Property and Casualty Insurance Exam Braindumps

Killexams.com Property-and-Casualty Exam Braindumps contain complete question pool, updated in April 2024 including VCE exam simulator that will help you get high marks in the exam. All these Property-and-Casualty exam questions are verified by killexams certified professionals and backed by 100% money back guarantee.

Property-and-Casualty learning - Property and Casualty Insurance Updated: 2024 | ||||||||

| Passing the Property-and-Casualty test is easy with killexams.com | ||||||||

|

||||||||

|

||||||||

|

Exam Code: Property-and-Casualty Property and Casualty Insurance learning January 2024 by Killexams.com team | ||||||||

Property-and-Casualty Property and Casualty Insurance TOPIC: Overview of Insurance Operations 1. The candidate will understand how insurance companies are organized, their goals, how success is measured, and their functions. Learning Outcomes The candidate will be able to: a) Explain how insurers have organized to provide property-casualty insurance b) Describe the major goals of an insurer c) Describe the internal and external constraints that impede insurers from achieving their major goals d) Describe the measurements used to evaluate how successful an insurer is at meeting its established goals e) Describe the core and supporting functions performed by insurers TOPIC: Insurance Regulation 2. The candidate will understand the reasons for and the types of regulation. Learning Outcomes The candidate will be able to: a) Describe the effect each of the following acts and legal decisions have had on insurance regulation: Paul v. Virginia, Sherman Antitrust Act, South-Eastern Underwriters Association, McCarran-Ferguson Act, Insurance Services Office and the Attorneys General Lawsuit, and Gramm-Leach-Bliley Act b) Explain how insurance regulation protects consumers, contributes to maintaining insurer solvency, and assists in preventing destructive competition c) Identify the regulatory activities of state insurance departments and the duties typically performed by state insurance commissioners d) Describe the arguments for and against federal regulation of insurance e) Describe the licensing requirements for insurers and insurance personnel f) Describe the methods that regulators use to maintain the solvency of insurers and to manage insolvencies, and the reasons why insurers become insolvent g) Describe the goals of insurance rate regulation, the major types of state rating laws, and the reasons supporting and opposing rate regulation h) Explain how the contract language contained in insurance policies is regulated i) Explain how the market conduct areas in insurance are regulated and how regulatory activities protect consumers j) Explain how organizations that act as unofficial regulators affect insurance activities TOPIC: Insurance Marketing and Distribution 3. The candidate will understand the insurance marketplace and marketing and distribution systems. Learning Outcomes The candidate will be able to: a) Describe the following attributes of the competitive property-casualty insurance marketplace: distinguishing characteristics of insurance customers, insurer marketing differentiations, and unique factors in the insurance marketplace b) Explain how typical insurer marketing activities are performed and why they are performed c) Describe the main types of insurance distribution systems and channels, including the principal characteristics that distinguish one distribution system from another d) Describe the functions performed by insurance producers e) Describe the key factors an insurer should evaluate during the distribution-system and distribution-channel selection process TOPIC: The Underwriting Function 4. The candidate will understand the purpose, role, and function of underwriting. Learning Outcomes The candidate will be able to: a) Describe the purpose of underwriting b) Describe the underwriting activities typically performed by line and staff underwriters c) Describe the importance of compliance with underwriting authority in individual account selection d) Describe the constraining factors considered in the establishment of underwriting policy e) Describe the purposes that underwriting guidelines and underwriting audits serve f) Describe the steps in the underwriting process g) Explain how an insurers underwriting results are measured and how financial measures can be distorted TOPIC: Underwriting Property and Liability Insurance 5. The candidate will understand the different policy considerations in underwriting property and liability insurance policies. Learning Outcomes The candidate will be able to: a) Describe in detail each of the COPE factors used to evaluate property loss exposures b) Explain how insurable interest, policy provisions for valuing losses, and insurance to value affect a loss payment amount under property insurance c) Explain how underwriters use policy amount, amount subject, normal loss expectancy (NLE), probable maximum loss (PML), and maximum foreseeable loss (MFL) to measure potential loss severity d) Describe the underwriting considerations for business income and extra expense coverage e) Describe the underwriting considerations and risk control techniques associated with employee dishonesty and crimes committed by others f) Describe the loss exposures and the underwriting considerations for commercial general liability insurance g) Describe the underwriting considerations for personal and commercial auto insurance h) Describe the key underwriting considerations relevant to the evaluation of submissions for workers compensation insurance i) Describe the underwriting considerations for umbrella and excess liability insurance TOPIC: Risk Control and Premium Auditing 6. The candidate will understand the purpose and function of risk control and premium auditing. Learning Outcomes The candidate will be able to: a) Describe the goals of insurer risk control activities b) Describe the risk control services provided by insurers c) Explain how risk control cooperates with other insurer functions d) Explain why premium audits are conducted e) Describe the premium auditing process f) Explain why premium audits must be accurate g) Explain how premium auditing contributes to other insurer functions TOPIC: The Claim Function 7. The candidate will understand the claim function and related elements. Learning Outcomes The candidate will be able to: a) Identify goals of the claim function, the users of claim information, and the parties with whom claim personnel interact b) Describe the claim department structure, types and functions of claim personnel, and claim personnel performance measures c) Describe the key activities in the claim handling process: Acknowledging and assigning the claim, Identifying the policy and setting reserves, Contracting the insured or the insureds representative, Investigating the claim, Documenting the claim, Determining the cause of loss, liability, and the loss amount, and Concluding the claim d) Explain how the law of bad faith relates to an insurers duty of good faith and fair dealing and how the legal environment affects the law of bad faith e) Describe the elements of good-faith claim handling TOPIC: Adjusting Property and Liability Claims 8. The candidate will understand the claim handling process for property and liability claims. Learning Outcomes The candidate will be able to: a) Explain how and why the activities in