multiple assets, providing a balanced and managed approach. By diversifying your investments, you can mitigate potential losses and increase your chances of long-term financial success. Tip 4: Take Advantage of Tax BenefitsFamiliarize yourself with the tax laws in the UAE and explore available tax deductions and exemptions. Optimize Retirement Contributions: Contribute to recognized retirement funds, like the Golden Pension Scheme, for maximum tax advantages. Explore Charitable Contributions: Investigate eligible donations that qualify for tax benefits, aligning your giving with financial advantages. By taking advantage of tax benefits, you can minimize your tax burden and allocate more funds towards your financial goals. Tip 5: Protect Your Assets with Insurance

Keep your belongings safe by getting insurance. It’s like a protective shield for your things, guarding them against unexpected problems. With insurance, you can face life’s uncertainties knowing that your important stuff is well taken care of. Take charge of your finances with smart management. Get Mandatory Car Insurance: Comply with UAE regulations by securing best vehicle insurance in UAE for protection against accidents. This provides a financial safety net by reducing the impact of vehicle repairs on your budget, and it often comes with roadside assistance. Prioritize Health Insurance: Ensure Health insurance in UAE for financial protection and access to quality healthcare during illnesses, thereby reducing the impact of unforeseen medical bills and easing strain on your financial resources. Seek Expert Advice: Consult UAE insurance professionals for guidance in choosing policies that suit your needs, providing comprehensive coverage and Smart planning in your financial management . Assess your insurance needs and choose policies that align with your circumstances and financial goals. Tip 6: Create a Realistic BudgetCrafting a comprehensive budget is crucial for effective financial management. A budget allows you to track your income and expenses, providing a clear overview of your financial situation. Start by categorizing your expenses into fixed and variable, urgent and non-urgent, necessities and luxuries, and avoidable and unavoidable. Embrace the 50/30/20 Rule: Follow the guideline of allocating 50% of your income to necessities, 30% to discretionary spending, and 20% to savings. This balanced approach promotes financial stability and future planning Explore Local Discounts and Offers: Explore ways to maximize your savings in the UAE by taking advantage of various discounts and offers. While focusing on everyday expenses, don’t overlook the potential savings on necessities like car insurance. It’s essential to stay informed about your car insurance status to ensure you’re getting the coverage you need at the best possible rate One convenient way to check your car insurance status in the UAE is by utilizing online platforms. With the digital transformation in the insurance industry, you can now easily access information about your policy from the comfort of your home This will help you prioritize your spending and make necessary adjustments to stay within your means. Regularly review your budget and make modifications as needed to ensure it aligns with your financial goals. Tip 7: Save for Retirement Early

Start saving for retirement as early as possible. The UAE offers retirement savings plans like the Golden Pension Scheme, which is open to all expats working in the country. By contributing regularly to a retirement fund, you can take advantage of compounding interest and ensure a comfortable retirement. Choose a Retirement Plan: Pick a suitable retirement savings plan, like the Golden Pension Scheme, tailored for expats in the UAE. Automate Contributions: Set up automatic contributions from your salary or bank account to ensure regular savings and benefit from compounding interest. Optimize Employer Contributions: Maximize your retirement savings by taking full advantage of any employer-sponsored plans or contributions. Tip 8: Pay Off Debts StrategicallyDebt can hinder your financial progress, so it’s important to prioritize debt repayment. Target High-Interest Debts First: Begin by paying off debts with the highest interest rates, such as credit card balances. This approach minimizes long-term interest costs. Use Windfalls Wisely: Direct unexpected funds, like bonuses, towards debt repayment to accelerate the process and alleviate financial pressure. Automate Payments: Set up automatic payments to ensure timely and consistent debt repayments, preventing late fees. By strategically tackling your debts, you can free up more resources to invest or save for your future. By following these eight tips, you can enhance your financial management skills and pave the way for a secure and prosperous financial future in the UAE. ConclusionSo there you have it, the 8 tips to get your financial life in order here in the UAE. Making a budget, saving automatically, spending mindfully, buying insurance, and planning for the future will set you up for success. Take it step by step and focus on progress, not perfection. You’ve got this! Living in such an exciting country with so many opportunities also means taking responsibility for your financial well-being. Follow these tips and leverage services like insura to secure your financial future Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor for personalized guidance. RED BANK, N.J., Jan. 05, 2024 (GLOBE NEWSWIRE) -- OceanFirst Financial Corp. (NASDAQ:OCFC), the holding company for OceanFirst Bank, today announced that it will issue its earnings release for the quarter ended December 31, 2023 on Thursday, January 18, 2024 after the market close. Management will then conduct a conference call at 11:00 a.m. Eastern Time, on Friday, January 19, 2024 to discuss highlights of the Company's quarterly operating performance. The direct dial number for the call is 1-833-470-1428, toll free, using the access code 040735. For those unable to participate in the conference call, a replay will be available. To access the replay, dial 1-866-813-9403, Access Code 247218, from one hour after the end of the call until February 16, 2024. The conference call will also be available (listen-only) via the Internet by accessing the Company's Web address: www.oceanfirst.com - Investor Relations. Web users should go to the site at least fifteen minutes prior to the call to register, get and install any necessary audio software. The webcast will be available for at least 30 days. OceanFirst Financial Corp.’s subsidiary, OceanFirst Bank N.A., founded in 1902, is a $13.5 billion regional bank providing financial services throughout New Jersey and the major metropolitan markets of Philadelphia, New York, Baltimore, and Boston. OceanFirst Bank delivers commercial and residential financing, treasury management, trust and asset management, and deposit services and is one of the largest and oldest community-based financial institutions headquartered in New Jersey. OceanFirst Financial Corp.'s press releases are available at https://www.oceanfirst.com. Forward-Looking Statements In addition to historical information, this news release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words "believe," "expect," "intend," "anticipate," "estimate," "project," "will," "should," "may," "view," "opportunity," "potential," or similar expressions or expressions of confidence. The Company's ability to predict results or the real effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to: changes in interest rates, general economic conditions, levels of unemployment in the Bank’s lending area, real estate market values in the Bank’s lending area, future natural disasters and increases to flood insurance premiums, the level of prepayments on loans and mortgage-backed securities, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company's market area and accounting principles and guidelines. These risks and uncertainties are further discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and subsequent securities filings and should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

