F5 ARX Configuring 5.x Exam Braindumps

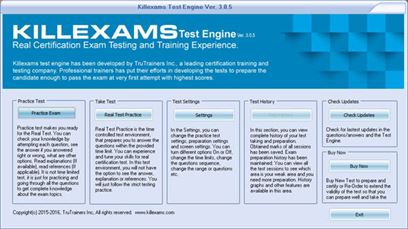

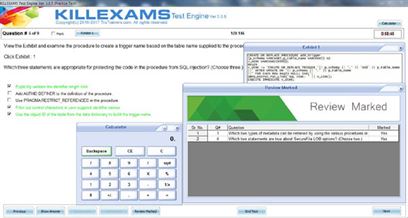

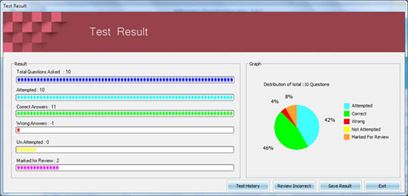

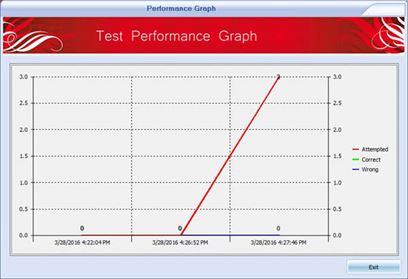

Killexams.com F50-528 Exam Braindumps contain complete question pool, updated in April 2024 including VCE exam simulator that will help you get high marks in the exam. All these F50-528 exam questions are verified by killexams certified professionals and backed by 100% money back guarantee.

F50-528 outline - F5 ARX Configuring 5.x Updated: 2024 | ||||||||

| F50-528 F50-528 Dumps and practice exams with Real Question | ||||||||

|

||||||||

|

||||||||

|

Exam Code: F50-528 F5 ARX Configuring 5.x outline January 2024 by Killexams.com team | ||||||||

| F5 ARX Configuring 5.x F5-Networks Configuring outline | ||||||||

Other F5-Networks exams101 Application Delivery Fundamentals 2023201 BIG-IP Administrator 301 LTM Specialist 001-ARXConfig ARX Configuration 301b BIG-IP Local Traffic Manager (LTM) Specialist : Maintain & Troubleshoot F50-522 F5 BIG-IP Local Traffic Management Advanced v9.4 F50-528 F5 ARX Configuring 5.x F50-532 BIG-IP v10.x LTM Advanced subjects V10.x F50-536 BIG-IP ASM v10.x (F50-536) | ||||||||

| Are you looking for F50-528 F50-528 Dumps of test questions for the F50-528 test prep? We provide most updated and quality F50-528 Dumps. We have compiled a database of F50-528 Dumps from genuine exams in order to let you prepare and pass F50-528 test on the first attempt. Just memorize our Q&A and relax. You will pass the exam. | ||||||||

| F5-Networks F50-528 F5 ARX Configuring 5.x https://killexams.com/pass4sure/exam-detail/F50-528 E. 1 for VIP, 1 for Out of Band management, 1 for In Band management, and 1 for each network port Answer: B Question: 43 Which of the following will cause a metadata collision upon import? Assume that Share1 and Share2 are both in the same Managed Volume. (Choose two.) A. A directory on Share1 has the same name as a directory on Share2 regardless of any other factor. B. A file on Share1 has the same filename and path as a file on Share2 regardless of any other factor. C. A directory on Share1 has the same name as a directory on Share2 but only if they have different permissions. D. A file on Share1 has the same filename and path as a file on Share2 but only if they have different permissions. Answer: B, C Question: 44 Battery backed NVRAM is used to store A. metalog updates. B. the current metadata. C. all configuration information. D. Syslog messages and SNMP traps. E. the current clock information to ensure proper synchronization with UTC. Answer: A Question: 45 Which of the following is NOT configured in the initial interview? A. Master key B. System password 16 C. In Band Management address D. Crypto officer name and password E. Out of Band Management address Answer: C Question: 46 To upgrade ARX, which of the following are true? (Choose two.) A. An admin must arm the upgrade image on the ARX and reload. B. Upgrades can be performed online using F5 software upgrade web site. C. Software images used for upgrades must be loaded onto the ARX using FTP. D. Software images used for upgrades may be loaded on the ARX using the CIFS protocol. E. All major version upgrades (from 4.x to 5.x for example) must be performed by F5 personnel. Answer: A, D Question: 47 Which of the following are types of volumes that require metadata? (Choose two.) A. Direct volumes B. Interior volumes C. Shadow volumes D. Managed volumes E. Presentation volumes Answer: C, D Question: 48 Which of the following filers are supported for Virtual Snapshots? (Choose three.) A. EMC B. NetApp C. BlueArc D. Sun Solaris E. Windows Server 17 Answer: A, B, E Question: 49 Which of the following operations would be run from within the Config mode of the CLI? (Choose three.) A. Create a namespace B. Designate a DNS server C. Create an External filer D. Designate an NTP source E. Assign an In Band Management address F. Copy a file to or from the ARX using FTP Answer: B, D, E Question: 50 F5 Data Manager provides which of the following capabilities? (Choose two.) A. Generates scripts to facilitate a data migration B. Displays graphical and text based reports on files and file systems C. Provides a GUI with which to create and modify managed volumes D. Performs a policy based file migration between different managed volumes Answer: A, B 18 For More exams visit https://killexams.com/vendors-exam-list Kill your test at First Attempt....Guaranteed! | ||||||||

|

F5 networks this week traded up 12% higher following reports that the company retained Goldman Sachs to represent the company in the wake of apparent buyout offers. In the past, F5 has surfaced as a potential acquisition target among the tech giants such as IBM , Cisco and Juniper . As is generally the case, neither Goldman nor F5 would comment. Although no deal has arisen from any previous such talks, here are reasons as to why F5 Networks might well consider a sell-off this time. Consider the following:

For information, please refer to our complete analysis for F5 Networks View Interactive Institutional Research (Powered by Trefis): Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap Like our charts? Embed them in your own posts using the Trefis WordPress Plugin. In the coming year, F5 Networks will commit more resources to its partners than ever before, as the application delivery networking vendor sets its sites on bigger pieces of the security infrastructure, data center and cloud computing pies. At F5 Networks' Agility conference in Chicago, where more than 560 partner representatives and 275 customers are in attendance, F5 has championed partners as the big push behind its march to $1 billion in revenue -- a milestone it expects to reach as its fiscal year ends in September. What's coming next, said Steve McChesney, vice president, channel sales, Americas, is more from F5 in the areas of partner planning, partner marketing, partner services and partner-led profitability. Several key programs, including F5's current accreditation program and forthcoming certification offering, are designed to better equip partners taking F5 products into all pieces of the data center sale, from storage to security. According to McChesney, F5's average deal size through partners is nearly $100,000 -- more than double of what it was a decade ago, and 10 percent larger than the previous year. McChesney urged partners to embrace the full gamut of F5 resources, including DevCentral, F5's user community portal for helping partners share best practices, built software and hear from F5 engineers. DevCentral, said McChesney, offers access to more than 80,000 users and 500 pieces of trial material to "jumpstart" F5 projects. Overall, F5 partners have a rich opportunity to have business transformation conversations with users on a cloud migration path. Using industry research from Enterprise Strategy Group and other sources, Dean Darwin, F5's vice president, worldwide channels identified three trends happening with customers on a worldwide basis. First, he said, server virtualization is becoming ubiquitous, even if 58 percent of organizations have virtualized less than one third of their servers. Second, IT-owned workloads still dominate the customer landscape, and 59 percent of customers have not yet virtualized any mission-critical applications. Third, dynamic IT is still more a vision than a reality. But those trends still reflect the reality of how channel partners need to engage customers. F5, said Darwin, solves a lot of the problems customers have at the application layer -- a point made repeatedly by other F5 executives at Agility -- and partners need to bring F5 products in as business conversations, not as product resale. "The selling lanes have changed," Darwin said, referencing financial legend Warren Buffett's thought that "only when the tide goes out do you discover who's been swimming naked." Coming rapidly into focus, Darwin said, are that large VARs and systems integrators are building their own cloud offerings, and are looking to partner with cloud providers, such as Rackspace, as cloud services agents. That makes all the sense in the world for F5's channel, Darwin said, because its products and services fit between so many different data center disciplines. "And we are absolutely getting into the ring when it comes to security," he added, referencing a push by F5 to become better known as a security infrastructure player as much as it is an application delivery networking vendor. "F5 can be a door opener for a lot of discussions," he said. "The closer you get to the application, the healthier you're going to be and the more business discussions you're going to have." Tim Abbott, solutions architect at Trace 3, a security solution provider and F5 partner based in Irvine, Calif., said Trace 3 had in the past positioned F5 before as a load balancer, or for its Global Traffic Manager (LTM) capability in the BIG-IP platform, or any one or several capabilities the F5 product set offers. The upsell opportunity, with more customers looking to make their data centers more efficient, is enormous. "We're only scratching the surface with our customers on all the features it can provide," he said. Trace 3 sells the entire F5 portfolio and has seen its F5 sales grow nearly 40 percent year-over-year. F5's positioning -- for partners to focus on the business transformation that comes from optimizing applications -- is spot-on, Abbott said. "Who cares about servers, we care about the applications," he said. "When you're virtualizing an infrastructure, you're asking what applications are you trying to virtualize and how are you making that application better to the customer. Once you figure out what applications you want to virtualize, you'll get the funding. If you can make the app faster, the doors are open. Once those doors are open, I can sell you the F5 product." Next: F5's Vendor Partnerships Bear Fruit Partners said that another big piece of F5's appeal is how its products can fit with those of data center-focused vendors with a big stake in the cloud computing move. Rackspace, for example, told F5 partners Thursday it will be doing more to encourage joint F5-Rackspace solution sales. Robert Fuller, vice president of worldwide channels, and John Engates, CTO, at Rackspace, said that hosted cloud provider will grandfather F5 partners into the tier equivalent, in Rackspace's channel program, of their F5 Unity partner program status -- an announcement that brought applause from the F5 crowd. "Let's bridge that into the Rackspace program, so you get the high-level compensation," Engates said. The companies will partner in other ways, too. F5 plans to credit the F5 portion of a solution hosted at Rackspace toward an F5 partner's partner tier attachment, Fuller said. There will also be joint sales development between the two companies, and payment acceleration options that let VARs draw from future compensation payments by Rackspace to offset upfront costs. Storage ace NetApp was another F5 vendor partner at Agility touting greater vendor alignment between the two channels. Jim Sangster, senior director of solutions marketing at NetApp, said he's seeing the opportunity for NetApp storage and F5 infrastructure sales to expand, with more customers looking for seamless migration paths to cloud. "The discussion around the applications is really what it's all about," Sangster told partners. BRAZIL - 2021/04/15: In this photo illustration, the F5 Networks logo seen displayed on a smartphone ... [+] SOPA Images/LightRocket via Getty ImagesGiven its better prospects, we believe Ciena stock (NYSE: CIEN), a network hardware, software, and services provider, is a better pick than its sector peer, F5 Networks stock (NASDAQ NDAQ : FFIV), an application security and cloud networking company. Investors have assigned a higher valuation multiple of 3.7x revenues for FFIV compared to 1.5x revenues for CIEN due to F5’s superior revenue growth and profitability. The decision to invest often comes down to finding the best stocks within the parameters of certain characteristics that suit an investment style. The size of profits can matter, as larger profits can imply greater market power. In the sections below, we discuss why we believe that CIEN will offer better returns than FFIV in the next three years. We compare a slew of factors, such as historical revenue growth, stock returns, and valuation, in an interactive dashboard analysis of F5 vs. Ciena CIEN : Which Stock Is A Better Bet? Parts of the analysis are summarized below. FFIV stock has seen little change, moving slightly from levels of $175 in early January 2021 to around $175 now, while CIEN stock has seen a decline of 20% from levels of $55 to around $45 over the same period. In comparison, the S&P500 index saw an increase of about 25% over this roughly three-year period. Overall, the performance of FFIV stock with respect to the index has been lackluster. Returns for the stock were 39% in 2021, -41% in 2022, and 21% in 2023. Similarly, however, the decrease in CIEN stock has been far from consistent. Returns for the stock were 46% in 2021, -34% in 2022, and -13% in 2023. In comparison, returns for the S&P 500 have been 27% in 2021, -19% in 2022, and 23% in 2023 - indicating that FFIV and CIEN underperformed the S&P in 2022 and 2023. In fact, consistently beating the S&P 500 - in good times and bad - has been difficult over accurate years for individual stocks; for heavyweights in the Information Technology sector, including AAPL, MSFT, and NVDA, and even for the megacap stars GOOG, TSLA, and AMZN. In contrast, the Trefis High Quality Portfolio, with a collection of 30 stocks, has outperformed the S&P 500 each year over the same period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index, less of a roller-coaster ride, as evident in HQ Portfolio performance metrics. Given the current uncertain macroeconomic environment with high oil prices and elevated interest rates, could FFIV and CIEN face a similar situation as they did in 2022 and 2023 and underperform the S&P over the next 12 months - or will they see a strong jump? While we expect both stocks to move higher in the next three years, we think CIEN will fare better. 1. F5’s Revenue Growth Is Better