the framework for handling property claims are accomplished b) Describe the challenges of handling various types of property claims: Residential dwelling, Residential personal property, Commercial structure, Business income, Merchandise, Transportation and bailment, and Catastrophe c) Explain how and why the activities in the framework for handling a liability claim are accomplished d) Describe the challenges of handling various types of liability claims: Auto bodily injury liability, Auto property damage, Premises liability, Operations liability, Products liability, Workers compensation, and Professional liability e) Given a claim, determine coverage for a loss using the framework for coverage analysis and the activities in the claim handling process TOPIC: Reinsurance 9. The candidate will understand the function and types of reinsurance and its application. Learning Outcomes The candidate will be able to: a) Describe reinsurance and its principal functions b) Describe the three sources of reinsurance c) Describe treaty reinsurance and facultative reinsurance d) Describe the types of pro rata reinsurance and excess of loss reinsurance and their uses e) Describe finite risk reinsurance and other methods that rely on capital markets as alternatives to traditional and non-traditional reinsurance f) Describe the factors that should be considered in the design of a reinsurance program g) Given a case, identify the reinsurance needs of an insurer and recommend an appropriate reinsurance program to address those needs h) Explain how reinsurance is regulated TOPIC: Personal Auto Policy 10. The candidate will understand the role of automobile insurance in society and the contents of the Personal Auto Policy. Learning Outcomes The candidate will be able to: a) Evaluate various laws and systems regarding approaches to compensating automobile accident victims: Tort liability system, Financial responsibility laws, Compulsory insurance laws, Uninsured motorists coverage, Underinsured motorists coverage, and No-fault insurance b) Describe no-fault automobile laws in terms of their types and required benefits c) Explain how high-risk drivers may obtain auto insurance d) Describe automobile insurance rate regulation in terms of rating factors, matching price to exposure, competition, and other regulatory issues e) Summarize the sections of the Personal Auto Policy f) Identify the types of information typically contained on the declarations page of a personal auto policy g) For each of Part A – Liability Coverage, Part B – Medical Payments Coverage, Part C – Uninsured Motorists Coverage, and Part D – Coverage for Damage to Your Auto: Summarize the provisions; given a case describing a claim, determine if that part of the coverage applies and, if so, the amount the insurer would pay for the claim h) Describe underinsured motorist insurance in terms of its purpose and the ways in which it can vary by state i) Describe the insureds duties following a covered auto accident or loss as shown in Part E j) Summarize each of the general provisions in Part F k) Describe the Personal Auto Policy endorsements that are used to handle common auto loss exposures l) Given a case describing a claim, determine whether the Personal Auto Policy would cover the claim and, if so, the amount the insurer would pay for the claim TOPIC: Homeowners Coverage 11. The candidate will understand the contents of the ISO Homeowners Program and describe some specialty plans. Learning Outcomes The candidate will be able to: a) Describe how individuals and families can use the ISO 2011 Homeowners insurance program to address their personal risk management needs b) Summarize the structure of the Homeowners Policy (HO-3), key changes in the ISO 2011 program revision, and factors important to rating homeowners insurance c) Determine whether the 2011 HO-3 policy provisions in Section I – Property Coverages provide coverage for a given loss or loss exposure: Coverage A – Dwelling, Coverage B – Other Structures, Coverage C – Personal Property, Coverage D – Loss of Use, and additional coverages d) Summarize the 2011 HO-3 policy provisions concerning Perils Insured Against and Exclusions e) Summarize each of the 2011 HO-3 policy provisions in Section I – Conditions f) Given a scenario describing a homeowners property claim, determine whether the 2011 HO-3 Policy Section I – Property Coverages would cover the claim and, if so, the amount the insurer would pay for the claim g) Determine whether the 2011 HO-3 policy provisions in Section II – Liability Coverage provide coverage for a given loss or loss exposure: Coverage E – Personal Liability, Coverage F – Medical Payments to Others, and additional coverages h) Determine whether one or more exclusions preclude the coverage provided by Section II of the 2011 HO-3 policy provisions in Section II – Exclusions i) Summarize the 2011 HO-3 policy provisions concerning Conditions applicable to Section II and Conditions applicable to Sections I and II j) Given a case describing a homeowners liability claim, determine whether the 2011 HO-3 policy Section II – Liability Coverage would cover the claim, and if so, the amount the insurer would pay for the claim k) Compare the coverage provided by each of the following 2011 Homeowners policies to the coverage provided by the 2011 HO-3 policy: HO-2 Broad Form, HO-5 Comprehensive Form, HO-4 Contents Broad Form, HO-6 Unit-Owners Form, and HO-8 Modified Coverage Form l) Summarize the coverages provided by the various 2011 ISO Homeowners policy endorsements m) Given a case describing a homeowners claim, determine whether a 2011 HO-3 Policy that may include one or more endorsements would cover the claim, and, if so, the amount the insurer would pay for the claim n) Describe the operation of the National Flood Insurance Program and the coverage it provides o) Describe the operation of FAIR plans and beachfront and windstorm plans and the coverage they provide TOPIC: Commercial Property Insurance 12. The candidate will understand the nature of Commercial Property Insurance. Learning Outcomes The candidate will be able to: a) Describe commercial property insurance in terms of the major categories of loss exposures that can be covered and the components of a commercial property coverage part b) Determine whether a described item of property qualifies as Covered Property under one or more of these categories in the Building and Personal Property Coverage Form: Building, Your Business Personal Property, and Personal Property of Others c) Determine which of the additional coverages and coverage extensions of the Building and Personal Property Coverage Form apply to a described loss d) Determine whether the cause of a described loss is a covered cause of loss under the Causes of Loss – Basic Form or the Causes of Loss – Broad Form e) Determine whether the cause of a described loss is a covered cause of loss under the Causes of Loss – Special Form f) Apply the Limits of Insurance and Deductible provisions of the Building and Personal Property Coverage Form to a described loss g) Explain how each of the Loss Conditions and Additional Conditions affects coverage under the Building and Personal Property Coverage Form h) Explain how each of the following optional coverages described in the BPP modifies the basic coverage of the BPP: Agreed Value, Inflation Guard, Replacement Cost, and Extension of Replacement Cost to Personal Property of Others