WINNIPEG, MB, Jan. 5, 2024 /CNW/ - IGM Financial Inc. (IGM) (TSX: IGM) today reported preliminary total consolidated net outflows of $518 million during December 2023 as shown in Table 1. Total assets under management and advisement were $240.2 billion at December 31, 2023, compared with $234.9 billion at November 30, 2023, and $224.2 billion at December 31, 20221). Assets under management and advisement are shown in Table 2. DECEMBER HIGHLIGHTS IGM Financial – Assets under management & advisement of $240.2 billion were up 2.2% in the month. Total net outflows were $518 million compared to net outflows of $28 million in December 20222). Investment fund net redemptions were $514 million compared to net redemptions of $390 million in December 20222). IG Wealth Management – Assets under advisement of $121.2 billion were up 2.3% in the month. Total net outflows were $118 million compared to net inflows of $156 million in December 2022. Mackenzie – Assets under management of $195.7 billion were up 2.2% in the month. Total net redemptions were $401 million compared to net redemptions of $171 million in December 2022. Investment fund net redemptions were $250 million compared to net redemptions of $141 million in December 2022.

Glossary of Terms Mutual fund gross sales, net sales and assets under management reflect the results of the mutual funds managed by the respective operating companies, and in the case of the Wealth Management segment also include other discretionary portfolio management services provided by the operating companies, including separately managed account programs. "ETF's" represent exchange traded funds managed by Mackenzie. Institutional SMA represents investment advisory and sub-advisory mandates to institutional investors through separately managed accounts. "Other dealer net flows" and "other assets under advisement" represents financial savings products held within client accounts at the Wealth Management operating companies that are not invested in products or programs where these operating companies perform investment management activities. These savings products include investment funds managed by third parties, direct investment in equity and fixed income securities and deposit products." "Assets under advisement" represents all savings products held within client accounts at the Wealth Management operating companies. "Net flows" represents the total net contributions, in cash or in kind, to client accounts at the Wealth Management operating companies and the overall net sales to the Asset Management segment. "Wealth Management" – Reflects the activities of operating companies that are principally focused on providing financial planning and related services to Canadian households. This segment includes the activities of IG Wealth Management and Investment Planning Counsel. These firms are retail distribution organizations who serve Canadian households through their securities dealers, mutual fund dealers and other subsidiaries licensed to distribute financial products and services. The majority of the revenues of this segment are derived from providing financial advice and distributing financial products and services to Canadian households. This segment also includes the investment management activities of these organizations, including mutual fund management and discretionary portfolio management services. "Asset Management" – Reflects the activities of operating companies primarily focused on providing investment management services, and represents the operations of Mackenzie Investments. Investment management services are provided to a suite of investment funds that are distributed through third party dealers and financial advisors, and also through institutional advisory mandates to pension and other institutional investors. "Discontinued operations" - Reflects the activities of Investment Planning Counsel. On April 3, 2023, IGM Financial announced the sale of 100% of the common shares of Investment Planning Counsel Inc. for cash consideration of $575 million. The transaction closed on November 30, 2023. IGM Financial Inc. is one of Canada's leading diversified wealth and asset management companies with approximately $240 billion in total assets under management and advisement. The company provides a broad range of financial planning and investment management services to help more than two million Canadians meet their financial goals. Its activities are carried out principally through IG Wealth Management, Mackenzie Investments and Investment Planning Counsel. IGM Financial is a member of the Power Corporation group of companies. SOURCE IGM Financial Inc.

For further information: Media Relations: Nini Krishnappa, 647-828-2553, [email protected]; Investor Relations: Kyle Martens, 204-777-4888, [email protected] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CMA learner | CMA questions | CMA learning | CMA action | CMA pdf | CMA thinking | CMA information search | CMA mission | CMA health | CMA test plan | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Killexams test Simulator Killexams Questions and Answers Killexams Exams List Search Exams | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||