CPA Regulation Exam Braindumps

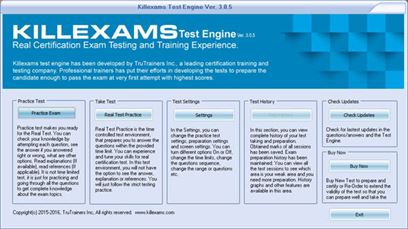

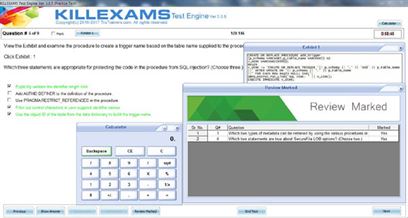

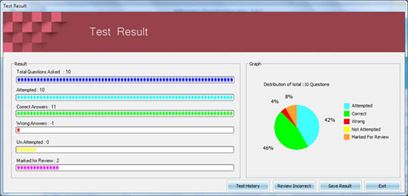

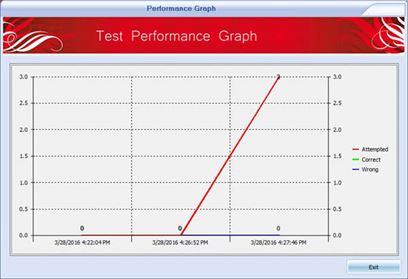

Killexams.com CPA-REG Exam Braindumps contain complete question pool, updated in April 2024 including VCE exam simulator that will help you get high marks in the exam. All these CPA-REG exam questions are verified by killexams certified professionals and backed by 100% money back guarantee.

CPA-REG education - CPA Regulation Updated: 2024 | ||||||||

| Just study these CPA-REG CPA-REG dumps Questions and Pass the real test | ||||||||

|

||||||||

|

||||||||

|

Exam Code: CPA-REG CPA Regulation education January 2024 by Killexams.com team | ||||||||