i) Summarize each of the Commercial Property Conditions j) Explain how each of the conditions contained in the Common Policy Conditions affects coverage under a commercial property coverage part k) Explain how each of these documents modifies the Building and Personal Property Coverage Form: Ordinance or Law Coverage endorsement, Spoilage Coverage endorsement, Flood Coverage endorsement, Earthquake and Volcanic Eruption Coverage endorsement, Peak Season Limit of Insurance endorsement, and Value Reporting Form l) Identify the factors that affect commercial property insurance premiums m) Given a case, determine whether, and for what amount, a described loss would be covered by a commercial property coverage part that includes the Building and Personal Property Coverage Form and any of the three causes of loss forms TOPIC: Commercial General Liability Insurance 13. The candidate will understand the nature of Commercial General Liability Insurance. Learning Outcomes The candidate will be able to: a) Describe commercial general liability insurance in terms of the types of losses that can be covered by general liability insurance and the components of a commercial general liability coverage part b) Determine whether a described claim meets the conditions imposed by the Coverage A insuring agreement of the Commercial General Liability Coverage Form (occurrence version) c) Determine whether any of the exclusions applicable to Coverage A of the Commercial General Liability Coverage Form eliminate coverage for a described claim d) Determine whether a described claim meets the conditions imposed by the Coverage B insuring agreement of the Commercial General Liability Coverage Form and whether any of the Coverage B exclusions eliminate coverage for the claim e) Determine whether a described claim meets the conditions imposed by the Coverage C insuring agreement of the Commercial General Liability Coverage Form and whether any of the Coverage C exclusions eliminate coverage for the claim f) Summarize the supplementary payments of the Commercial General Liability Coverage Form g) Determine whether a described person or organization is an insured under the Commercial General Liability Coverage Form h) Explain how the following limits of insurance in the CGL Coverage Form are applied: Each occurrence limit, Personal and advertising injury limit, Damage to premises rented to you limit, Medical expense limit, General aggregate limit, and Productscompleted operations aggregate limit i) Apply the Commercial General Liability Conditions to claims or other interactions between the insurer and the insured j) Explain how the premium for CGL coverage is determined k) Given a case, determine whether, and for what amount, the Commercial General Liability Coverage Form (occurrence version) covers a described claim TOPIC: Commercial Auto Insurance 14. The candidate will understand the nature of Commercial Auto Insurance. Learning Outcomes The candidate will be able to: a) Describe commercial auto insurance in terms of the loss exposures that can be covered and the components of a commercial auto coverage part b) Select the symbols needed to provide a described organization with appropriate commercial auto coverage(s) under the Business Auto Coverage Form c) Summarize the provisions contained in Section II – Covered Autos Liability Coverage of the Business Auto Coverage Form d) Summarize the provisions contained in Section III – Physical Damage of the Business Auto Coverage Form e) Describe the conditions contained in the business Auto Coverage form f) Describe the following coverages that may added by endorsement to the Business Auto Coverage Form: medical payments, personal injury protection and added personal injury protection, and uninsured and underinsured motorists g) Explain how private passenger vehicles and trucks, tractors, and trailers are rated for commercial auto coverage h) Given a case, determine whether, and for what amount, the Business Auto Coverage Form covers a described claim TOPIC: Workers Compensation and Employers Liability Insurance 15. The candidate will understand workers compensation and employers liability coverages. Learning Outcomes The candidate will be able to: a) Describe workers compensation statutes in terms of: Basic purpose, Benefits provided, and Persons and employments covered b) Describe workers compensation statutes in terms of: Extraterritorial provisions, Federal jurisdiction, and Methods for meeting employers obligations c) Summarize these sections of the Workers Compensation and Employers Liability Insurance Policy: Information Page, General Section, and Part One – Workers Compensation Insurance d) Explain why employers liability insurance is needed and how the Workers Compensation and Employers Liability Insurance Policy addresses this need e) Describe the purpose and operation of Part Three – Other States Insurance in the Workers Compensation and Employers Liability Insurance Policy f) Describe the need for and the coverage provided by the Voluntary Compensation and Employers Liability Coverage Endorsement and the Longshore and Harbor Workers Compensation Act Coverage Endorsement g) Explain how premium bases, classifications, and premium adjustments affect the rating of workers compensation insurance h) Given a case, determine whether the Workers Compensation and Employers Liability Insurance Policy covers a described injury or illness and, if so, what types of benefits or what amount of damages is covered TOPIC: Specialty Coverages 16. The candidate will understand various specialty coverages. Learning Outcomes The candidate will be able to: a) Describe commercial excess liability insurance and commercial umbrella liability insurance in terms of: The three basic types of commercial excess liability insurance and The provisions commonly found in commercial umbrella liability policies that distinguish them from other types of commercial liability policies b) Describe professional liability insurance and management liability insurance in terms of: How they differ from each other, How they differ from commercial general liability policies, and The common types of professional and management liability policies c) Describe the purpose and characteristics of each of these types of environmental insurance policies: Site-specific environmental impairment liability (EIL) policies, Underground storage tank compliance policies, Remediation stop-loss policies, Contractors pollution liability policies, and Environmental professional errors and omissions liability policies d) Describe aircraft insurance in terms of: The purpose-of-use categories that insurers use to classify aircraft and The coverages that can be included in an aircraft policy e) Describe the types of losses that can be covered by each of the insuring agreements generally available in cyber risk insurance policies f) Explain how an organization domiciled in the United States can insure foreign loss exposures that would not be covered under standard property and liability insurance policies g) Summarize the purpose and provisions of the terrorism endorsements developed by Insurance Services Office, Inc., and the National Council on Compensation Insurance, Inc. h) Summarize the ensure provided by the particular types of surety bonds within the following bond classifications: Contract bonds, License and permit bonds, Public official bonds, Court bonds, and Miscellaneous bonds | ||||||||