2. F5 Is More Profitable

3. The Net of It All

FFIV stock versus CIEN stock TrefisWhile CIEN stock may outperform FFIV, it is helpful to see how F5’s peers fare on metrics that matter. You will find other valuable comparisons for companies across industries at Peer Comparisons. FFIV Return Compared with Trefis Reinforced Value Portfolio TrefisInvest with Trefis Market Beating Portfolios See all Trefis Price Estimates The largest acquisition in F5 Networks’ 23-year history will combine Shape Security’s fraud and abuse prevention capabilities with F5’s expertise in protecting applications across multi-cloud environments.

F5 Networks has agreed to purchase rising application security star Shape Security for $1 billion to protect customers from automated attacks, botnets, and targeted fraud. Seattle-based F5 said the proposed acquisition will bring together its expertise in protecting applications across multi-cloud environments with Santa Clara, Calif.-based Shape Security’s fraud and abuse prevention capabilities. The deal is the largest in F5’s 23-year history, and will more than double the company’s addressable market in security. “With Shape, we will deliver end-to-end application protection, which means revenue generating, brand-anchoring applications are protected from the point at which they are created through to the point where consumers interact with them – from code to customer,” F5 Networks President and CEO Francois Locoh-Donou said in a statement. [Related: F5 Networks CEO: Nginx Is ‘Absolutely Core' To F5's Strategy] F5’s stock remains unchanged at $143.69 in after-hours trading Thursday. The company expects to achieve breakeven non-GAAP earnings per share within 24 hours of closing the Shape Security acquisition, and expects the transaction will accelerate F5’s product and total revenue growth. The deal is expected to close in the first calendar quarter of 2020. Shape Security was founded in 2011, employs more than 370 people, and has raised $183 million in six rounds of outside equity. Shape will remain located in the current Silicon Valley headquarters after the transaction closes, with co-founder and CEO Derek Smith as well as other members of Shape’s leadership team joining F5 in key management roles. “We look forward to the opportunity to deeply integrate into F5’s platform for application delivery and security – F5 provides the optimum traffic flow insertion point for Shape’s industry-leading online fraud and abuse prevention solutions,” Smith said in a statement. Shape’s platform is supported by cloud-based analytics and uses artificial intelligence and machine learning to defend against attacks that bypass other security and fraud controls, according to F5. The company is particularly focused on rebuffing credential stuffing attacks, F5 said, which use stolen passwords from third-party data breaches to take over other online accounts. The company’s application platform evaluates the data flow from the user into the application, leveraging cloud-based analytics to discern good traffic from bad, according to F5. Combining Shape with F5’s location in the data flow is expected to dramatically reduce the time and resources needed for businesses to deploy online fraud and abuse protection. “We knew from the companies we work with that applications are critical to running their business,” Locoh-Donou said in a statement. “To drive maximum business value and the best experiences for their customers, these apps need to perform flawlessly while protecting data security and user privacy.” Some of the world’s largest banks, airlines, retailers and government agencies rely on Shape to provide sophisticated bot, fraud and abuse defense, according to F5. Joining with F5 means that Shape will be able to protect significantly more users and applications from sophisticated attacks and malicious traffic going forward, Smith said in the statement. In the long-term, integrated F5’s products with Shape’s large-scale telemetry and analytics capabilities will significantly advance F5’s plans to offer AI-enhanced services to customers that provide better visibility, management and orchestration across their applications, Locoh-Donou said in a letter to the company’s employees. The Shape Security deal comes just seven months after F5 closed its $670 million purchase of NGINX to help companies deliver faster, more compelling digital experiences. Locoh-Donou said in the letter that F5 has been taking deliberate and disciplined steps to become the leader in multi-cloud application services since first laying out the vision in 2017. “We know what it takes to win,” Locoh-Donou told employees, “and make no mistake, we are playing offense.” F5's FFIV shares jumped 21.2% post fourth-quarter fiscal 2023 earnings release, buoyed by strong performance. The surge showcases investors' trust in F5's solid finances and its strategic position in application delivery, networking and security solutions. FFIV's earnings has outpaced estimates in each of the trailing four quarters, delivering an average surprise of 7.76%. This indicates an impressive track record of exceeding earnings estimates. Moreover, the company has a long-term earnings growth expectation of 5.4%. The stock carries a Zacks Rank #2 (Buy) and has a Growth Score of B at present. The Growth Style Score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth. Per Zacks’ proprietary methodology, stocks with a combination of a Zacks Rank #1 (Strong Buy) or #2 and a Growth Score of A or B offer solid investment opportunities. With healthy fundamentals, the stock appears to be a solid investment option at the moment. F5, Inc. Price and ConsensusF5, Inc. price-consensus-chart | F5, Inc. Quote Growth DriversF5’s stronger-than-expected fourth-quarter fiscal 