CPA-REG CPA Regulation Content area allocation Weight I. Ethics, Professional Responsibilities and Federal Tax Procedures 10–20% II. Business Law 10–20% III. Federal Taxation of Property Transactions 12–22% IV. Federal Taxation of Individuals 15–25% V. Federal Taxation of Entities 28–38% minutes — Welcome/enter launch code 5 minutes — Confidentiality/section information 4 hours — Testing time 15 minutes — Break after third testlet (option to pause test timer) 5 minutes — Survey Each of the four test sections is broken down into five smaller sections called testlets. These testlets feature multiple-choice questions (MCQs) and task-based simulations (TBSs). In the case of BEC, you also have to complete three written communication tasks. The number of MCQs and TBSs tested varies depending upon the specific section taken. You will receive at least one research question (research-oriented TBS) in the AUD, FAR and REG sections. To complete them, you will have to search the related authoritative literature and find an appropriate reference. The REG section blueprint is organized by content AREA, content GROUP and content TOPIC. Each Topic includes one or more representative TASKS that a newly licensed CPA may be expected to complete when performing tax preparation services, tax advisory services or other responsibilities of a CPA. The tasks in the blueprint are representative. They are not intended to be (nor should they be viewed as) an all-inclusive list of tasks that may be tested in the REG section of the Exam. Additionally, it should be noted that the number of tasks associated with a particular content group or Topic is not indicative of the extent such content group, Topic or related skill level will be assessed on the Exam. Similarly, examples provided within the task statements should not be viewed as all-inclusive. Area I Ethics, Professional Responsibilities and Federal Tax Procedures 10–20% Area II Business Law 10–20% Area III Federal Taxation of Property Transactions 12–22% Area IV Federal Taxation of Individuals 15-25% Area V Federal Taxation of Entities 28-38% Overview of content areas Area I of the REG section blueprint covers several topics, including the following: • Ethics and Responsibilities in Tax Practice – Requirements based on Treasury Department Circular 230 and the rules and regulations for tax return preparers • Licensing and Disciplinary Systems – Requirements of state boards of accountancy to obtain and maintain the CPA license • Federal Tax Procedures – Understanding federal tax processes and procedures, including appropriate disclosures, substantiation, penalties and authoritative hierarchy • Legal Duties and Responsibilities – Understanding legal issues that affect the CPA and his or her practice Area II of the REG section blueprint covers several Topics of Business Law, including the following: • Knowledge and understanding of the legal implications of business transactions, particularly as they relate to accounting, auditing and financial reporting. • Areas of agency, contracts, debtor-creditor relationships, government regulation of business, and business structure. - The Uniform Commercial Code under the Topics of contracts and debtor-creditor relationships. - Nontax-related business structure content. Area V of the REG section blueprint covers the tax-related issues of the various business structures. • Federal and widely adopted uniform state laws and references as identified in References below. Area III, Area IV and Area V of the REG section blueprint cover various topics of federal income taxation and gift and estate tax. Accounting methods and periods, and tax elections are included in the Areas listed below: • Area III covers the federal income taxation of property transactions. Area III also covers Topics related to federal estate and gift taxation. • Area IV covers the federal income taxation of individuals from both a tax preparation and tax planning perspective. • Area V covers the federal income taxation of entities including sole proprietorships, partnerships, limited liability companies, C corporations, S corporations, joint ventures, trusts, estates and tax-exempt organizations, from both a tax preparation and tax planning perspective. Section assumptions The REG section of the test includes multiple-choice questions, task-based simulations and research prompts. Candidates should assume that the information provided in each question is material and should apply all stated assumptions. To the extent a question addresses a Topic that could have different tax treatments based on timing (e.g., alimony arrangements or net operating losses), it will include a clear indication of the timing (e.g., use of real dates) so that the candidates can determine the appropriate portions of the Internal Revenue Code or Treasury Regulations to apply to Remembering and understanding is mainly concentrated in Area I and Area II. These two areas contain the general ethics, professional responsibilities and business law knowledge that is required for newly licensed CPAs and is tested at the lower end of the skill level continuum. • Application and analysis skills are primarily tested in Areas III, IV and V. These three areas contain more of the day-to-day tasks that newly licensed CPAs are expected to perform and therefore are tested at the higher end of the skill level continuum. The representative tasks combine both the applicable content knowledge and the skills required in the context of the work that a newly licensed CPA would reasonably be expected to perform. The REG section does not test any content at the Evaluation skill level as newly licensed CPAs are not expected to demonstrate that level of skill in regards to the REG content. 