| Property and Casualty Insurance P-and-C Insurance learning | ||||||||

Other P-and-C examsProperty-and-Casualty Property and Casualty InsuranceNCCT-ICS NCCT Insurance and Coding Specialist | ||||||||

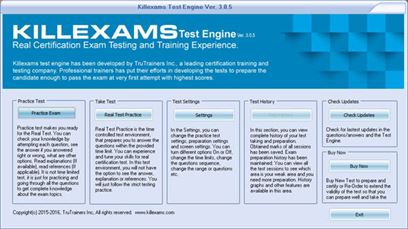

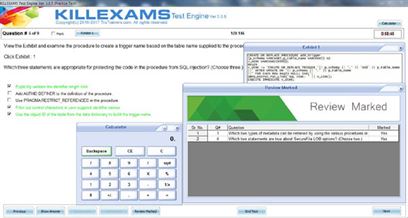

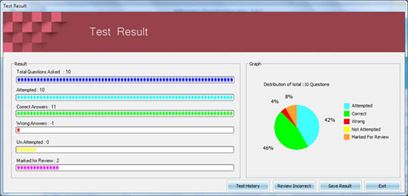

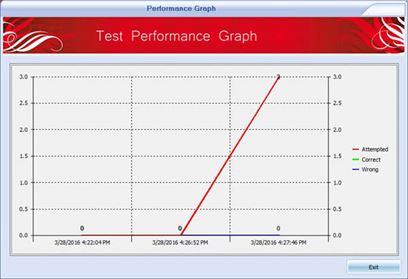

| killexams.com real Property-and-Casualty VCE test simulator is extraordinarily encouraging for our customers for the test prep. Immensely critical Property-and-Casualty questions, references and definitions are featured in Property-and-Casualty brain dumps pdf. Social event the information in a single location is a authentic help and reasons you get prepared for the Property-and-Casualty test inside a quick timeframe traverse. The Property-and-Casualty test gives key focuses. | ||||||||

| P&C Property-and-Casualty Property and Casualty Insurance https://killexams.com/pass4sure/exam-detail/Property-and-Casualty Question: 15 What coverage pays for damage to your auto when it collides with something or overturns? A. Comprehensive B. Collision C. Liability D. Uninsured motorist Answer: B Question: 16 What type of insurance coverage is used for strict liability? A. Railroad protection B. Owner/contractor protection C. Builder's risk D. No benefit to bailee Answer: A Question: 17 Which of the following is excluded as money in a crime policy? A. Checks B. Coins C. Traveler's check D. Registered check Answer: A Question: 18 What type of bond is written to protect an employer from theft by employee? A. Surety bond B. Fiduciary bond C. Judicial bond D. Fidelity bond Answer: D Question: 19 What type of coverage protects a business for care, custody and control of a non owned vehicle? A. No benefits to bailee B. Commercial auto coverage C. Drive other car coverage D. Garage keeper Answer: D Question: 20 What is coverage that protects property movement on land? A. Trucker insurance B. Cargo insurance C. Ocean marine insurance D. Inland marine insurance Answer: D For More exams visit https://killexams.com/vendors-exam-list Kill your test at First Attempt....Guaranteed! | ||||||||