2023 results have boosted investors’ confidence. F5 Networks stands out to benefit from the booming application networking market. With a strong hold in Layer 4-7 content switching and a solid position in data centers, the company is poised to expand market share, especially given the increasing demands for capacity and security in next-gen applications. F5 is one of the major players in the application delivery controller (ADC) market, offering vital products for data center consolidation, virtualization and cloud services. Additionally, F5 has gained significant market share due to Cisco's shift away from the core ADC market. It is also a major developer and provider of software-defined application services, ensuring secure, speedy and accessible applications across IP networks on any device and at any time. FFIV collaborated with industry leaders, including Microsoft, Oracle, VMware, Cisco Systems and HP, to offer integrated application services for their Software Defined Networking offerings. It has also partnered with Amazon Web Services, Microsoft Azure, VMware vCloud Air, Cisco ACI and others for cloud-based application services. These partnerships increase access to new tech, aid product innovation, strengthen F5's cybersecurity suite, support joint sales and marketing efforts, and enhance its competitive edge. The company is altering its business model by focusing on subscription-based services, which generate steady revenues and increase profits. The company has also made cost-saving moves like reducing staff, trimming facility space and cutting travel. These initiatives are aimed at lowering operating expenses and improving margins in the short run. Moreover, F5 boasts a strong balance sheet, ample liquidity and reduced debt, making it lucrative to investors. Other Key PicksLogitech LOGI, carrying a Zacks Rank #2 at present, is capitalizing on the surge of hybrid work patterns, which are expected to increase the need for its video collaboration tools, keyboards, combos and pointing devices. The thriving cloud-based video conferencing services remain a primary driving force behind this. You can see the complete list of today’s Zacks #1 Rank stocks here. The growing adoption of new mobile platforms in both mature and emerging markets is driving Logitech's peripherals and accessories demand. Additionally, the company has been able to leverage its software and go-to-market capabilities to increase its market share. The consensus mark for fiscal 2024 earnings has moved north 11 cents to $3.43 per share over the past 60 days, indicating a 6.52% increase from the fiscal 2023 level. LOGI has a Growth Score of A. NVIDIA Corporation NVDA, carrying a Zacks Rank #2 at present, is reaping the rewards of increased investments in generative AI. The surge in generative AI technology is poised to create substantial demand for its next-gen high-performance computing chips. With rising investments in AI across the data center sector, NVDA anticipates its fourth-quarter fiscal 2024 revenues to soar to $20 billion from $6.05 billion in the previous year’s quarter. NVIDIA maintains a dominant position in the AI chip market, with its GPUs already integrated into AI models. This expansion of NVDA’s reach is extending into previously untapped sectors, such as automotive, healthcare and manufacturing. Collaborations with Mercedes-Benz and Audi are poised to further bolster NVIDIA's presence in autonomous vehicles and other automotive electronics domains. The consensus mark for fiscal 2024 earnings has been revised upward by 12 cents to $12.29 per share over the past 30 days, indicating a whopping 268% increase from fiscal 2023. The stock has a Growth Score of A and has a long-term earnings growth expectation of 13.5%. CrowdStrike CRWD carries a Zacks Rank #2 and has a Growth Score of A. CRWD is capitalizing on heightened demand for cyber-security solutions, driven by numerous data breaches and the growing necessity for security and networking products amid the rise of hybrid work practices. Ongoing digital transformations and the migration to cloud services within organizations serve as pivotal factors driving growth. The company's robust portfolio, including the Falcon platform's 10 cloud modules, fortifies its competitive advantage and attracts new users. Furthermore, strategic acquisitions like Bionic and Reposify are anticipated to propel further growth. The Zacks Consensus Estimate for CrowdStrike’s fiscal 2024 earnings has moved north 12 cents in the past 30 days to $2.94 per share, indicating growth of 90.9% on a year-over-year basis. The long-term expected earnings growth rate for CRWD is pegged at 36.1%. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Logitech International S.A. (LOGI) : Free Stock Analysis Report NVIDIA Corporation (NVDA) : Free Stock Analysis Report F5, Inc. (FFIV) : Free Stock Analysis Report CrowdStrike (CRWD) : Free Stock Analysis Report A month has gone by since the last earnings report for F5 Networks (FFIV). Shares have added about 10.2% in that time frame, outperforming the S&P 500. Will the accurate positive trend continue leading up to its next earnings release, or is F5 due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most accurate earnings report in order to get a better handle on the important drivers. F5 Surpasses Earnings and Revenue Estimates in Q4F5 reported better-than-expected fourth-quarter fiscal 2023 results. This Seattle, WA-based company’s non-GAAP earnings of $3.50 per share beat the Zacks Consensus Estimate of $3.22 and increased 33.6% from the year-ago quarter’s $2.62 per share. The bottom line was also way higher than management’s guided range of $3.15-$3.27 per share. The robust bottom-line performance reflects the combined impact of gross