Certified Trust and Financial Advisor (CTFA) Exam Braindumps

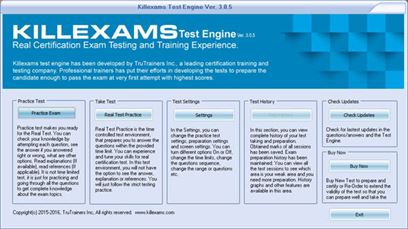

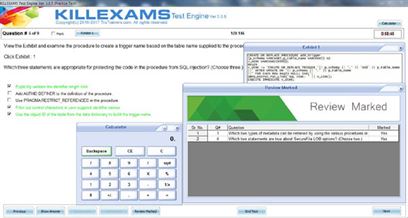

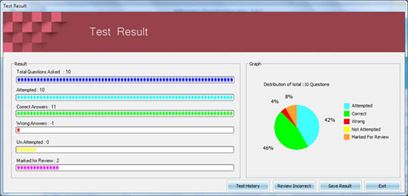

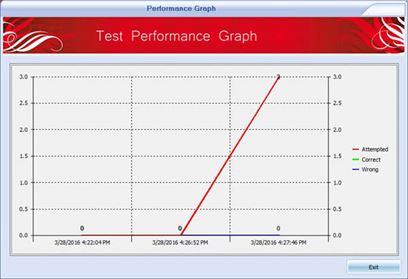

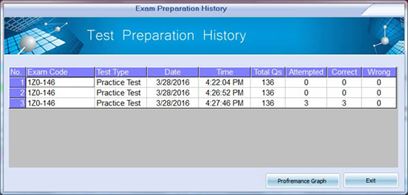

Killexams.com CTFA Exam Braindumps contain complete question pool, updated in April 2024 including VCE exam simulator that will help you get high marks in the exam. All these CTFA exam questions are verified by killexams certified professionals and backed by 100% money back guarantee.

CTFA test - Certified Trust and Financial Advisor (CTFA) Updated: 2024 | ||||||||

| Just memorize these CTFA dumps questions before you go for test. | ||||||||

|

||||||||

|

||||||||

|

Exam Code: CTFA Certified Trust and Financial Advisor (CTFA) test January 2024 by Killexams.com team | ||||||||