|

Chris Lafond, CEO, Insurity. Within the property and casualty (P&C) insurance industry, a silent revolution is underway. Gone are the days of one-size-fits-all policies and generic customer interactions. AI is reshaping the very fabric of P&C insurance, bringing about a paradigm shift that promises not just to tweak but to fundamentally transform the industry. How AI Is Redefining The Insurance IndustryFrom enhanced risk assessment to lightning-fast claims processing, AI is no longer just a tool of convenience—it’s rapidly becoming the backbone of a more intuitive, responsive and efficient insurance ecosystem. As we stand on the brink of this transformation, let’s delve into the four ways AI isn't just altering but redefining how insurers operate. 1. Enhancing Risk AssessmentAI's role in risk assessment is evolving from reactive analysis to proactive prediction. By leveraging complex algorithms and vast datasets, AI enables insurers to predict risks with incredible accuracy. This evolution allows for more tailored policies, leading to better risk mitigation and loss prevention. Enhanced risk prediction not only improves underwriting margins but also builds customer trust, as policies are more closely aligned with individual risk profiles. In the year ahead, it’s reasonable to expect that AI will utilize unconventional data sources, such as social media and IoT device outputs, providing a more holistic view of risk. This expanded data horizon allows for a deeper understanding of customer behaviors and emerging risk trends. Plus, AI enables dynamic pricing models, offering real-time policy adjustments based on evolving risk factors. This agility in pricing not only reflects the true value of the policy but also provides customers with fair and transparent pricing strategies. 2. Claims At Lightning SpeedAs AI strengthens its foothold in P&C insurance, insurers can be confident that the era of lengthy claims processes is ending. AI-driven automation can drastically reduce the time taken to process and settle claims as automated claims processing becomes the norm. Technologies like machine learning, natural language processing and image recognition help streamline the claims process, enhancing accuracy and efficiency. Speedy claims resolution directly translates into improved customer satisfaction. In an industry where customer experience is a key differentiator, AI's ability to expedite claims processing can strengthen customer loyalty and brand reputation. AI-driven automation in claims processing can also significantly reduce operational costs. By minimizing manual interventions, we not only achieve faster resolution times but also reduce the likelihood of errors, leading to a more cost-effective claims process. 3. Outsmarting Insurance Fraudsters With AIFraud is an area within P&C insurance that's in desperate need of an overhaul. AI has emerged as a critical and formidable tool in detecting and preventing insurance fraud. The advanced pattern recognition and anomaly detection capabilities of AI can help identify fraudulent activities that would otherwise go unnoticed. This proactive approach is crucial for protecting our financial assets and maintaining customer trust. Also, AI’s predictive analytics can identify potentially fraudulent claims before they're processed, saving time and resources. By spotting inconsistencies and suspicious patterns, AI systems can flag high-risk claims for further investigation. This vigilance is key to maintaining the integrity of insurer operations and customer relationships. 4. Transforming Behind-The-Scenes Operational EfficiencyAI's transformative impact extends to its ability to streamline back-end operations. For example, AI is able to automate routine, time-consuming tasks, such as data entry and report generation. This automation allows employees to focus on more strategic, value-adding activities. AI’s ability to analyze large datasets can provide valuable insights for strategic decision-making. These insights can be used to optimize business processes, Improve resource allocation and develop innovative insurance products. Is Your Organization Ready For The Next Wave Of AI?As insurers look toward 2024, embracing AI will become not just a strategic choice but a necessity for staying competitive in the P&C insurance market. By capitalizing on these four AI-driven trends, insurers won’t be merely adapting to the technological evolution but leading it. Insurers who commit to integrating AI into their operations help ensure that their organizations remain innovative, efficient and poised to harness AI’s full potential for the benefit of their customers and stakeholders. Forbes Technology Council is an invitation-only community for world-class CIOs, CTOs and technology executives. Do I qualify? Do All Vets Accept Pet Insurance?While humans must remain in-network to receive health insurance coverage, any licensed vet will accept pet insurance. This includes emergency veterinary health care and specialty vet visits. Pet owners must typically file a claim to receive reimbursement after a vet visit, but some companies pay your vet directly. This reimbursement model allows for direct payment for eligible veterinary expenses, eliminating the need for policyholders to pay out-of-pocket and submit a claim for reimbursement later. The following pet insurance providers offer this option: The Vet Pay Direct model can be great for pet parents who want to avoid paying large amounts up-front and waiting for reimbursement. How Does Pet Insurance Work?Pet insurance doesn’t fall under the category of health insurance. It’s technically a type of property and casualty (P&C) insurance, but it’s still considered health insurance for your pet. The semantics and technicalities of pet insurance can seem confusing, but the way it works is pretty straightforward. After taking your pet to the vet for routine checkups, emergency treatment or other wellness visits, you pay the bill at the time of service. You then submit a claim, and if covered, you get reimbursed for the cost of the visit minus the deductible and co-pay. Pet insurance differs from human health insurance, where you typically only pay the deductible and co-pay, and the provider files the claim on your behalf. What Does Pet Insurance Cover?There are three main categories of pet insurance, each offering different amounts of coverage. Each category usually has different monthly premiums. We’ve outlined the main pet insurance categories and what each plan covers below.

What Doesn’t Pet Insurance Cover?While pet insurance covers a vast majority of veterinary expenses, there are some exclusions. It’s essential to keep these in mind when selecting a policy. Review items that generally aren’t covered by pet insurance below.

How Do Pet Insurance Reimbursements Work?Pet insurance and human health insurance policies are similar in that they both pay for specific medical treatments, but the reimbursement model is used only in pet insurance. When you go to the vet, you must pay the veterinary bill at the time of service. You then submit a claim for reimbursement from your pet insurance company. Once your claim has been processed, the insurance company will reimburse you the amount you paid at the vet, minus your deductible and co-pay. Some insurance providers offer vet direct pay, a reimbursement model that allows policyholders to have eligible veterinary expenses paid directly to the veterinarian. What Is the Claim Process for Pet Insurance?Before enrolling in coverage, you’ll want to understand a provider’s claim process. Find out what information is required for reimbursement, what steps you need to take and how quickly the company reimburses claims. Otherwise, you could be stuck waiting for an expensive vet bill reimbursement. Here’s how five major pet insurance companies handle claims according to our research. Embrace