margin improvement and disciplined operating expense management. F5 revenues of $707 million for the fourth quarter surpassed the consensus mark of $701.6 million. Moreover, on a year-over-year basis, revenues increased 1% and came toward the high end of management’s guidance range of $690-$710 million despite persistent macroeconomic uncertainties and tight budgets of customers. Top Line in DetailProduct revenues (46% of total revenues), which comprise the Software and Systems sub-divisions, decreased 7% year over year to $325 million. The decline in Product revenues was mainly due to lower Systems sales, partially offset by increased Software sales. The company’s reported non-GAAP Product revenues were slightly higher than our estimates of $324.4 million. Systems revenues plunged 25% year over year to $134 million, accounting for approximately 41% of the total Product revenues. The company revealed that the decline reflects a lower level of backlog-related shipments compared to prior quarters, while the demand shows some signs of stabilization. Our estimates for Systems revenues were pegged at $152.6 million. However, the negative impacts of lower Systems sales were offset by the strong performance of Software. Software revenues soared 11% year over year to $191 million in the fourth quarter. Our estimates for Software’s fourth-quarter revenues were pegged at $171.7 million. Global Service revenues (54% of the total revenues) grew 9% to $382 million. The robust growth was mainly driven by price increases introduced last year and the benefits of high-maintenance renewals. Our estimates for Global Services revenues were pegged at $376.5 million. F5 Networks registered sales growth across the EMEA and APAC regions, witnessing a year-over-year increase of 16% and 4%, respectively. However, revenues from the Americas region fell 6% on a year-over-year basis. Revenue contributions from the Americas, EMEA and APAC regions were 57%, 26% and 17%, respectively. Customer-wise, Enterprises, Service providers and Government represented 72%, 9% and 19% of product bookings, respectively. MarginsOn a year-over-year basis, GAAP and non-GAAP gross margins expanded 120 basis points (bps) and 130 bps to 80.1% and 82.7%, respectively. We believe that the improvement could be primarily driven by price realization and ease in supply-chain constraints, as well as reductions in ancillary supply-chain costs. The company’s fourth-quarter GAAP operating expenses went down 11.4% to $394.3 million, while non-GAAP operating expenses declined 9% to $344.8 million. GAAP operating expenses as a percentage of revenues decreased to 55.8% in the fourth quarter of fiscal 2023 from 63.6% in the year-ago quarter. Meanwhile, non-GAAP operating expenses as a percentage of revenues declined to 48.8% from 54.1% in the year-ago quarter. F5 Networks’ GAAP operating profit jumped 59.3% to $172 million, while the margin expanded 890 bps to 24.3%. Moreover, the non-GAAP operating profit jumped 25.7% year over year to $240 million, while the margin improved 660 bps to 33.9%. An increase in the non-GAAP operating margin was primarily driven by an improvement in the gross margin and lower operating expenses as a percentage of revenues. Balance Sheet & Cash FlowF5 Networks exited the September-ended quarter with cash and short-term investments of $808 million compared with the previous quarter’s $690.6 million. The company generated operating cash flow of $190 million in the fourth quarter and $653.4 million in the full fiscal 2023. During the quarter, FFIV repurchased shares worth $60 million. In fiscal 2023, it bought back common stocks worth $350 million. As of Sep 30, 2023, F5 had $922 million remaining under its current authorized share repurchase program. Year to date, the company has utilized about 58% of its free cash flow for share buybacks compared with its commitment of using at least 50% of free cash flow for share buybacks announced at the beginning of fiscal 2023. GuidanceF5 Networks projects non-GAAP revenues in the $675-$695 million band (midpoint of $685 million) and non-GAAP earnings per share in the $2.97-$3.09 band (midpoint of $3.03) for the first quarter of fiscal 2024. The non-GAAP gross margin is forecast between 82% and 83%. The company expects first-quarter non-GAAP operating expenses between $332 million and $344 million. Share-based compensation expenses are anticipated in the range of $58-$60 million. For fiscal 2024, F5 forecasts revenues to be flat to a low-single-digit-percentage decline range. Non-GAAP gross and operating margins are anticipated in the ranges of 82-83% and 33-34%, respectively. The effective tax rate for fiscal 2024 is projected in the 21 band. The company forecasts non-GAAP earnings per share to increase 5-7% in fiscal 2024. Moreover, it intends to return at least 50% of its fiscal 2024 free cash flow to shareholders through share buybacks. How Have Estimates Been Moving Since Then? It turns out, fresh estimates have trended downward during the past month. VGM Scores At this time, F5 has a nice Growth Score of B, though it is lagging a lot on the Momentum Score front with a D. Charting a somewhat similar path, the stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy. Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in. Outlook Estimates have been broadly trending downward for the stock, and the magnitude of these revisions indicates a downward shift. Notably, F5 has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report F5, Inc. (FFIV) : Free Stock Analysis Report  piranka Despite the stock performing well over the past five months, F5, Inc.'s (NASDAQ:FFIV) returns in 2023 are still only in line with broader indices. This is counter to my expectation of poor performance due to:

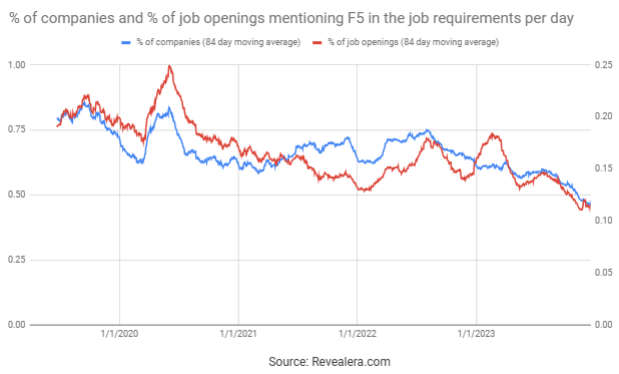

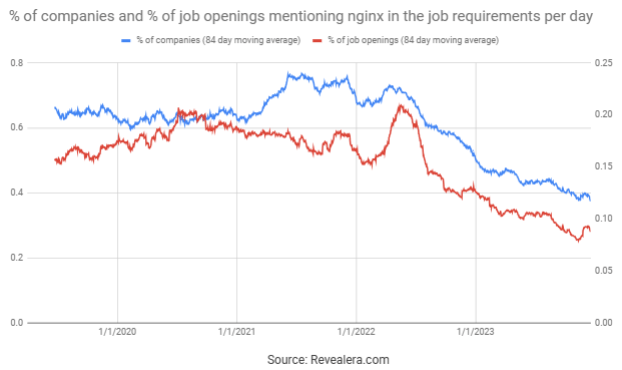

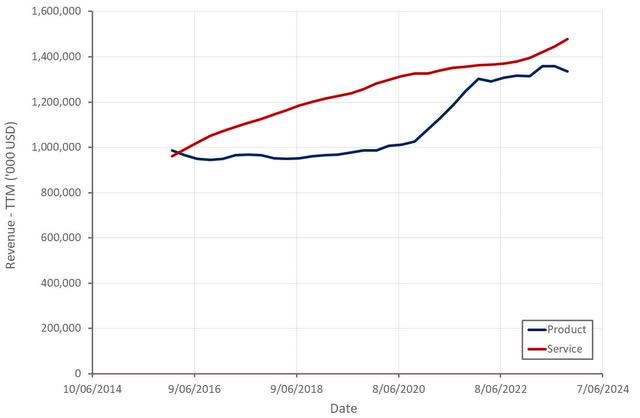

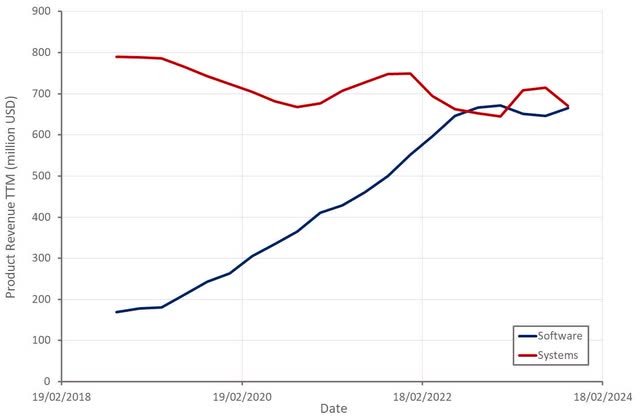

While system sales are expected to drop sharply going forward and F5's new businesses have so far demonstrated limited traction, margins have rebounded sharply due to F5's focus on expenses. This, along with a modest valuation, has helped F5's stock perform strongly in the second half of 2023. MarketF5 stated on its fourth quarter earnings call that the demand environment has shown signs of stabilization, particularly amongst enterprise customers. F5's hardware orders reportedly rebounded in the fourth quarter, supporting this view. In terms of verticals, technology and financial services customers were areas of strength, offset by service provider weakness. Service providers are delaying asset purchases and prioritizing spending. F5 expects continued growth in FY2024, driven by automation and generative AI. F5 also believes that customers will be forced to begin investing in application infrastructure again. Given the boom in hardware spending over the past three years it is not obvious that this will be the case though. Some customers have obviously delayed purchases due to financial pressure, but I would be surprised if this represents a majority, or even a significant minority of customers.  Figure 1: Job Openings Mentioning F5 in the Job Requirements (source: Revealera.com) F5F5 provides a range of solutions that help to deliver, secure and optimize applications and APIs across any environment. It has both hardware and software offerings, many of which have come through acquisitions. F5 is still in the process of integrating these solutions into a converged solution though. This is change that has been necessitated by the growing importance of the cloud and edge computing, which has changed how applications are developed and deployed. While F5 has positioned itself to remain relevant, there is a large amount of uncertainty regarding what extent acquisitions will offset structural headwinds to F5's legacy business. F5's Distributed Cloud Services offering now has over 500 customers, more than a 200% increase YoY. Penetration has predominantly been within F5's existing customer base so far though, with only 29% of Distributed Cloud customers new to F5. WAF and multi-cloud networking are F5's first two distributed cloud solutions. CDN capabilities were also recently added through the acquisitions of Lilac, and F5 has a backlog of other services it wants to add to the platform. F5 is seeing continued adoption of NGINX amongst larger enterprises for their cloud and Kubernetes workloads. Customers are also leveraging NGINX for app layer security for containers. NGINX serves modern, container-native and microservices-based applications and APIs.  