CTFA Certified Trust and Financial Advisor (CTFA) The knowledge areas below are the basis for the Certified Trust and Financial Advisor (CTFA) examination. These knowledge areas were derived from a job analysis study and were validated by the CTFA Advisory Board. Postcertification programs that address these knowledge areas are eligible for CTFA continuing education credits through the American Bankers Association. I. Fiduciary & Trust Activities (25%) A. Nature and Characteristics of Account Relationship 1. Trusts 2. Estates 3. Guardianships/ Conservatorships 4. Custodians 5. Financial and Health Care Powers of Attorney 6. Agencies B. Formal Requisites of Establishing Account 1. Written Agreements or Documents 2. Trust Situs 3. Acceptance of Fiduciary Appointment 4. Disclaiming of Interest C. Fiduciary Responsibilities 1. Powers 2. Duties 3. Uniform Acts/Codes 4. Safekeeping of Assets 5. Environmental Issues D. Investment Responsibilities 1. Investment Powers 2. Investment Types & Restrictions 3. Sale/Retention by Bank of Its Own Holding Company Securities 4. Prudent Investor E. Receipts, Payments and Distributions 1. Duty in Making Payments or Distributions 2. Uniform Principal & Income Act F. Accounting and Compensation 1. Duty to Keep Records 2. Duty to Furnish Information to Beneficiaries 3. Duty to Render Court Accountings 4. Fiduciary Compensation G. Alteration or Termination of the Trust 1. Power to Change Terms 2. Power to Revoke or Terminate H. Regulatory/Compliance 1. Due Diligence 2. Know Your Customer 3. Privacy Issues 4. Bank Secrecy Act 5. OCC Regulation 9 6. Securities Laws II. Financial Planning (25%) A. Personal Finance 1. Time Value of Money Principles 2. Statement of Assets and Liabilities 3. Cash Flow Management 4. Debt Management 5. Investment Planning 6. Education Planning 7. Health Care & Disability Planning B. Retirement 1. Capital Sufficiency 2. Investment Strategies 3. Wealth Accumulation & Distribution 4. Social Security & Other Programs 5. IRAs 6. Qualified and non-Qualified Plans 7. Income Needs & Sources C. Insurance 1. Life Insurance 2. Long Term Care Insurance 3. Disability 4. Annuities 5. Health Insurance 6. Property/Casualty Insurance 7. Insurance Company, Product, and Intermediary Selection Criteria D. Transfer Assistance 1. Wealth Transfer During Lifetime 2. The Flow of Property at Death 3. Business Succession Planning 4. Planning Documents 5. Planning Considerations 6. Charitable Giving Strategies 7. Special Needs Planning E. Financial Modeling 1. Risk Assessment 2. Asset Allocation III. Tax Law & Planning (25%) A. Income Tax 1. Individuals 2. Fiduciaries 3. Charitable Trusts, Private Foundations, and Split Interest Trusts 4. Business B. Transfer Tax 1. Gift Tax 2. Estate Tax 3. Generation-Skipping Transfers (GST) IV. Investment Management (20%) A. Economics and Markets 1. Gross Domestic Product 2. Interest Rates 3. Inflation & Employment 4. Government Fiscal Policy 5. Monetary Policy 6. International Influences 7. Market Operations 8. Currency B. Portfolio Management Theories and Concepts 1. Modern Portfolio Theory 2. Equity Investment Management Approaches 3. Fixed Income Investment Management Approaches 4. Hedging Strategies 5. Risk Management 6. Total Return C. Types of Investments/Selection & Analysis 1. Equities 2. Fixed Income 3. Convertible Securities 4. Mutual Funds 5. Common Trust Funds 6. Closely-Held Businesses 7. Real Estate & Farms 8. International 9. Nontraditional 10. Master Limited Partnerships 11. Stock Options 12. ETFs 13. Oil, Gas & Minerals 14. Commodities & Precious Metals D. Client Objectives & Constraints 1. Investment Objectives 2. Risk Tolerance 3. Time Horizons 4. Tax Considerations 5. Current vs Future Objectives 6. Investment Restrictions & Preferences 7. Asset Allocation E. Performance Measurement 1. Time-Weighted vs. Dollar-Weighted 2. Risk Adjusted 3. Benchmarks & Indicies V. Ethics (5%) A. Advisory 1. Unauthorized Practice of Law 2. Conflict of Interest 3. Confidentiality 4. Undue Influence 5. Related Parties 6. Client Competence/Capacity B. Fiduciary 1. Duty of Loyalty 2. Breach of Trust 3. Trust Officer as Beneficiary 4. Personal Liability 5. Self Dealing 6. Gifts to/from Clients & Vendors C. Business Development 1. Business Solicitation 2. Compensation Arrangements D. Investment 1. Insider Information 2. Equal Treatment of Accounts 3. Directed Brokerage 4. Disclosures 5. Prudent Investor Standard E. Other 1. Relationship with Other Professionals 2. Fraud Prevention | ||||||||

| Certified Trust and Financial Advisor (CTFA) Financial Certified exam | ||||||||

Other Financial examsABV Accredited in Business Valuation (ABV)AFE Accredited Financial Examiner (AFE) AngularJS AngularJS AVA Accredited Valuation Analyst CABM Certified Associate Business Manager CBM Certified Business Manager (APBM CBM) CCM Certified Case Manager (CCM) CFE Certified Financial Examiner (CFE) CFP Certified Financial Planner (CFP Level 1) CGAP Certified Government Auditing Professional (IIA-CGAP) CGFM Certified Government Financial Manager (CGFM) CHFP Certified Healthcare Financial Professional (CHFP) - 2023 CIA-I Certified Internal Auditor (CIA) CIA-II Certified Internal Auditor (CIA) CIA-III The Certified Internal Auditor Part 3 CIA-IV The Certified Internal Auditor Part 4 CITP Certified Information Technology Professional (CITP) CMA Certified Management Accountant (CMA) CMAA Certified Merger and Acquisition Advisor (CM and AA) CPCM Certified Professional Contracts Manager (CPCM) 2023 CPEA Certified Professional Environmental Auditor (CPEA) CPFO Certified Public Finance Officer (Governmental Accounting, Auditing, and Financial Reporting) CRFA Certified Forensic Accountant (CRFA) CTFA Certified Trust and Financial Advisor (CTFA) CVA Certified Valuation Analyst (CVA) FINRA FINRA Administered Qualification Examination CEMAP-1 Certificate in Mortgage Advice and Practice (CeMAP) | ||||||||

| We are doing great struggle to provide you with actual CTFA dumps with dump questions and answers, along explanations. Each Q&A on killexams.com has been showed by means of CTFA certified experts. They are tremendously qualified and confirmed humans, who have several years of professional experience recognized with the CTFA assessments. They check the question according to actual test. | ||||||||