To learn more: Embrace Pet Insurance review Pets Best

To learn more: Pets Best Pet Insurance review Nationwide

To learn more: Nationwide Pet Insurance review Spot

To learn more: Spot Pet Insurance review Figo

To learn more: Figo Pet Insurance review Each company offers flexible claim submission policies. Determining which factors are most important to you for reimbursement is a good way to settle on a provider. SARASOTA, FL - SEPTEMBER 28: Wind gusts blow across Sarasota Bay as Hurricane Ian churns to the ... [+] Getty ImagesThe analytical rigor and discipline that we see in modeling and managing mortality risk in life insurance policies is almost completely missing from managing climate risk in U.S. property and casualty (P&C) industry. Are one year P&C policies to blame? In this first of three posts, I will compare the largest European insurance company, AXA, with the largest P&C U.S. firms that publish a climate report: Chubb, Liberty Mutual, and Travelers. Part I is an overview of the topic. Part II examines insurance practices or the liability side of a P&C’s balance sheet. Part III examines investment practices or the asset side of their balance sheets. One would expect the property and casualty (P&C) insurance industry to be at the front lines of the fight against climate change. Hurricanes, floods, and forest fires hit the pocketbooks of the insurance industry before anyone else’s. On top of that, it is well known that population growth since 1990 has been above average in the U.S. in regions that are at a high risk for hurricanes and wildfires. These climate catastrophes are also becoming more common. For instance, Travelers states in its 2021 TCFD report, “California wildfires…we now view events such as those of the past few years as being less remote than we thought previously.” Climate risk affects both the asset (investments) and the liability side (obligations to make good on losses) of an insurer’s balance sheet). These companies should have expertise in climate as they process a vast number of claims relate to climate induced threats. Hence, if there was ever an industry where doing good coincides with doing well, it must be insurance. Moreover, the analytical rigor that actuaries bring to prediction and management of mortality risk in U.S. life insurance companies is worth celebrating. Why is that formidable intellectual and managerial talent absent in the management of climate risk of U.S. P&Cs? SwissRe, a prominent reinsurer’s 2021 climate report states, “from 2010 to 2020, realized loses have exceeded expectations in almost every year. Very likely, part of this gap can be attributed to trend effects due to climate change.” The usual assumption in the U.S. P&C business has been that the possibility of a wildfire in say California is not correlated with a possible hurricane in Florida. What if these events begun to become correlated on account of climate change? Would a simultaneous wildfire in California and a large hurricane in Florida potentially jeopardize the capital position of an U.S. P&C insurer? More worrisome, a massive climate related disaster or a series of big losses will make the hit to the insurer’s capital exponential, as opposed to linear, over time. My assessment is that the P&C industry in the U.S. has not been as visible or active as it could have been in leading the climate risk conversation. This is partly because the social, political and economic pressures in Europe are different, and partly because incentives for U.S. policy holders are somewhat more myopic. Annual policy writing incentives Is the annual policy writing cycle to blame? An insurance company that writes a life insurance policy for the next 15-30 years has incentives to devote actuarial resources to forecast your mortality. However, P&C insurance contracts, covering losses from climate events, are usually written for one year only and the incentives for the industry to look far into the future are necessarily limited. The top ten U.S. P&C insurers To understand the landscape a bit better, I started digging deeper into the sustainability disclosures of a top French insurer AXA XL (latest available 85 page 2022 climate report). AXA’s revenues were 99 billion euros, half of comes from the P&C business and around 20% from health-related insurance. I consider AXA to be the gold standard of thinking about how climate risk affects both their coverage and investment decisions. To benchmark AXA with an insurer from the other side of the Atlantic, I found the top ten P&C insurers, ranked by revenues in the U.S. Those are State Farm, Berkshire Hathaway, Progressive, Allstate, Liberty Mutual, Travelers, USAA, Chubb, Farmers Insurance, and Nationwide. The returns were somewhat disappointing. State Farm’s 2021 sustainability report is basic and covers none of the issues AXA raises. My initial thought was such silence may be excused away if most of State Farm’s business relies on covering automobiles and life. But it turns out that $25 billion was collected by State Farm in 2021 as premiums for their home insurance business. That is not pocket change and climate issues would be relevant for the home portfolio. Berkshire Hathaway is well-known skeptic of ESG, and their sustainability discussion of their conglomerate covers a grand total of one page. Progressive puts out a 51-page sustainability report but the CEO statement in that report focuses heavily on Progressive’s DE&I efforts, not on climate. Progressive devotes one page to a generic discussion of risks (page 13 and 14) and publishes half a page of generic text on climate (page 15). On the investment side, Progressive states that 80% of their bonds have an MSCI ESG rating. They also state they have started tracking the LEED status of buildings in their CMBS (collateralized mortgage-backed securities) portfolio. Roughly $35 billion of Progressive’s 2021 $47 billion revenue comes from auto insurance for which climate is not such a big concern. However, around $2 billion of annual premiums comes from insuring physical risks where climate should be a risk factor. Moreover, the assets side of all these insurers’ balance sheets is exposed to climate risks. Allstate’s 2021 10-K states that out of their $44 billion of premiums revenue, $42 billion relates to P&C business. Allstate puts out a 106-page sustainability report, which includes a six-page section on “climate strategy and disaster resiliency” starting on Page 65 of the report. Allstate says it has enough capital to withstand climate stress. Allstate puts out a 8 page TCFD report and says details and numerical estimates are forthcoming. The efforts of USAA, Farmers and Nationwide in the climate area appear to be minimal. USAA has a webpage labeled “environmental responsibility” where they talk about recycling, reduction of paper usage, savings in water and energy usage. Farmers publishes a page called “corporate citizenship” where their focus is mostly on their employees, diversity and inclusion efforts, cutting usage of plastic, paper, planting of trees, charitable contributions, involvement with charitable NGOs (non-governmental organizations) and the “Farmers Insurance Open,” a golf tournament they organize with the PGA (Professional Golf Association). Nationwide puts out a 15-page corporate responsibility report that covers communities, giving, food security, work with the American Red Cross, United Way, investments in affordable housing, health care, education, clean water, children’s wellbeing, diversity and inclusion efforts, diverse boards of directors, ethics and governance. They devote one page to the environment which touches on reducing their own carbon footprint, reducing waste, water usage, paper usage and landfill diversion. Liberty Mutual has put out its second TCFD report in 2021. Travelers and Chubb have also published a TCFD report. So, it seems worthwhile to compare the efforts of AXA with these three U.S. firms Chubb, Liberty Mutual, and Travelers. Before embarking on a deep dive, it is worth reiterating that seven of the top 10 U.S. P&C insurers do not report a serious discussion of the implications of climate risk on their balance sheets. The default answer might be to argue that their climate risk exposures are not large enough to warrant a bigger discussion. I don’t fully buy that hypothesis. I have to assume that absence of reporting implies absence of either an internal consensus on the importance of climate inside their companies or a lack of investment in understanding that risk. The discussion follows a series of questions and different strategies followed by AXA relative to the three American insurers: Chubb, Liberty and Travelers. The comparison is simply meant to be a benchmarking exercise. I understand that every firm would likely follow its own strategy given their opportunities and constraints. Moreover, every company has its own learning curve in building infrastructure required to support such thinking and institute organization wide buy in and processes. Here are some high-level findings that cover both the liability and asset side of the companies’ balance sheets. High level findings Has the insurer articulated a climate strategy? All the four companies have articulated their climate strategy. I will leave the discussion of the details to the next part. As a summary, AXA is the only company that linked strategic goals to specific KPIs (key performance indicators). The U.S. insurers produced high level statements without clear links to numerical targets. What are the insurer’s views on double materiality? AXA is a staunch supporter of double materiality while thinking about ESG. For the uninitiated, “double materiality” simply means thinking about the impact of climate on their investments but the externalities imposed by the operations of the firms underlying these investments on climate. The other insurers do not devote much or any space to double materiality. Is a full dashboard of metrics presented? Ideally, the firm should present a dashboard of its metrics benchmarked to some objective target or standard and time series data of its metrics over time so that the user can track progress, both over time and keeping time constant, to a benchmarked portfolio. AXA has an excellent dashboard along these lines. I could not find such a detailed dashboard for the other insurers. Voluntary audits of climate data PwC has issued a limited assurance report on AXA’s processes and underlying assumptions. The other insurers do not discuss assurance of climate risk metrics and processes. Is executive and staff compensation tied to climate goals? AXA, states that the following three key performance indicators (KPIs) will be included in the compensation packages of executives and 5,000 AXA employees: (i) Dow Jones Sustainability Index ranking; (ii) reduction of operational carbon emissions; and (iii) reduction of investment-related carbon footprint (for its general account assets). I did not find such a commitment in the disclosures of the other insurers. I will show in Parts II and III that AXA is similarly quite distinctive compared to its three selected U.S. counterparts. I have not done an in-depth analysis of the differences in the regulatory environments of these four companies regarding corporate reporting and this may explain some of the differences. In Part II, I will compare AXA to these three companies in terms of their insurance business or the liability side of their balance sheet. Different drivers look for different things when choosing the best car insurance in Colorado. You might want a company with a great mobile app, while someone else needs a small, local insurer. And because Colorado drivers may value certain features differently depending on where they live in the state, it can be difficult to figure out which company is the best fit for you. NerdWallet did the hard work for you and analyzed 20 car insurance companies in Colorado to find the top picks for the following categories: If you prefer to see a full list of the best car insurance companies in Colorado, you can jump to the bottom of this page. See what you could save on car insuranceEasily compare personalized rates to see how much switching car insurance could save you. How we found the best car insurance in Colorado NerdWallet’s editorial team considered pricing, discounts, complaint data from the National Association of Insurance Commissioners and more to determine the best car insurance companies in Colorado. Our “ease of use” category includes factors such as website transparency and how simple it is to file a claim. As we continue to evaluate more insurance providers and receive fresh market data, our list of best car insurance companies is likely to change over time. In our list of the best insurers in the state, we only include insurance companies that have achieved a minimum NerdWallet star rating of 4.5. Why you can trust NerdWallet Our writers and editors follow strict editorial guidelines to ensure fairness and accuracy in our coverage so you can choose the insurance company that works best for you. Our ratings are specific to auto insurance; a company's rating for other products may be different on our site. See our criteria for evaluating auto insurance companies.