1. Regulations governing practice before the Internal Revenue Service Recall the regulations governing practice before the Internal Revenue Service. Apply the regulations governing practice before the Internal Revenue Service given a specific scenario. 2. Internal Revenue Code and Regulations related to tax return preparers Recall who is a tax return preparer. Recall situations that would result in federal tax return preparer penalties. Apply potential federal tax return preparer penalties given a specific scenario. B. Licensing and disciplinary systems Understand and explain the role and authority of state boards of accountancy. C. Federal tax procedures 1. Audits, appeals and judicial process Explain the audit and appeals process as it relates to federal tax matters. Explain the different levels of the judicial process as they relate to federal tax matters. Identify options available to a taxpayer within the audit and appeals process given a specific scenario. Identify options available to a taxpayer within the judicial process given a specific scenario. 2. Substantiation and disclosure of tax positions Summarize the requirements for the appropriate disclosure of a federal tax return position. Identify situations in which disclosure of federal tax return positions is required. Identify whether substantiation is sufficient given a specific scenario. 3. Taxpayer penalties Recall situations that would result in taxpayer penalties relating to federal tax returns. Calculate taxpayer penalties relating to federal tax returns. 4. Authoritative hierarchy Recall the appropriate hierarchy of authority for federal tax purposes. D. Legal duties and responsibilities 1. Common law duties and liabilities to clients and third parties Summarize the tax return preparers common law duties and liabilities to clients and third parties. Identify situations which result in violations of the tax return preparers common law duties and liabilities to clients and third parties. 2. Privileged communications, confidentiality and privacy acts Summarize the rules regarding privileged communications as they relate to tax practice. Identify situations in which communications regarding tax practice are considered privileged. 1. Authority of agents and principals Recall the types of agent authority. Identify whether an agency relationship exists given a specific scenario. 2. Duties and liabilities of agents and principals Explain the various duties and liabilities of agents and principals. Identify the duty or liability of an agent or principal given a specific scenario. B. Contracts 1. Formation Summarize the elements of contract formation between parties. Identify whether a valid contract was formed given a specific scenario. Identify different types of contracts (e.g., written, verbal, unilateral, express and implied) given a specific scenario. 2. Performance Explain the rules related to the fulfillment of performance obligations necessary for an executed contract. Identify whether both parties to a contract have fulfilled their performance obligation given a specific scenario. 3. Discharge, breach and remedies Explain the different ways in which a contract can be discharged (e.g., performance, agreement and operation of the law). Summarize the different remedies available to a party for breach of contract. Identify situations involving breach of contract. Identify whether a contract has been discharged given a specific scenario. Identify the remedy available to a party for breach of contract given a specific scenario. C. Debtor-creditor relationships 1. Rights, duties and liabilities of debtors, creditors and guarantors Explain the rights, duties and liabilities of debtors, creditors and guarantors. Identify rights, duties or liabilities of debtors, creditors or guarantors given a specific scenario. 2. Bankruptcy and insolvency Explain the rights of the debtors and the creditors in bankruptcy and insolvency. Summarize the rules related to the different types of bankruptcy. Explain discharge of indebtedness in bankruptcy. Identify the rights of the debtors and the creditors in bankruptcy and insolvency given a specific scenario. Identify the type of bankruptcy described in a specific scenario. 3. Secured transactions Explain how property can serve as collateral in secured transactions. Summarize the priority rules of secured transactions. Explain the requirements needed to create and perfect a security interest. Identify the prioritized ordering of perfected security interests given a specific scenario. Identify whether a creditor has created and perfected a security interest given a specific scenario. D. Government regulation of business 1. Federal securities regulation Summarize the various securities laws and regulations that affect corporate governance with respect to the federal Securities Act of 1933 and federal Securities Exchange Act of 1934. Identify violations of the various securities laws and regulations that affect corporate governance with respect to the federal Securities Act of 1933 and federal Securities Exchange Act of 1934. 2. Other federal laws and regulations (e.g., employment tax, qualified health plans and worker classification) Summarize federal laws and regulations, for example, employment tax, qualified health plans and worker classification federal laws and regulations. Identify violations of federal laws and regulations, for example, employment tax, qualified health plans and worker classification federal laws and regulations. 