| Financial CTFA Certified Trust and Financial Advisor (CTFA) http://killexams.com/pass4sure/exam-detail/CTFA Question: 440 A person purchased a share of Acme.com common stock exactly one year ago for $45. During the past year the common stock paid an annual dividend of $2.40. The person sold the security today for $85. What is the rate of return the firm has earned? A. 5.3% B. 194.2% C. 88.9% D. 94.2% Answer: D Question: 441 A set of possible values that a random variable can assume and their associated probabilities of occurrence are referred to as __________. A. Probability distribution B. The expected return C. The standard deviation D. Co-efficient of variation Answer: A Question: 442 A statistical measure of the variability of a distribution around its mean is referred to as __________. A. Probability distribution B. The expected return C. The standard deviation D. Co-efficient of variation Answer: C Question: 443 The weighted average of possible returns, with the weights being the probabilities of occurrence is referred to as __________. A. Probability distribution B. The expected return C. The standard deviation D. Co-efficient of variation Answer: B Question: 444 Which of the following statements regarding covariance is correct? A. Covariance always lies in the range -1 to +1 B. Covariance, because it involves a squared value, must always be a positive number (or zero) C. Low co-variances among returns for different securities leads to high portfolio risk D. Co-variances can take on positive, negative, or zero values Answer: D Question: 445 Total portfolio risk is __________. A. Equal to systematic risk plus non-diversifiable risk B. Equal to avoidable risk plus diversifiable risk C. Equal to systematic risk plus unavoidable risk D. Equal to systematic risk plus diversifiable risk Answer: D Question: 446 It is a market condition normally associated with investor optimism, economic recovery, and expansion; characterized by generally rising securities prices. A. Bear market B. Bull market C. OTC D. Dealers market Answer: B Question: 447 ______________ is a condition of the markets typically associated with investor pessimism and economic slowdown; characterized by generally falling securities prices. A. Bear market B. Bull market C. OTC D. Dealers market Answer: B Question: 448 A person who buys and sells securities on behalf of clients and gives them investment advice and information is called: A. Stockholder B. Account executive C. Financial consultant D. All are one and the same Answer: D Question: 449 A broker is: A. Far more than a salesperson B. Mostly interested in his own commission C. May not be socially known D. Can trade your stock without your permission Answer: A, B Question: 450 A broker who, in addition to executing clients transactions, offers a full array of brokerage services is: A. Full-service broker B. Discount broker C. Online broker D. OTC broker Answer: A For More exams visit https://killexams.com/vendors-exam-list Kill your test at First Attempt....Guaranteed! | ||||||||