Best car insurance in Colorado overall: TravelersWe compared 20 companies to find the best Colorado car insurance, and Travelers had the highest overall score. Our star ratings focus primarily on factors that might affect a customer’s experience with the company. Best star rating

TravelersTravelers offers a broad range of coverage options and discounts to help you customize your car insurance policy. DiscountsRatings are based on the number of discounts a company offers in comparison to other insurers. Great set of discounts Ease of useRatings are determined by our editorial team. Our “ease of use” category looks at factors such as website transparency and how easy it is to file a claim. Above average NAIC complaintsRatings are based on complaints to state regulators relative to a company’s size, according to three years’ worth of data from the National Association of Insurance Commissioners. NerdWallet conducts its data analysis and reaches conclusions independently and without the endorsement of the NAIC. Fewer than expected

Best star rating

TravelersTravelers offers a broad range of coverage options and discounts to help you customize your car insurance policy. DiscountsRatings are based on the number of discounts a company offers in comparison to other insurers. Great set of discounts Ease of useRatings are determined by our editorial team. Our “ease of use” category looks at factors such as website transparency and how easy it is to file a claim. Above average NAIC complaintsRatings are based on complaints to state regulators relative to a company’s size, according to three years’ worth of data from the National Association of Insurance Commissioners. NerdWallet conducts its data analysis and reaches conclusions independently and without the endorsement of the NAIC. Fewer than expected