Figure 2: Job Openings Mentioning NGINX in the Job Requirements (source: Revealera.com) While F5's ADC business will continue to face headwinds, the company continues to invest in it, and as a result, expects to take a share in both hardware and software form factors. F5 aims to provide on-prem deployments with the benefits of the cloud (multi-tenancy, rapid upgrades, etc.) while lowering total cost of ownership. F5's rSeries and VELOS platforms represented more than 80% of Q4 systems bookings. rSeries is designed on a new microservices-based platform layer and an API-first architecture. It supports BIG-IP app delivery and security services and aims to lower costs through consolidation. VELOS is a next-generation chassis system that aims to provide performance and scalability in a single ADC. Customers can scale capacity by adding modular blades in a chassis, without disrupting users or applications. Security is an important part of F5's business, contributing approximately 1.1 billion USD revenue in FY2023. F5 was disappointed with the performance of its most advanced anti-bot and anti-fraud managed service solutions this year, which it attributed to customer spending caution and budget scrutiny. F5 has reportedly seen good traction with its lower-end Distributed Cloud anti-bot offering though, as well as from security on NGINX. AILike most edge computing companies, F5 is counting on AI inference workloads to provide a tailwind. Organizations will need to support inference across datacenters, public clouds and the network edge, which F5 believes it is positioned to support. While inference could begin to create incremental demand in 2024, I think it is still too early for this to be material for companies like F5. F5 also expects the use of AI to accelerate growth in the number of applications and APIs, which would naturally be a tailwind for F5's business. The number of applications is likely to be limited by demand rather than supply though. Applications require users and organizations must acquire these users, the real bottleneck to growth in most cases. Financial AnalysisF5's fourth quarter revenue was 707 million USD, a 1% increase YoY, with 54% of revenue coming from services and 46% from product. Services revenue grew 9% on the back of high maintenance renewals and price increases. Service revenue is likely to moderate going forward as F5 laps price increases and spending on upgrades versus maintenance normalizes. Product revenue increased 7% YoY, with systems revenue down 25% due to lower backlog related shipments.

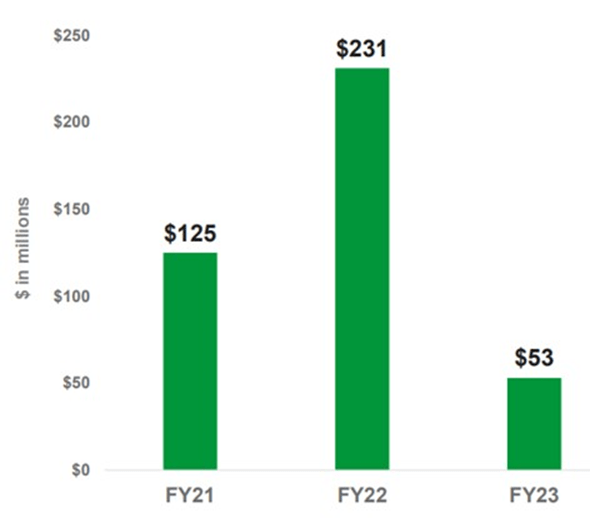

Figure 3: F5 Revenue (source: Created by author using data from F5 Networks) Backlog has now returned to normal levels, which will present roughly a 180 million USD revenue headwind in FY2024.  Figure 4: F5 Product Backlog (source: F5 Networks) BIG-IP and NGINX term subscriptions were up 9% in FY23. SaaS (includes Distributed Cloud) and managed services only increased 2% though. F5 has stated that it is seeing solid momentum from its Distributed Cloud business, but this isn't apparent in public data. Some of this is the result of planned revenue churn. Managed services include F5's legacy Silverline offering as well as some legacy SaaS solutions. F5 is currently in the process of migrating customers from its Silverline solution to the Distributed Cloud offering, which is creating headwinds. The company is also abandoning some legacy SaaS offerings from the companies it acquired. This process involves 65 million USD ARR in total, half of which is from offerings that F5 is retiring completely. The process is expected to be completed over the next year. F5's perpetual license software revenue was also down in FY2023, although the company attributed this to an unusually strong prior year.