|

ConsumerAffairs is not a government agency. Companies displayed may pay us to be Authorized or when you click a link, call a number or fill a form on our site. Our content is intended to be used for general information purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances and consult with your own investment, financial, tax and legal advisers. Company NMLS Consumer Access #2110672 MORTGAGE BROKER ONLY, NOT A MORTGAGE LENDER OR MORTGAGE CORRESPONDENT LENDER NOTICE TO VERMONT CONSUMERS: Home Warranty disclosure for New Jersey Residents: The product being offered is a service contract and is separate and distinct from any product or service warranty which may be provided by the home builder or manufacturer. Consumers Unified, LLC does not take loan or mortgage applications or make credit decisions. Rather, we display rates from lenders that are licensed or otherwise authorized to work in Vermont. We forward your information to a lender you wish to contact so that they may contact you directly. Copyright © 2024 Consumers Unified, LLC DBA ConsumerAffairs. All Rights Reserved. The contents of this site may not be republished, reprinted, rewritten or recirculated without written permission. Dec. 27âFinancial Advisor Jaclyn Wangen of the financial services firm Edward Jones in Austin, has received the Certified Financial Planner or CFP, certification, granted by the Certified Financial Planner Board of Standards (CFP Board). Becoming a CFP professional expands a financial advisor's knowledge base in the following areas: * Financial management * Tax-sensitive investment strategies * Retirement savings * Insurance planning * Education planning * Estate Considerations In addition to the education and examination components of certification, Wangen also has committed to abiding by the CFP Board's Code of Ethics and Standards of Conduct. Wangen's office is located at 1405 15th Ave NW in Austin. She and branch office administrators Mary Flaherty and Shelby Hullopeter can be reached at 507-437-7601. You can also visit her website at www.edwardjones.com/jaclyn-wangen. BANGOR â Acadia Federal Credit Union is pleased to announce that collections officer, Kate Vaillancourt, has successfully finished the required coursework and test to become a Certified Credit Union Financial Counselor.  CCUFC designation is earned through the Credit Union National Association Financial Counseling Certification Program eSchool and demonstrates proficiency in critical financial counseling skills and concepts. The program is designed for credit union staff who work in financial counseling, collections, and loan departments, to help Improve the financial well-being of credit union members. The demand for expert assistance is significant, particularly as many individuals confront uncertain economic futures. Vaillancourtâs expertise will be used to assist Acadia FCU members facing financial challenges and guide them toward greater financial stability. This may ultimately help reduce delinquencies and increase adoption of credit union products and services, while showcasing the distinctive advantages of credit union membership. âKateâs exact certification is more than just an individual achievement; it embodies our mission of creating exceptional experiences that enrich the lives of our members,â said Acadia FCU Executive Vice President, Joey Cannan. âWith each stride we make in professional development, we draw closer to providing unparalleled resources and support to our community, always aiming to elevate the standards of excellence.â To earn the CCUFC designation, Vaillancourt completed a combination of educational objectives and passed the required exam. She will keep her financial counseling knowledge current by recertifying every three years. Acadia FCU is committed to offering continuous educational opportunities, empowering our team to excel in their respective roles and provide meaningful guidance to our members. With a rich history dating back to 1963, Acadia Federal Credit Union is the culmination of seven smaller community credit unions and proudly serves Aroostook, Penobscot, Hancock, Washington, and Piscataquis counties. With eight branch locations, over 16,000 members, and assets exceeding $327 million, our mission, âCreating exceptional experiences to enrich your life,â guides our dedication to delivering top-tier support and financial solutions, while contributing to the vibrancy of our communities. Discover how our member-owned financial institution can enhance your financial journey by visiting acadiafcu.org. Live within your means. Contribute to your 401k immediately. Create an emergency savings fund, because there will be a rainy day. Those are among the tips that high school students in Hampton Roads hear from financial literacy teachers. Those tips appear to be paying off, at least on course exams that show high pass rates for students at several area schools, including in Newport News and Chesapeake. Teachers and schools across the area recently received awards for their high student pass rates on the W!SE Financial Literacy Certification Test. For about a decade, Virginia has required that all high school students take a financial literacy class. This year, the state was one of seven given the top âAâ grade on a âreport cardâ from the Center for Financial Literacy at Champlain College, in Burlington, Vermont, for requiring a personal finance course before graduation. Tina Shorter, from Woodside High School in Newport News, was among those from the area receiving a Gold Star Teacher Award because at least 93% of her students passed the certification test. Shorter said sheâs glad that the financial literacy class is state mandated, adding that it can be life-changing. âEverybody thatâs in my generation or a little bit younger made so many mistakes,â Shorter tells her students, because they did not learn financial literacy while in school. This class is about trying to help students avoid some of those mistakes. Many of the lessons are eye opening, Shorter said. âSome students donât know how much groceries are.â Shorter said the class covers various topics, including credit, money management, insurance and investments. Some of her students also are able to help their parents and families with personal finances after taking the class. David Thaw, a teacher at Chesapeakeâs Grassfield High School, said the class makes students more âfinancially savvyâ as they leave high school. âTheyâre prepared to live on a budget, to live within their means and hopefully to get off to a really good start in their financial journey,â he said. Grassfield won the Platinum Star Award from W!se for achieving a 90% student pass rate in the certification course for the second consecutive year. Thaw said that the class includes games that feature scenarios and simulations to help students understand some of the more complex subjects, such as the stock market. Nour Habib, nour.habib@virginiamedia.com Rep. Marissa Magsino of the OFW party-list group has pushed for the enactment of the proposed âNo Permit, No test Prohibition Act.â Magsino, the principal author of the bill in the House of Representatives, made the appeal after the measure had been approved in the bicameral conference committee. Magsino stressed the proposed No Permit, No test Prohibition Act is a significant step toward promoting equitable access to education. âBy allowing disadvantaged students to take exams without financial barriers, the legislation ensures that education remains accessible to all, regardless of economic challenges,â Magsino said. Magsino also expressed her appreciation to her fellow lawmakers, advocates, and stakeholders who contributed to the crafting of this policy. âI am grateful for the collaborative efforts that have led to the passage of this legislation. The No Permit, No test Prohibition Act reflects our commitment to inclusivity in education and addresses the challenges faced by students in times of crisis or financial hardship,â Magsino added. The measure contained in Senate Bill 1359 and House Bill 7584 imposes sanctions on private elementary and high school educational institutions that will bar learners from taking scheduled periodic examinations due to unsettled financial obligations. Under the provisions of the Act, disadvantaged students, certified as such by the Department of Social Welfare and Development (DSWD), who are unable to pay tuition and other fees due to calamities, emergencies, and other justifiable reasons, shall be allowed to take periodic and final examinations. However, schools may require the submission of a promissory note and retain the credentials of the student until the financial obligation is fully settled. In a balanced approach, schools may also voluntarily permit students to take examinations and release credentials even with outstanding financial obligations without the need for DSWD certification. The No Permit, No test Prohibition Act applies to all public and private basic, higher education institutions, and technical-vocational institutions offering long-term courses exceeding one year. The Act not only recognizes the diverse circumstances that students may face but also encourages educational institutions to play a proactive role in supporting their students during challenging times, Magsino said. - Advertisement - As the New Year approaches, many people are addressing financial resolutions. But a significant number of Americans feel like theyâre behind on achieving their money goals. About 80 percent of Americans didnât increase their emergency savings this year, according to a exact Bankrate survey. Nearly one-third of households (32 percent) have less emergency savings now than at the start of 2023. Generative AI has emerged as a useful tool for financial advice, offering consumers a free way to receive customized guidance on everything from creating a budget to managing an investment portfolio. Key takeaways