1. Selection and formation of business entity and related operation and termination Summarize the processes for formation and termination of various business entities. Summarize the non-tax operational features for various business entities. Identify the type of business entity that is best described by a given set of nontax-related characteristics. 2. Rights, duties, legal obligations and authority of owners and management Summarize the rights, duties, legal obligations and authority of owners and management. Identify the rights, duties, legal obligations or authorities of owners or management given a specific scenario. 1. Basis and holding period of assets Calculate the tax basis of an asset. Determine the holding period of a disposed asset for classification of tax gain or loss. 2. Taxable and nontaxable dispositions Calculate the realized and recognized gain or loss on the disposition of assets for federal income tax purposes. Calculate the realized gain, recognized gain and deferred gain on like-kind property exchange transactions for federal income tax purposes. Analyze asset sale and exchange transactions to determine whether they are taxable or nontaxable. 3. Amount and character of gains and losses, and netting process (including installment sales) Calculate the amount of capital gains and losses for federal income tax purposes. Calculate the amount of ordinary income and loss for federal income tax purposes. Calculate the amount of gain on an installment sale for federal income tax purposes. Review asset transactions to determine the character (capital vs. ordinary) of the gain or loss for federal income tax purposes. Analyze an agreement of sale of an asset to determine whether it qualifies for installment sale treatment for federal income tax purposes. 4. Related party transactions (including imputed interest) Recall related parties for federal income tax purposes. Recall the impact of related party ownership percentages on acquisition and disposition transactions of property for federal income tax purposes. Calculate the direct and indirect ownership percentages of corporation stock or partnership interests to determine whether there are related parties for federal income tax purposes. Calculate a taxpayers basis in an asset that was disposed of at a loss to the taxpayer by a related party. Calculate a taxpayers gain or loss on a subsequent disposition of an asset to an unrelated third party that was previously disposed of at a loss to the taxpayer by a related party. Calculate the impact of imputed interest on related party transactions for federal tax purposes. B. Cost recovery (depreciation, depletion and amortization) Calculate tax depreciation for tangible business property and tax amortization of intangible assets. Calculate depletion for federal income tax purposes. Compare the tax benefits of the different expensing options for tax depreciation for federal income tax purposes. Reconcile the activity in the beginning and ending accumulated tax depreciation account. 1. Transfers subject to gift tax Recall transfers of property subject to federal gift tax. Recall whether federal Form 709 — United States Gift (and Generation-Skipping Transfer) Tax Return is required to be filed. Calculate the amount and classification of a gift for federal gift tax purposes. Calculate the amount of a gift subject to federal gift tax. 2. Gift tax annual exclusion and gift tax deductions Recall allowable gift tax deductions and exclusions for federal gift tax purposes. Recall situations involving the gift tax annual exclusion, gift-splitting and the impact on the use of the lifetime exclusion amount for federal gift tax purposes. Compute the amount of taxable gifts for federal gift tax purposes. 3. Determination of taxable estate Recall assets includible in a decedents gross estate for federal estate tax purposes. Recall allowable estate tax deductions for federal estate tax purposes. Calculate the taxable estate for federal estate tax purposes. Calculate the gross estate for federal estate tax purposes. Calculate the allowable estate tax deductions for federal estate tax purposes Calculate the amounts that should be included in, or excluded from, an individuals gross income as reported on federal Form 1040 — U.S. Individual Income Tax Return. Analyze projected income for use in tax planning in future years. Analyze client-provided documentation to determine the appropriate amount of gross income to be reported on federal Form 1040 — U.S. Individual Income Tax Return. B. Reporting of items from pass-through entities Prepare federal Form 1040 — U.S. Individual Income Tax Return based on the information provided on Schedule K-1. C. Adjustments and deductions to arrive at adjusted gross income and taxable income Calculate the amount of adjustments and deductions to arrive at adjusted gross income and taxable income on federal Form 1040 — U.S. Individual Income Tax Return. Calculate the qualifying business income (QBI) deduction for federal income tax purposes. Analyze client-provided documentation to determine the validity of the deductions taken to arrive at adjusted gross income or taxable income on federal Form 1040 — U.S. Individual Income Tax Return. D. Passive activity losses (excluding foreign tax credit implications) Recall passive activities for federal income tax purposes. Calculate net passive activity gains and losses for federal income tax purposes. Prepare a loss carryforward schedule for passive activities for federal income tax purposes. Calculate utilization of suspended losses on the disposition of a passive activity for federal income tax purposes. Uniform CPA Examination Blueprints: Regulation (REG) REG16 Regulation (REG) Area IV – Federal Taxation of Individuals | ||||||||