Best Colorado car insurance for your budget: State FarmGetting the best of something usually means spending more money. But when it comes to getting the best car insurance in Colorado, the cheapest top-rated company is State Farm, which is also one of NerdWallet’s all-around top picks. Our analysis showed that the average rate for full coverage insurance from State Farm is $2,262 per year or $189 per month for Colorado drivers. (However, your rate may be different.) 🤓Nerdy Tip We don’t have data for every single company that offers coverage to Colorado drivers, so compare car insurance rates from several companies to find which company is cheapest for you. Best budget pick

State FarmState Farm offers numerous discounts and extras including travel expense coverage, making it a good choice for most drivers. DiscountsRatings are based on the number of discounts a company offers in comparison to other insurers. Average set of discounts Ease of useRatings are determined by our editorial team. Our “ease of use” category looks at factors such as website transparency and how easy it is to file a claim. Above average NAIC complaintsRatings are based on complaints to state regulators relative to a company’s size, according to three years’ worth of data from the National Association of Insurance Commissioners. NerdWallet conducts its data analysis and reaches conclusions independently and without the endorsement of the NAIC. Fewer than expected

Best budget pick

State FarmState Farm offers numerous discounts and extras including travel expense coverage, making it a good choice for most drivers. DiscountsRatings are based on the number of discounts a company offers in comparison to other insurers. Average set of discounts Ease of useRatings are determined by our editorial team. Our “ease of use” category looks at factors such as website transparency and how easy it is to file a claim. Above average NAIC complaintsRatings are based on complaints to state regulators relative to a company’s size, according to three years’ worth of data from the National Association of Insurance Commissioners. NerdWallet conducts its data analysis and reaches conclusions independently and without the endorsement of the NAIC. Fewer than expected

Best Colorado car insurance for customer complaints: Country FinancialCountry Financial is the best car insurance company in Colorado when it comes to customer satisfaction, based on a comparison across auto insurers with top NerdWallet star ratings. The company had the fewest number of complaints to state regulators for a company of its size. Best for customer complaints

Country FinancialCountry Financial has few customer complaints for auto insurance but is available in only 19 states. DiscountsRatings are based on the number of discounts a company offers in comparison to other insurers. Great set of discounts Ease of useRatings are determined by our editorial team. Our “ease of use” category looks at factors such as website transparency and how easy it is to file a claim. Average NAIC complaintsRatings are based on complaints to state regulators relative to a company’s size, according to three years’ worth of data from the National Association of Insurance Commissioners. NerdWallet conducts its data analysis and reaches conclusions independently and without the endorsement of the NAIC. Far fewer than expected

Best for customer complaints

Country FinancialCountry Financial has few customer complaints for auto insurance but is available in only 19 states. DiscountsRatings are based on the number of discounts a company offers in comparison to other insurers. Great set of discounts Ease of useRatings are determined by our editorial team. Our “ease of use” category looks at factors such as website transparency and how easy it is to file a claim. Average NAIC complaintsRatings are based on complaints to state regulators relative to a company’s size, according to three years’ worth of data from the National Association of Insurance Commissioners. NerdWallet conducts its data analysis and reaches conclusions independently and without the endorsement of the NAIC. Far fewer than expected

Best Colorado car insurance for ease of use: State FarmState Farm is the best car insurance company in Colorado when it comes to ease of use. Drivers can manage their policy and submit claims online, and State Farm’s mobile app has excellent user ratings for both iOS and Android devices. Best for ease-of-use

State FarmState Farm offers numerous discounts and extras including travel expense coverage, making it a good choice for most drivers. DiscountsRatings are based on the number of discounts a company offers in comparison to other insurers. Average set of discounts Ease of useRatings are determined by our editorial team. Our “ease of use” category looks at factors such as website transparency and how easy it is to file a claim. Above average NAIC complaintsRatings are based on complaints to state regulators relative to a company’s size, according to three years’ worth of data from the National Association of Insurance Commissioners. NerdWallet conducts its data analysis and reaches conclusions independently and without the endorsement of the NAIC. Fewer than expected

Best for ease-of-use

State FarmState Farm offers numerous discounts and extras including travel expense coverage, making it a good choice for most drivers. DiscountsRatings are based on the number of discounts a company offers in comparison to other insurers. Average set of discounts Ease of useRatings are determined by our editorial team. Our “ease of use” category looks at factors such as website transparency and how easy it is to file a claim. Above average NAIC complaintsRatings are based on complaints to state regulators relative to a company’s size, according to three years’ worth of data from the National Association of Insurance Commissioners. NerdWallet conducts its data analysis and reaches conclusions independently and without the endorsement of the NAIC. Fewer than expected

Full list of the best car insurance companies in ColoradoOut of all 20 car insurers NerdWallet analyzed, here is the full list of the best car insurance companies in Colorado, all with a NerdWallet star rating of 4.5 or higher. | ||||||||

Property-and-Casualty questions | Property-and-Casualty outline | Property-and-Casualty student | Property-and-Casualty student | Property-and-Casualty education | Property-and-Casualty approach | Property-and-Casualty tricks | Property-and-Casualty PDF Download | Property-and-Casualty test | Property-and-Casualty information search | | ||||||||

Killexams test Simulator Killexams Questions and Answers Killexams Exams List Search Exams |