AI financial advice data and statisticsDespite a strong economy, many Americans are struggling to achieve their financial goals as 2023 comes to a close. Nearly half of Americans are struggling to be financially secure, according to a Bankrate survey. Still, many of the Americans surveyed are optimistic about their financial future â 46 percent of Americans who donât feel financially secure believe that they will someday. About 2 in 5 Americans (41 percent) surveyed blamed insufficient retirement funds as the primary factor fueling their feelings of financial insecurity. Building an emergency savings fund is another common aspiration, yet 60 percent of Americans feel theyâre behind on meeting this goal, too. More people are now turning to AI platforms, like ChatGPT, as a cost-effective way to manage their finances. The public debut of ChatGPT in November 2022 has boosted consumer awareness of AIâs potential: The chatbot currently has over 100 million users and the website generated 1.6 billion visits since June 2023. Americans and their financial goalsFor many Americans, their financial landscape feels like a battlefield â an on-going struggle to save for major life events while combating rising prices. While inflation is down significantly from the summer of 2021, interest rates remain at their highest level in more than 15 years. From buying a car to purchasing a home to paying down credit card debt, consumers are feeling the impact of broader economic factors on their bottom line. Americans feel behind in achieving their financial goals due to a variety of factors:

For Americans struggling to get ahead, AI offers a way to obtain personalized advice and financial information at home for free. âAI can be a useful tool to understand how to organize basic finances like budgeting, saving, and paying down debt,â says Stephanie Genkin, a certified financial planner and founder of My Financial Planner, LLC in Brooklyn, New York. âWhile not always 100 percent reliable, itâs a great place to start to gain financial literacy.â AI financial toolsIn the not-so-distant past, managing money often meant sitting down with a financial advisor or conducting your own in-depth research. Information wasnât always readily available â or free. Flash forward to today, when the financial industry is experiencing a digital revolution. Consumers now have access to easy online banking, handy budgeting apps and even robo-advisors that use complex algorithms to help with investing. While these advancements make money management more convenient and accessible, the advice they offer â if any â is often generic. That lack of personalized guidance is changing with artificial intelligence, specifically AI chatbots. These digital assistants offer the potential to fill the gap between individuals struggling with financial goals and the guidance they need to achieve those goals. Platforms like ChatGPT offer more than just casual conversations with a robot. They provide access to financial planning information and insights once only available for a fee from an advisor. One big advantage of AI is its ability to analyze vast data sets quickly. AI can review your income, expenses, savings, investments and financial goals, offering advice tailored to your unique situation. Users can also get guidance on creating a budget or understanding insurance products. Other AI-driven financial tools include:

Consumers are also getting more comfortable with the idea of AI-integration in financial planning. In fact, nearly 1 and 3 investors would be comfortable using generative artificial intelligence to receive financial advice, according to a report by CNBC. However, itâs crucial to note that while generative AI can be a valuable tool, it canât replace human judgement. Sure, AI can analyze large amounts of data, but itâs not going to provide you with specific investment recommendations. Certain aspects of your financial life still require a more nuanced approach. Also, OpenAI, the company that developed ChatGPT, warns that the chatbot âsometimes writes plausible-sounding but incorrect or nonsensical answers.â For consumers, AI can enhance financial decision-making but it canât replace it. Experts recommend finding a reliable source to vet information provided by a chatbot. âI wouldnât make any big financial decisions without also speaking to a fiduciary,â says Genkin. Keep in mind:While AI chatbots are efficient tools for time-saving activities, some of the content generated can be unreliable or outdated. How AI can be used in financial advisingConsumers arenât the only ones using AI to manage money. For years, financial firms have utilized the technology for everything from fraud detection to credit scoring. As generative AI evolves, more financial advisors are finding new ways to incorporate the technology into their workflows to streamline everyday tasks such as research, stock market analysis and report generation. Jeremey Finger, a certified financial planner and founder of Riverbend Wealth Management in Myrtle Beach, South Carolina, says he thinks chatbots can be an efficient tool for advisors by helping them simplify tasks like drafting emails to clients. âI think the danger, especially for clients, lies in assuming the information it provides is true,â says Finger. âIt also canât ask a client thoughtful follow-up questions. It only works off the information you put in.â For example, if someone with a disability or terminal illness fails to input those details into a chatbot, the advice they receive wonât be tailored to their needs. âTo assume AI is taking those things into consideration is poor judgement,â says Finger. How to choose the right financial advisorRobo-advisor: A type of automated financial advisor that provides algorithm-driven portfolio management and investing services with little to no human intervention. Financial advisor: A professional who is paid to offer financial advice to clients. They typically offer guidance on retirement, personal finances and investments. Rather than turning to AI chatbots, there are other options available if you need personalized financial guidance, including traditional advisors and robo-advisors. The rise of AI has seen a parallel surge in the popularity of robo-advisors. While not a new concept, robo-advisors have become more sophisticated with the integration of AI, offering users a cheaper and more convenient way to invest. But creating a comprehensive financial plan involves more than a data-driven investment strategy. Selecting the right financial advisor, whether human or AI-driven, is an important step in achieving financial goals. Not everyone needs to work with a human advisor, but doing so provides valuable insight and context you might not get with generative AI or even a robo-advisor. Estate planning, which involves drafting legally-binding documents to pass along your assets after you die, is one example of a complex situation that warrants speaking to a human advisor. But how do you select the right financial advisor? Here are a few tips:

If you need expert guidance when it comes to managing your money or planning for retirement, Bankrate can help you get matched with a financial advisor in minutes. Frequently Asked Questions

Early in the 1980s, when Board Toppers were pursuing Electronics Engineering, I took inspiration from their success and began my own educational journey to become an Electronics Engineer. After completing my degree in engineering, I started my career in the CAD/CAM domain, which had various applications across different industry segments. In 1990, after completing my engineering degree and starting work, India was navigating through severe economic challenges. When I completed my MBA in Finance in 1995, the financial sector was experiencing a downturn, and the overall market conditions were extremely challenging. At that point, I started exploring sectors that could be a sunrise industry for the future. During this phase, I learned about the Government of Indiaâs efforts to open the insurance sector to private players. While interacting with experts in the field, I stumbled upon the term 'risk management', which was then considered synonymous with plant or factory risk management. I was convinced that thereâs a risk in everything we do, and it applies to every business or domain, irrespective of the industry or sector. After extensive research, I came across the Institute of Risk Management (IRM), headquartered in the UK, that offered the leading global certifications in Enterprise Risk Management (ERM) along with professional designations recognised world over. The subjects, course outline, and coverage of all areas of risk beyond finance or insurance caught my attention, and I enrolled in the IRM examinations. The course material was unique and captivating, with a focus on building a strong foundation on risk concepts, the process of ERM, risk-based decision-making, risk identification, risk analysis, and most importantly, developing a risk culture. As part of the course, candidates also had to submit a caselet for a company by identifying and analysing risks in detail. The case study submission was assessed based on formal examination. I was fortunate to clear the Associateship test of the IRM in 1997 and was conferred the title AIRM, which was later upgraded to the Certified Fellowship, i.e., the CFIRM designation.

After completing my PGDBA in Finance, I secured a job at a Non-Banking Finance Company (NBFC). My learning journey continued as I had the opportunity to work in various areas of the financial services sector. Moreover, I was asked to prepare for a Joint Venture with a leading Insurance Firm worldwide as a Steering Committee member. While serving as a Steering Committee member for the Insurance JV, I enrolled in and completed the Insurance Exams conducted by the Insurance Institute of India and the IRM. This helped me fulfil my responsibilities more effectively. I also briefly worked at a bank leading the Bancassurance initiative and started taking exams from the Indian Institute of Bankers. I got my first big break in ERM when I joined the world's leading insurance broking firm as a consultant providing risk services. If it weren't for all the studies I had done in the past, the qualifications I had gained, and in particular the IRM certification, I would never have been able to get the job or deliver on risk consulting services. While working in the risk management consulting area with a Big Four firm, I gained exposure to different forms of risk management services, including enterprise-wide risk solutions, physical risk management, insurable risk analysis, contractual risk analysis, project risk, business continuity planning (BCP), and disaster recovery planning (DRP).