| CPA Regulation AICPA Regulation education | ||||||||

Other AICPA examsBEC CPA Business Environment and ConceptsFAR CPA Financial Accounting and Reporting CPA-REG CPA Regulation CPA-AUD CPA Auditing and Attestation PCAP-31-03 Certified Associate in Python Programming - 2023 PCEP-30-01 Certified Entry-Level Python Programmer | ||||||||

| killexams.com helps thousands of candidates pass the exams and get their certifications. We have thousands of successful reviews. Our CPA-REG dumps are reliable, affordable, updated and of really best quality to overcome the difficulties of any IT certifications. killexams.com CPA-REG test dumps are latest updated in highly outclass manner on regular basis and material is released periodically. | ||||||||

| CPP-Institute CPA-REG CPA Regulation https://killexams.com/pass4sure/exam-detail/CPA-REG Question: 63 Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom�s daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom�s dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores� 1994 Form 1040. Tom�s 1994 wages were $53,000. In addition, Tom�s employer provided group- term life insurance on Tom�s life in excess of $50,000. The value of such excess coverage was $2,000. A. $0 B.$500 C. $900 D. $1,000 E. $1,250 F. $1,300 G. $1,500 1-1. $2,000 1. $2,500 J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000 Answer: A Explanation: "N" is correct. $55,000. The value of employer-provided group term life insurance for which the face amount exceeds $50,000 is taxable income to the insured employee and the $53,000 in wages would both be included on page one, Form 1040. Question: 64 Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom�s daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom�s dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores� 1994 Form 1040. During 1994, the Moores received a $2,500 federal tax refund and a $1,250 state tax refund for 1993 overpayments. In 1993, the IV|oores were not subject to the alternative minimum tax and were not entitled to any credit against income tax. The Moores� 1993 adjusted gross income was $80,000 and itemized deductions were $1,450 in excess of the standard deduction. The state tax deduction for 1993 was $2,000. A. $0 B.$500 C. $900 D. $1,000 E. $1,250 F. $1,300 G. $1,500 1-1. $2,000 I. $2,500 J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000 Answer: E Explanation: "E" is correct. $1,250. The Moores itemized deductions in 1993 because such deductions were $1,450 in excess of the standard deduction. The amount of state taxes deducted in 1993 was $2,000, which (along with the fact that the Moores were not subject to alternative minimum tax, which may have reduced their tax benefit) indicates that the Moores received a tax benefit in 1993 from deducting the $1,250 state tax refund they received in 1994. The $1,250 is taxable in 1994. Question: 65 Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom�s daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom�s dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores� 1994 Form 1040. In 1994, Joan received $1,300 in unemployment compensation benefits. Her employer made a $100 contribution to the unemployment insurance fund on her behalf. A. $0 B.$500 C. $900 D. $1,000 E. $1,250 F. $1,300 G. $1,500 H .$2,000 I. $2,500 J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000 Answer: F Explanation: "F" is correct. $1,300. Unemployment compensation benefits are fully taxable (when received by the employee), but contributions made by the employer to the insurance fund are not taxable. Question: 66 Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom�s daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom�s dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores� 1994 Form 1040. The Moores received $8,400 in gross receipts from their rental property during 1994. The expenses for the residential rental property were: A. $0 B.$500 C. $900 D. $1,000 E. $1,250 F. $1,300 G. $1,500 H. $2,000 I. $2,500 J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000 Answer: I Explanation: "I" is correct. $2,500. Rental actMty net income is reported on page one; the gross income ($8,400) is fully reportable; and all deductions listed (total = $5,900) are fully deductible for a net of $2,500. Question: 67 Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom�s daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom�s dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores� 1994 Form 1040. The Moores received a stock dMdend in 1994 from Ace Corp. They had the option to receive either cash or Ace stock with a fair market value of $900 as of the date of distribution. The par value of the stock was $500. A. $0 B.$500 C. $900 o. $1,000 E. $1,250 F. $1,300 G. $1,500 H. $2,000 I. $2,500 J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000 Answer: C Explanation: "C" is correct. $900. If a taxpayer has the option of taking a dMdend either in stock or in other property (e.g., cash), the dMdend is taxable regardless of the option the taxpayer selects. Question: 68 Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom�s daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom�s dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores� 1994 Form 1040. In 1994, Joan received $3,500 as beneficiary of the death benefit, which was provided by her brother�s employer. Joan�s brother did not have a nonforfeitable right to receive the money while lMng. A. $0 B.$500 C. $900 D. $1,000 E. $1,250 F. $1,300 G. $1,500 H. $2,000 I. $2,500 J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000 Answer: A Explanation: "A" is correct. $0. Life insurance proceeds received by reason of the death of the insured are not taxable income to the recipient. Question: 69 Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom�s daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom�s dependent. Determine the amount of income or loss, if any that should be included on page one of the Moores� 1994 Form 1040. Tom received $10,000, consisting of $5,000 each of principal and interest, when he redeemed a Series EE savings bond in 1994. The bond was issued in his name in 1990 and the proceeds were used to pay for Laura�s college tuition. Tom had not elected to report the yearly increases in the value of the bond. A. $0 B.$500 C. $900 D. $1,000 E. $1,250 F. $1,300 G. $1,500 H. $2,000 I. $2,500 J. $3,000 K. $10,000 L. $25,000 M. $50,000 N. $55,000 O. $75,000 Answer: A Explanation: "A" is correct. $0. Generally, if a taxpayer does not make an election to accrue interest income from Series EE bonds, the interest is taxable at the time the bonds are cashed. However, an exception applies in this case because Tom Moore meets the criteria (assume he was 24 years or older in 1990). Savings bonds is tax-exempt when: (1) It is used to pay for qualified higher-education expenses for the taxpayer, spouse, or dependents; (2) There is taxpayer or joint ownership with spouse; (3) The taxpayer is age 24 (or over) when the bonds are issued; and (4) The bonds are acquired after 1989. For More exams visit https://killexams.com/vendors-exam-list Kill your test at First Attempt....Guaranteed! | ||||||||