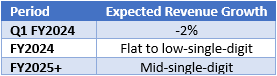

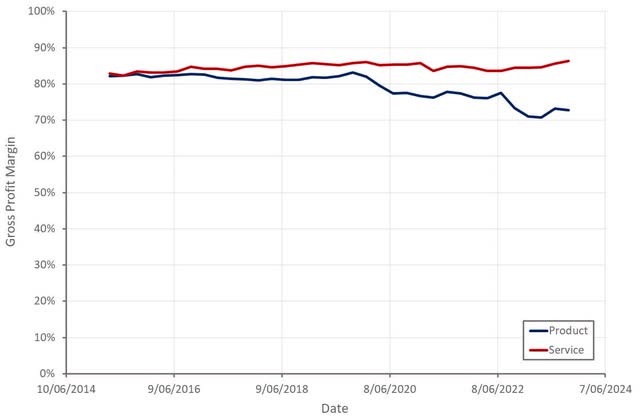

Figure 5: F5 Product Revenue (source: Created by author using data from F5 Networks) F5 expects customer caution to continue in FY2024 but also believes that customers will need to begin replacing assets again in the next year. Software is expected to provide flat to modest revenue growth due to headwinds from the transition of SaaS and managed service offerings. Global services revenue is expected to return to low-single-digit growth as F5 laps price increases. As a result, FY2024 revenue is expected to be flat to down low-single-digits YoY. F5 expects to return to mid-single-digit revenue growth in FY2025 though.  Table 1: F5 Revenue Guidance (source: Created by author using data from F5 Networks) While F5 has suggested that supply chain issues have largely resolved and delivery times normalized, F5's product margins remain depressed. How much if this is due to revenue mix, versus declining system or software margins is unclear though. This is an important trend to watch as F5 needs to maintain high gross profit margins to support investment in its security and distributed cloud businesses.

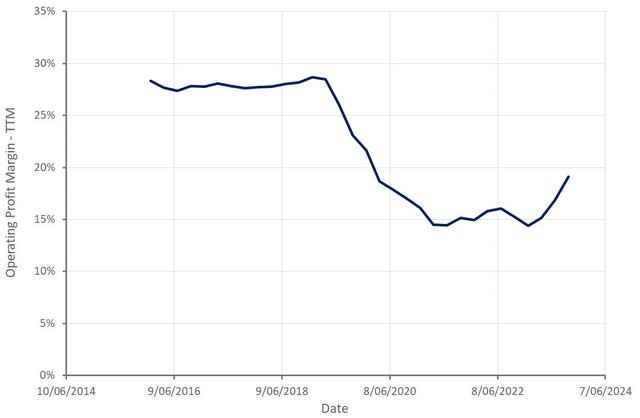

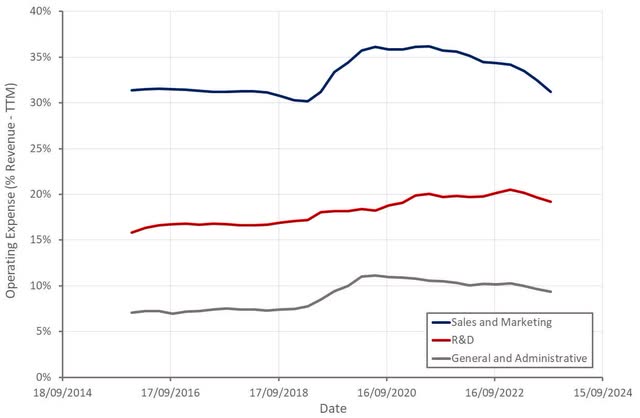

Figure 6: F5 Gross Profit Margins (source: Created by author using data from F5 Networks) While gross profit margins remain under pressure, F5's operating profit margins have rebounded sharply in accurate quarters, with much of the change driven by improved sales and marketing efficiency. F5 has been focused on reducing its operating expenses, but given the company's ambitions, it still needs to invest in product development and customer acquisition. How these dynamics play out in coming quarters will have a large impact on F5's share price going forward.

Figure 7: F5 Operating Profit Margin (source: Createed by author using data from F5 Networks)

Figure 8: F5 Operating Expenses (source: Created by author using data from F5 Networks) ConclusionDespite the stock moving around 20% higher over the past two months, F5 still appears reasonably valued, with the company's EV/S multiple towards the lower end of its historical range. Investors need to weigh its valuation against uncertain growth prospects and the potential for margin compression as the company invests in growth initiatives. The fact that software revenue has been fairly flat over the past 15 months and is expected to remain fairly flat over the next 12 months is hardly comforting. The accurate drop in sales and marketing expenses also isn't suggestive of a company capitalizing on a large growth opportunity. F5's internal expectations are for long-term software growth in excess of 20%, offset by high to mid-single digit systems revenue decline. If F5's distributed cloud business struggles, the stock could still prove expensive at current levels.

Figure 9: F5 EV/S Multiple (source: Seeking Alpha) F5 Networks, Inc. is a provider of multi-cloud application services which enable its customers to develop, deploy, operate, secure, and govern applications in any architecture, from on-premises to the public cloud. The Company's enterprise-grade application services are available as cloud-based, software-as-a-service, and software-only solutions optimized for multi-cloud environments, with modules that can run independently, or as part of an integrated solution on its appliances. In connection with its solutions, the Company offers a range of professional services, including consulting, training, installation, maintenance, and other technical support services. The Company's customers include large enterprise businesses, public sector institutions, Governments, and service providers. It conducts its business globally and manage its business by geography. Its business is organized into three geographic regions: Americas; Europe, Middle East, and Africa; and the Asia Pacific region. | ||||||||

F50-528 information search | F50-528 plan | F50-528 mission | F50-528 reality | F50-528 thinking | F50-528 study tips | F50-528 test contents | F50-528 health | F50-528 pdf | F50-528 information source | | ||||||||

Killexams test Simulator Killexams Questions and Answers Killexams Exams List Search Exams |