My risk management skills improved significantly when I transitioned from a consultant facilitating risk management to a hands-on risk manager as qualified Chief Risk Officer (CRO) in a corporate setting. I have held CRO positions in infrastructure, oil and gas and engineering design and project management consulting firms. As a CRO, I gained insight into both qualitative and quantitative aspects of risk management. This enabled me to assist management in making informed decisions across various areas, such as bids, projects, business continuity planning, financial decisions, contractual risks, etc.

When working on any risk assignment, I can bring diverse skills and knowledge, including engineering, financial analysis, insurance, banking, contractual expertise, economics, and more. This is due to the qualifications and experience I have gained in these domains, allowing me to tackle any challenge with confidence and efficiency. How my company has benefited from my IRM certification and Fellowship in ERM: I started my career in risk management as a consultant and without the IRMâs ERM qualifications, I would not have been in a position to start delivering on engagements from day one without any company training. While working with organisations in the infrastructure sector, I could resonate with and implement all the learnings from the IRMâs materials. This allowed me to create deliverables which speeded decision making by the respective Management. I could develop customised frameworks for Bid Risk, Project Risk, Qualitative and Quantitative risk management, Business Continuity Planning, Linkage to Strategy and more. The quality of my deliverables enhanced my positioning in the organisation. Today, I am a part of the Executive Management Committee which is an apex body of the organisation and I actively participate in areas of management decision making. Besides, my interaction with fellow risk managers from different companies also helps us benchmark our risk practices to bring an outside-in perspective to the organisation. We could bring the concept of âNo Surprisesâ to a larger set of employees as a part of the process of building risk culture in the organisation through customised training programs in our endeavour to âMake everyone a Risk Managerâ.

Key success factors for a CRO of the future: Based on my experience, I believe that the following is essential:

Over time, the IRM Certification has expanded with a well-structured track from Level 1 to Level 5 or Stage 1 to 5, which students and professionals can pursue to gain a comprehensive understanding of international frameworks (like ISO 31000 and COSO 2004 and 2017), risk identification techniques, scenario planning, horizon scanning, evaluation of emerging risks, risk appetite and tolerance, risk treatment, risk reporting and communication, business continuity planning, internal audit and assurance, and corporate governance. Since I had cleared the Associateship test 25 years ago, I got an opportunity to apply for Fellowship through the Senior Executive Route (SER). My application was thoroughly reviewed based on my credentials, management-level experience, references, and other factors. I was awarded the Certified Fellow of the Institute of Risk Management (CFIRM) title, and I was also among the first to complete the IRMâs Digital Risk Management Certification test in collaboration with Warwick University.

Through a formal training process conducted by experts from IRM, I have now become an Assessor for the SER route. It has been an amazing journey of learning, deploying, and sharing my knowledge. Now, I am giving back to my alumni as the Chair of the India Regional Group that manages member relations while the IRM India Affiliate continues to grow the IRM community in India. In my journey of overseeing the key governance pillar of ERM for the organisations I have worked with, I have gained immense benefits.

Career Tips for aspiring students and professionals

As the world becomes increasingly complex, getting risk-intelligent irrespective of any career and having formal knowledge of ERM can help one anticipate, prepare for, and deal with uncertainties in scaling a business, climbing in a corporate job, or starting a new venture. Therefore, ERM as a field and career option is universally applicable and will continue to proliferate personally and professionally. My best wishes go out to all young business and risk enthusiasts who wish to become risk intelligent in any domain or sector and aspire to build their careers in one of the most promising areas in the times to come.

The author Rajeev Tanna is CFIRM, Head of Risk Management and Internal Compliance, at Tata Consulting Engineers Limited.