|

Last week the Department of Education denied the request of the Center for Excellence in Higher Education (CEHE), a chain which operates several colleges in the western United States, to have its regulatory classification changed from for-profit to private nonprofit. This comes despite the IRS recognizing the organization as a 501(c)(3) nonprofit and the Education Department’s own database listing CEHE’s schools as nonprofits. Why is the distinction so important? For instance, for-profit colleges are subject to the 90/10 rule, which stipulates that an institution may receive no more than 90% of its revenues from federal student aid, such as Pell Grants and student loans. Another regulation, the gainful employment rule, cuts for-profit colleges (and a handful of programs at nonprofit and public schools) off from eligibility for aid programs if their graduates have a high debt-to-income ratio. Finally, the recently-issued defense to repayment regulations require for-profit colleges whose former students have low rates of loan repayment to prominently disclose that in promotional materials. In principle, these regulations make varying degrees of sense. Most reasonable people would agree that the repayment rate warnings and the 90/10 rule are particularly justified. So why only apply these provisos to for-profit colleges? In defending his Department’s denial of CEHE’s request for nonprofit status, Education Secretary John King said: “This should send a clear message to anyone who thinks converting to nonprofit status is a way to avoid oversight while hanging onto the financial benefits: don’t waste your time.” In his quote, King implicitly acknowledges that nonprofit schools can “avoid oversight” simply by virtue of their preexisting classification. The Department’s toughest regulations will not apply to the select group of colleges that have been pre-approved for nonprofit status. Schools labeled for-profit – even if they do not actually make a profit – must comply in order to keep receiving aid, while their peers in the nonprofit sector may go on receiving billions in taxpayer dollars even if they would not have survived the regulations without special treatment. The public and private nonprofit institutions within this inner circle are hardly paragons of virtue. A report released last week by the centrist think tank Third Way shows that many students at four-year public colleges do not finish. Private nonprofits fare better, but many still have problems. In my public comment on the Department’s most latest batch of regulations, I show that were the aforementioned repayment rate warnings expanded to include public and nonprofit colleges, 1.3 million additional students would be protected. Of the students attending institutions that would be affected by the warnings, only 47% go to for-profit schools. The Department, by its own admission, leaves the other 53% vulnerable simply because of their school’s classification. Secretary King argues that his department’s rules need not apply to public and nonprofit colleges because those institutions behave themselves. That is certainly not true. Even if it were, though, it would be no justification for exempting them from regulations—if King is so confident these schools will meet his standards, then let them prove it. By the Department’s logic, Katie Ledecky should receive a gold medal without actually competing, because we all know she’d win it anyway. Selective enforcement of regulation reeks of political favoritism and is no way to run the stewardship of the hundreds of billions of taxpayer dollars which flow through the Department’s aid programs. The for-profit college sector certainly has problems – but the Department’s regulatory philosophy amounts to a war on a business model rather than a war on bad education. The Internal Revenue Service plans to propose regulations on how to claim the energy efficient home improvement credit, including a requirement under the Inflation Reduction Act for a product identification number, and it's asking for comments ahead of time on the PIN requirement. On Friday, the Treasury Department and the IRS released Notice 2024-13, which announces the IRS's intention to propose regulations pertaining to the PIN requirement The energy efficient home improvement credit, which took effect Jan. 1, 2023, allows a tax credit, subject to certain limitations and caps, equal to 30% of the total amount paid by a taxpayer for some types of qualified expenditures, including qualified energy efficiency improvements installed during the year, residential energy property expenditures during the year, and home energy audits during the year. The credit can be claimed for qualifying property placed in service on or after Jan.1, 2023, and before Jan. 1, 2033. Starting Jan. 1, 2025, taxpayers who claim the tax credit also need to satisfy the PIN requirement for some kinds of products. An item will only qualify for the credit if it's produced by a qualified manufacturer, and if the taxpayer includes the item's qualified PIN on their tax return.  Tristan Spinski /The Washington Post/Getty Images In Notice 2024-13, the IRS discusses a PIN assignment system it's currently considering and asks for comments on several general and specific questions on the new PIN requirement. Any comments will be taken into consideration by the IRS and the Treasury as they develop proposed regulations to implement the PIN requirement. Ideally, comments should be sent by Feb. 27, 2024. After that date, comments will be considered only if they don't delay the guidance. The tax credit dates back to the Energy Policy Act of 2005 to provide the nonbusiness energy property credit for the purchase and installation of certain energy efficient improvements in taxpayers' principal residences. That law added Section 25C to the Internal Revenue Code and has been amended several times over the years, most recently by Section 13301 of the Inflation Reduction Act, which renamed this provision the "energy efficient home improvement credit." Before the IRA was enacted last year, Section 25C had expired on Dec. 31, 2021. Section 13301(a) of the IRA amended Section 25C(g) to make the Section 25C credit available from Jan. 1, 2022, through Dec. 31, 2032. (3) Section 13301(b) of the IRA amended Section 25C(a) to allow a credit for 30% of the amounts paid or incurred by individual taxpayers during the tax year for qualified energy efficiency improvements and residential energy property expenditures. As amended by the IRA, the Section 25C credit is generally limited to an annual cap of $1,200. Within this $1,200 limitation, there are some further annual caps for certain categories of improvements: $600 for any item of qualified energy property, as defined in Section 25C(d)(2); $600 for exterior windows and skylights; $250 for any single exterior door; and an aggregate of $500 for all exterior doors. Despite the $1,200 annual limitation and other limitations, the amounts paid or incurred for heat pumps, heat pump water heaters, biomass stoves and biomass boilers are allowed a separate, aggregate annual credit of up to $2,000. Watch CBS News