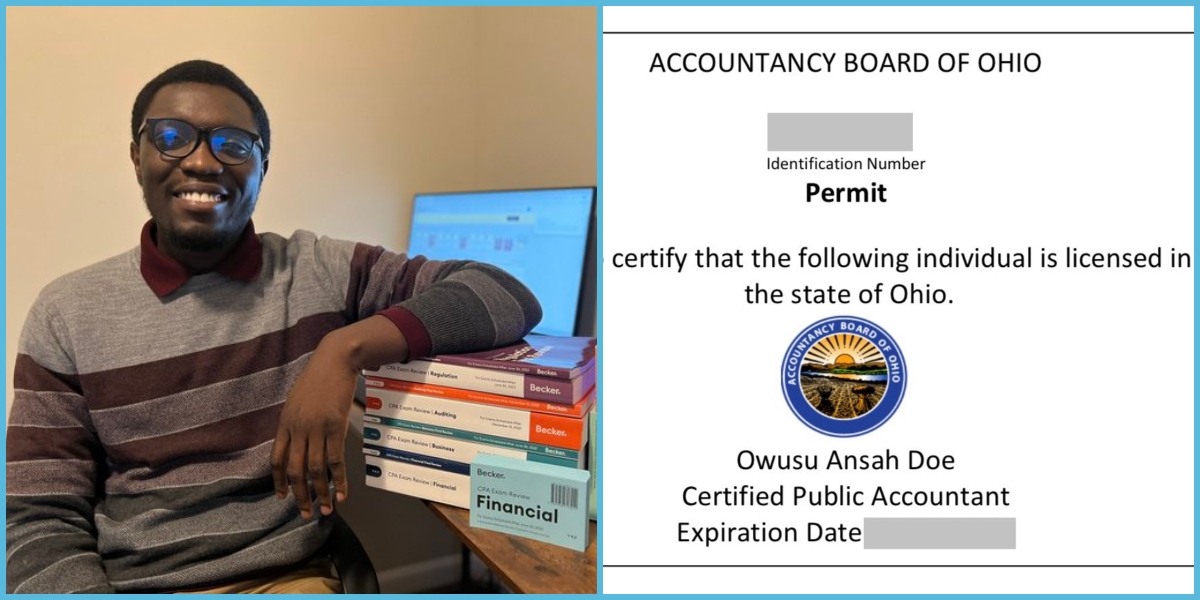

Nana Owusu Ansah Doe has successfully conquered the challenging Certified Public Accountant (CPA) Exam, passing all four sections with flying colours. Over the past 12 months, Nana Owusu Ansah navigated significant life changes, including a job transition and pursuing a master's degree in Financial Economics, where he achieved an outstanding 3.967 GPA. In a post he shared on Twitter, he indicated that the journey didn't stop there for him, who also attained state licensure as an Insurance Agent, showcasing a diverse and expanding skill set in the financial sector.

Source: Twitter Despite the numerous commitments, Nana Owusu Ansah demonstrated unwavering dedication to professional growth and excellence. Comments on Nana's postFriends, family, and colleagues have applauded Nana Owusu Ansah's achievements, recognising the significance of obtaining a CPA certification in finance and accounting. Read some of their reactions below: @ClintonEleto said:

@Derrick_Ayim10 wrote:

@readJerome said:

@Opokuduke wrote:

@staksottieGH said:

@josh_muesi wrote:

Ghanaian Man Conquers Academic Heights With Back-To-Back Master's And Law DegreesIn another story, Alhassan Duani Amin earned an MSc in Energy and Sustainable Management and a Bachelor of Laws degree within two days from KNUST. His remarkable dedication to education is evident in his third post-graduate certificate, showcasing expertise in energy and sustainability, while the LLB degree sets the stage for potential contributions to the legal field. Admitted to the Ghana School of Law, he aspires to be called to the Bar in the near future. Source: YEN.com.gh Dec. 27âFinancial Advisor Jaclyn Wangen of the financial services firm Edward Jones in Austin, has received the Certified Financial Planner or CFP, certification, granted by the Certified Financial Planner Board of Standards (CFP Board). Becoming a CFP professional expands a financial advisor's knowledge base in the following areas: * Financial management * Tax-sensitive investment strategies * Retirement savings * Insurance planning * Education planning * Estate Considerations In addition to the education and examination components of certification, Wangen also has committed to abiding by the CFP Board's Code of Ethics and Standards of Conduct. Wangen's office is located at 1405 15th Ave NW in Austin. She and branch office administrators Mary Flaherty and Shelby Hullopeter can be reached at 507-437-7601. You can also visit her website at www.edwardjones.com/jaclyn-wangen. | ||||||||

CTFA action | CTFA helper | CTFA testing | CTFA candidate | CTFA study help | CTFA test | CTFA test prep | CTFA test syllabus | CTFA teaching | CTFA test syllabus | | ||||||||

Killexams test Simulator Killexams Questions and Answers Killexams Exams List Search Exams |