Be the first to know Get browser notifications for breaking news, live events, and exclusive reporting. The IRS has begun coalescing its diverse policies and procedures toward digital assets into a singular central strategy, but actual implementation is being delayed by the regulatory approval process, according to a latest report from the Treasury Inspector General for Tax Administration. The report noted that the Inflation Reduction Act of 2022 mandated that the IRS provide digital asset monitoring and compliance activities. Prior to this, each IRS function addressed virtual currency tax issues with different procedures. Since then, according to TIGTA, the IRS has taken several actions to centralize its approach to addressing the significant impact that digital assets have and will continue to have on tax administration. The report pointed to the formation of the Digital Asset Advisory Committee (DAAC), which was created to enable IRS-wide information sharing and coordination, the development of the Digital Asset Initiative which outlines the IRS's priorities on the topic, and the setting up of the Digital Asset Initiative Project Office (DAIPO), which continues to coordinate Service-wide efforts including developing forms, instructions, and guidance; information systems to receive, store, and access the new digital asset information reporting returns; as well as conducting other outreach activities. However, the IRS cannot complete the development of the forms, instructions, and guidance until after the final digital asset regulations have been issued. Final regulations have yet to be completed and remain under development within the various stages of the federal government's required regulatory review process. Specifically, as of Aug. 29, 2023, I.R.C. Section 6045 Notice of Proposed Rulemaking was published in the Federal Register. The I.R.C. § 6050I regulations remain in draft mode within the Treasury Department. This means the IRS cannot comply with the mandate in the Inflation Reduction Act. The IRS said the regulations are taking so long because they concern a very complex topic. These proposed regulations would require brokers, including digital asset trading platforms, digital asset payment processors,26 and certain digital asset hosted wallets, to file information returns, and furnish payee statements on dispositions of digital assets effected for customers in certain sale or exchange transactions. TIGTA added that they have also required participation from multiple external agencies. IRS management noted that the passage of additional legislation related to digital assets could further delay its ability to move forward. The IRS noted that more than 40 potential bills are pending, including, but not limited to:

TIGTA made no recommendations in the report. IRS hasn't stopped TikTokers In other TIGTA news, another report faulted the IRS for not being able to fully implement the ban on social media app TikTok on government devices, a prohibition made out of security concerns connected to the platform's China-based owner. TIGTA said the IRS took steps in October 2022 to block Internet access to TikTok on 6,300 mobile devices and also noted that the TikTok application is not available for obtain on them. However TIGTA noted that the IRS Criminal Investigation division still maintains extensive access to the social media app. Inspectors identified more than 2,800 mobile devices used by CI that could access TikTok's website and approximately 900 CI employees that had the ability to get access to TikTok's website via their computers. In response to concerns raised to CI management, they issued a memorandum on May 15, 2023, instructing employees to identify and remove TikTok from IRS devices and systems. CI management also responded that they were evaluating whether a law enforcement exception would be requested to continue to permit access to TikTok. As of August 2023, CI has yet to request the required exception from the Department of Treasury nor has it taken steps to block access to TikTok on computers and mobile devices assigned to its personnel Inspectors also found 23 other devices which still had access, mostly belonging to members of the agency's Communications and Liaison group as a way to monitor social media sites. When TIGTA informed the IRS of this, the agency took corrective action to add these devices to the existing mobile device management software to ensure that the 23 devices could not access TikTok. TIGTA said the IRS should:

IRS management agreed with five recommendations. The IRS disagreed with the recommendation to block access to TikTok on more than 2,800 mobile devices used by CI. It said the IRS is developing an internal process to adjudicate limited exceptions. Part IPart IIAdmission1. Candidates for the degree of Bachelor of Education shall: (a) hold a New Zealand Diploma or Higher Diploma of Teaching, or approved equivalent; or (b) have completed at least two full-time years of approved relevant experience in an educational context, or approved equivalent. Qualification requirements2. Candidates for the Bachelor of Education shall follow a flexible programme of study, which shall consist of courses totalling at least 360 credits, comprising: (a) not more than 150 credits at 100 level; (b) at least 75 credits at 300 level; and including: (c) the core courses listed in Schedule A for the qualification; (d) the remaining courses from Schedules B and C for the qualification; (e) up to 75 credits from schedules for other qualifications offered by the University, with the approval of the College PVC or nominee. 3. Candidates who hold previous qualifications in teaching and/or education may have them assessed for credit to the Bachelor of Education. Such candidates shall follow an approved programme of study consisting of at least 120 credits, including the requirements of at least one major. Specialisations4. The Bachelor of Education may be completed with or without specialisation. 5. Candidates must complete the requirements of a major by passing at least 90 credits in one majoring subject, including: (a) at least 15 credits at 100 level; (b) at least 30 credits at 200 level; (c) at least 45 credits at 300 level. 6. The requirements for each major are set out in Schedule B of the Qualification. 7. Candidates may complete a double major by meeting all of the requirements of both majors. 8. Candidates may include a minor in the Bachelor of Education by passing at least 60 credits for one of majors listed in Schedule B, including: (a) no more than 15 credits at 100 level; (b) at least 15 credits at 300 level. 9. No course may be credited to both a major and a minor. 10. Minors may be included from any undergraduate degree within the University for which recognised minors are specified. Where the minor is from another undergraduate degree the regulations of that programme for the minor will apply. Completion requirements11. Any timeframes for completion as outlined in the General Regulations for Undergraduate Degrees, Undergraduate Diplomas, Undergraduate Certificates, Graduate Diplomas and Graduate Certificates will apply. Looking for a previous version of this regulation? Part IThese regulations are to be read in conjunction with all other Statutes and Regulations of the University including General Regulations for Postgraduate Degrees, Postgraduate Diplomas, and Postgraduate Certificates. Part IIAdmission1. Admission to the Degree of Master of Education requires that the candidate will: (a) meet the University admission requirements as specified; and shall have (b) been awarded or qualified for the Bachelor of Education with a grade average in the highest level courses of at least a B, or equivalent; or (c) been awarded or qualified for any other Bachelor’s degree with a grade average in the highest level courses of at least a B, or equivalent, and hold a professional qualification in teaching; or (d) been awarded or qualified for any other Bachelor’s degree with a grade average in the highest level courses of at least a B, or equivalent, and have professional experience relevant to the intended postgraduate subject; or (e) been awarded a Postgraduate Diploma in Education, or equivalent, with a grade average across all courses of at least B (Coursework pathway) or at least B+ (Research pathway). Qualification requirements2. Candidates for the Degree of Master of Education shall follow a parts-based programme of study totalling at least 180 credits from the Master of Education Schedule, comprising: (a) completion of Part One and Part Two as specified in the Schedule for the Degree; and including (b) 15 credits of research methods course(s) as listed in the Schedule for the Degree. 3. Notwithstanding Regulation 2, candidates admitted under Regulation 1(e) may apply for credit towards Part One of the qualification in accordance with the limits specified in the Recognition of Prior Learning regulations. Specialisations4. The Degree of Master of Education may be awarded with or without a subject. 5. A candidate may complete a subject by completing at least 120 credits (Coursework pathway) or at least 150 credits (Thesis pathway) in a subject including Part Two. The requirements for each subject are set out in the Schedule for the Degree. 6. Subjects available for the Master of Education are: Digital Education, Early Years, Educational Administration and Leadership, Inclusive Education, Literacy Education, Māori Education, and Mathematics Education. Student progression7. For progression to Part Two in the Master of Education (Coursework pathway), candidates must have achieved a B grade average in the first 120 credits of courses completed in Part One. 8. For progression to Part Two in the Master of Education (Research pathway), candidates must have achieved a B+ grade average in the first 90 credits of courses completed in Part One. 9. In cases of sufficient merit, the Degree of Master of Education may be awarded with Distinction or Merit. Completion requirements10. The timeframes for completion as outlined in the General Regulations for Postgraduate Degrees, Postgraduate Diplomas, and Postgraduate Certificates will apply. 11. Candidates may be graduated when they meet the Admission, Qualification and Academic requirements within the prescribed timeframes; candidates who do not meet the requirements for graduation may, subject to the approval of Academic Board, be awarded the Postgraduate Certificate in Education or the Postgraduate Diploma in Education should they meet the relevant Qualification requirements. Unsatisfactory academic progress12. The general Unsatisfactory Academic Progress regulations will apply. Transitional provisions13. Subject to the Maximum Time to Completion and Abandonment of Studies provisions specified in the Part I regulations for the degree, candidates enrolled in the Master of Education prior to 1 January 2024 who have successfully completed at least 90 credits will complete the qualification under the 2023 regulations. Where necessary all candidates enrolled prior to 1 January 2023, regardless of how many credits they have completed, will be permitted course substitutions beyond the stated limits. 14. These transition arrangements expire 31 December 2027. | ||||||||

CPA-REG test plan | CPA-REG benefits | CPA-REG teaching | CPA-REG reality | CPA-REG basics | CPA-REG Topics | CPA-REG Practice Test | CPA-REG learn | CPA-REG outline | CPA-REG Topics | | ||||||||

Killexams test Simulator Killexams Questions and Answers Killexams Exams List Search Exams |